The joy of speculation:

The limits to money, the limits to wealth

So the first thing I find really interesting and fascinating is thinking about money, the limits of money, wealth, etc.

For example, Seneca once said, “Nobody ever thinks to themselves, what if I am already too rich?â€ï¿¼

Simply put, my thought of the proper limit of money is once you have enough money to pay rent, utilities, and trips to Costco to buy meat, then, the positive utility of money diminishes. That is, sometimes having too much money is a positive distraction and burden; a lot of people who are too rich have issues diversifying and investing their money because they have no idea what to do with it.

A simple crypto hedge fund idea

If you want to invest in my fund, just shoot me an email at eric@erickim.com

So a very simple crypto hedge fund idea is this: 90% of your money in bitcoin, 10% in chainlink, or the opposite; 90% of your money and chainlink, and 10% of your assets in bitcoin.

The reason why I find this to be such an interesting and dynamic hedge, to quote TALEB is this –

How can you take a maximally risky and speculative bet, that is both “safeâ€, reducing risk, and also maximizing upside?

The first thought that NASSIM TALEB had was never put more than 10% of your life savings into one single investment or acid. For example, I heeded his words of wisdom, and when Cindy and I had around $250,000 of savings, I only put 10% of that into Digibyte and Bitcoin — around $22,000, I bought some bitcoin at $6000 a bitcoin, and I think I bought some digibyte at one cent or two cents a digibyte — and eventually I rode it all the way up to around $250,000 worth of investments, one bitcoin hit an all-time high at around $60-$65,000 a bitcoin. I did some swapping here and there, consolidating my digibyte back into bitcoin, a good move, I speculated and played around a little bit with Dogecoin, rode it up, eventually consolidated it back into bitcoin, etc.

More recently, I wired $125,000 back into my crypto account, and bought more bitcoin.

Why?

People seem to hate the volatility of crypto, but I love it. Why? Perhaps for myself, I thrive off of high intensity, and adrenaline.

Also one of the upsides of growing up poor, seeing my mom go through bankruptcy twice is that actually… I have almost close to zero anxieties when it comes to money. I’ve lived super poor before, on the brink of being homeless, as a kid, and that is what naturalistically made me so stoic.

The reason why I don’t trust or give any heed to people like Tim Ferris or Tony Robbins is that it seems that once upon a time, both of them were super depressed, fat, losers, planning ways on how to commit suicide and kill themselves, and how to do it gracefully. Tony Robbins was the fat depressed one, Tim Ferriss was the suicidal one.

I think it is very courageous that Tim Ferriss outlined the story of when he was an undergraduate at Princeton, he actually took out books to plan his own death, reading books on suicide and how to kill himself, and how to do it in a graceful manner, but fortunately somebody found out, had an intervention, unfortunately Tim didn’t do it. I don’t think anybody should ever commit suicide, under any costs.

Anyways, I think the reason why it matters is that when people try to commit suicide, or have been severely depressed in the past, in high school middle school college elementary school etc.… that trauma stays with them.

For myself I am a unique case; I experienced severe and potentially destroying trauma as a kid, for some reason, those experiences actually made me stronger. How and why?

First, think I was fortunate because of random life things. For example, a formative time in Bayside queens in a very safe community, hanging out with my friends Spencer, Aditya, Jonathan etc and living like free range kids, at the ripe age of 11 to 12 years old, and also some great mentors along the way, Troop 11 in Alameda California, my Boy Scouts troop leaders, my coach Greg Lowe who essentially became my Mr. Miyagi private tutor and father figure guide, who taught me life lessons through tennis.

Good schools

Also fortunately, the good timing; my mom moving our family out of Alameda, which was bordering Oakland; even though Alameda is a nice town, it borders Oakland, and so even Alameda high school was full of a bunch of these ghetto kids, gangbangers and bad influences. I went to high school at Castro Valley High, a very nice school with no drama, good teachers and good AP classes, eventually I was able to get to UCLA as an undergraduate, which helped accelerate my roadmap to success.

Think long

Along the line, meeting Cindy, then just another person I met my freshman year, at our Korean American Catholic club called Kyrie — later traveling the world with her, dating her, marrying her, and now having a kid with her, Seneca at age 3 years old.

Anyways, I have a lot of people to think, especially my uncle, who essentially helped my mom so much financially, and also my sister, for her private art school lessons, in order to get her into fashion school at Otis in LA, my sister eventually dropped out, but randomly through an apartment party, met her then future husband. Fortunately my sister‘s brother‘s family is very prosperous, opening up a fine art gallery in LA (VEFA)– will keep you updated with this, but anyways, our family is pretty set.

In the long run, everything works out just fine!

Just do what you believe to be righteous

I think it is critical to have a good dose of criticality when it comes to the opinions of others, even your spouse. I think we should always respect and lend an ear to the opinions of others, but ultimately, it is you who must be staunch, and perform things and your life in accordance with your own personal beliefs.

When people say “you’re not listening to me!†what they really mean to say is “how dare you not obey me!â€

The funny retort is people who get angry at us for not listening to them… aren’t they committing the same critical flaw of not listening to us?

My New Year’s resolution is actually to become MORE close minded, more staunch in my beliefs.

Speculation in the market

People don’t know but I’ve been trading stock ever since I was around maybe 15 or 16 years old, my sophomore junior year in high school. I remember actually investing really early in Adobe stock, because I used Photoshop and I found it to be a good tool. I actually made some money in high school, investing my life savings which was maybe around $1500 USD, maybe I will also get Seneca into trading at a young age.

Anyways, it was good learning and education because it taught me how to deal with ups and downs, and also losing it all.

Bitcoin will never go down to zero

The reason why I am so bullish about bitcoin is that I have a strong faith That you’ll never go down to zero. The reason why I would never put my money anymore into “alternative coins†[ALT COINS], or coins is that there is a high likelihood that a lot of them will go down to zero.

For example, I think when the biggest scams in the cryptocurrency space, is Ada Cardano. They have set up a fake foundation with the .org website, with a bunch of fake people, fake talking heads and suits, nobody has any idea what they’re going to do or what their product is, I think a huge profit can be made by shorting it. I’m pretty sure that Cardano will go down to zero.

Also, all these other weird alternative coins, only things that even have any nominal value include bitcoin, Ethereum, chainlink.

Why chainlink? First and foremost, chainlink isn’t really a crypto, it is like a new technology. I think of chainlink more like the next Google. Even the ex Google CEO ERIC Schmidt is on board.

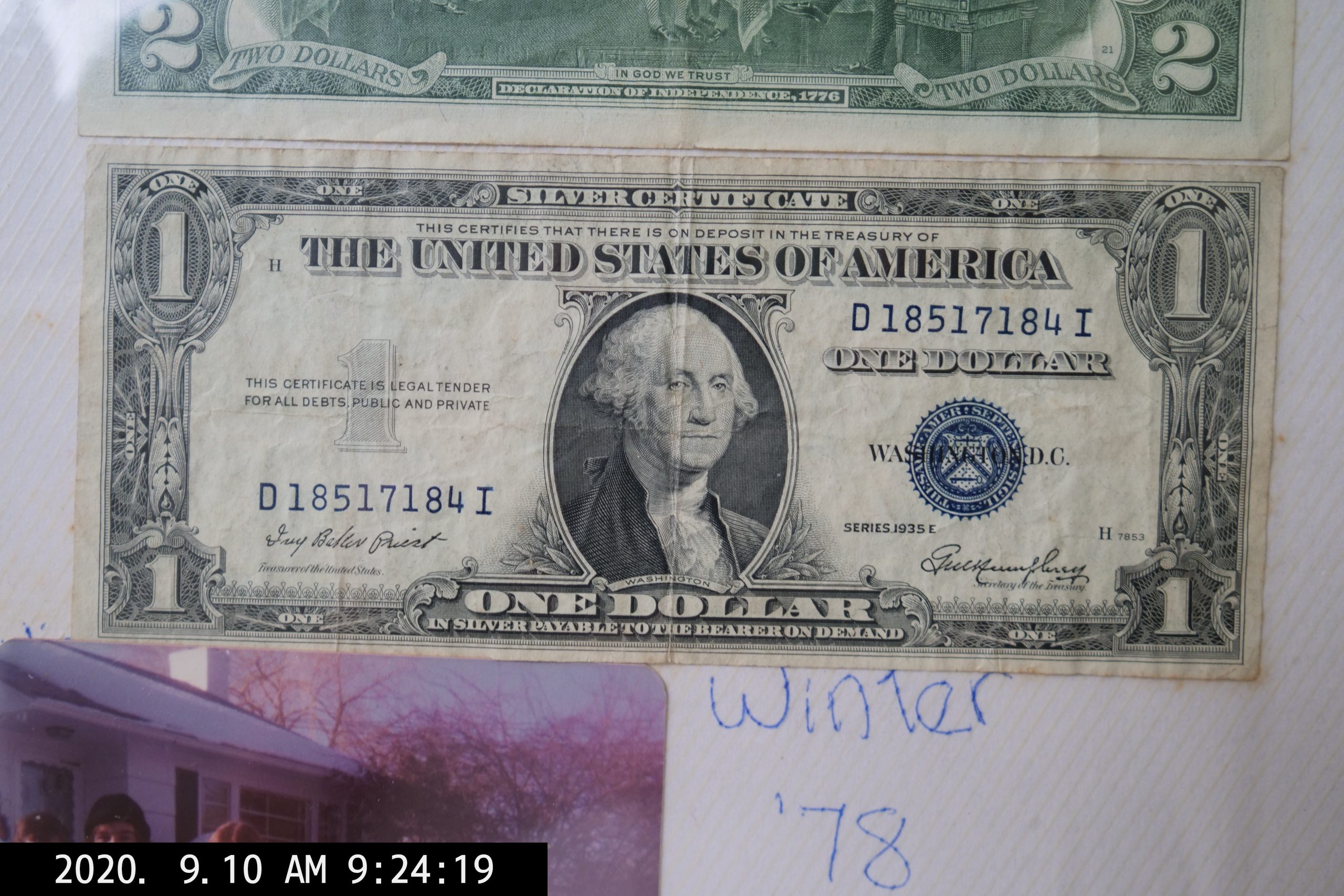

Bitcoin is fascinating because ultimately, everybody knows what it is. To quote Galiani, on his treatsie “on money“, Galiani once said that the word “ducatâ€, rolls off the tongue quite beautifully, I also see that the word “bitcoin“, also rolls off the tongue quite beautifully.

Ultimate test: even Cindy‘s mom, a Vietnamese refugee immigrant can pronounce bitcoin in her “broken English“, and knows what it is. She says “I know what bitcoin is! It is the fake money!†Haha — true.

So why does this matter?

I think the reason why this matters is you don’t want to be sitting on your butt, 10 years from now, Seneca will only be 13 years old still very young… and kick yourself in the butt for not taking a bold risk, and something you believed in, a decade ago. Jeff Bezos calls this the “regret minimization framework“.

For example, some moderately regretful things I’ve done the last two years is selling some bitcoin, converting into worthless US dollars, in order to “alleviate“, some financial concerns. But, moving forward, 2024 and beyond, I think the goal should be to become more staunch, more unyielding, More close minded.

MOAR BITCOIN!

20 BITCOINS; MATTE BLACK!

Being close minded is a virtue?

People say that being open minded is a virtue, but I’m starting to think, maybe not. Why? Do you want to be open minded about Adolf Hitler and Nazis? Or the new Nazis? Or alternative right wing weirdo conspiracy theorists, who want to hijack the American government, and promoting anarchy?

Also, I’m very close minded for these weird anti-fascist, loser skinny fat, fakeass woke, anarchists; they all have iPhones, watch YouTube, jerk off to porn on Google incognito late at night on their laptop or their phones, use piratebay and private VPNs– no capitalism, no consumerism, no pornography.

Trust no man who secretly watches porn.

Anti men

The really big issue at hand is that a lot of these people, men specifically, I don’t think we should trust most men. Why? A simple thing; it is true, the behavior of men and women is polar opposite.

For example, women do not start gangs, or become gangbangers. This is reserved to only men.

Or another example, the difference between a woman bathroom and a male bathroom; in any bathroom, for example let me quote Galbi King — my new favorite Korean barbecue place in Los Angeles, only $26 a person, look at the difference between the men’s restroom and the women’s restroom. The men’s restroom has all these dicks graffitid on the walls, scratches on the window, graffiti on the walls, graffiti made with knives in the mirrors etc. Go to the women’s restroom; nothing.

This is the tricky thing about sex and gender; sex is biological, gender is sociological. Therefore as a consequence,  people foolishly discount the differences of sex.

For example, I think it has to do with testosterone, testes, the male hormone. The reason why I distrust all these weird hormone replacement therapies is that why not just be natural? For example, I think it is actually normal to be LGBTQ? But once you inject hormones into yourself, not good.

For example, to inject any sort of external hormones to change your sex, is a patently bad one; we shame people for doing testosterone injections and steroids and stuff, why not the same consistency with these weird sex changing hormones?

Back to speculation

Some personal tips I recommend is stop using Google, either use bing.com, or just use ChatGPT, the premium one. Stop using Google.

In fact, I think Google, YouTube, YouTube shorts whatever is the real bad guy here. Think about all these weird conspiracy theorist people, who platform themselves on YouTube etc. And with enough wikipedia’ing and googling, you’re gonna eventually fall victim to weird conspiracy theories.

Also, put zero faith in TikTok, it is owned by mainland China, Tencent corporation —  if you’re on TikTok, or promote TikTok, you’re pro mainland China, not good.

Democracy and freedom is at odds with social media?

One thing I found very interesting about Donald Trump was he was very anti-TikTok, wise idea. Why? The way that one nation takes over another nation is through soft coercion, soft propaganda, sneaky propaganda.

For example, RIOT games which is owned by also the Tencent mainland Chinese corporation – they own league of legends, and a bunch of other games; this is essentially their low-key way of taking over the minds and the souls of the American youth.

Also the really big issue here is that a lot of these big tech companies are in bed with mainland China, this includes Apple, all of her phones and products are produced by Foxconn in mainland China, I think Google is trying to dip more into the mainland Chinese market, compromising their ethics by censoring the Tiananmen Square incident, And I am certain that Mark Zuckerberg wants to get into Maitland China as well; his wife is Chinese American, and I think Mark also taught himself Mandarin.

The new oligarchs?

I think a big issue at hand is that this New World, this New World order is not about nations or nation states anymore, but rather, individual rich oligarchs. What that means is individuals, doesn’t really matter your nationality, just trying to augment their wealth. Their private wealth.

I find this to be very greedy, and also, unpatriotic. Anyone who tries to dodge taxes, I find this to be very bad behavior.

Now what?

OK all these weird theories aside, what now?

First, think digital real estate, not physical real estate. I think still nowadays, the internet is still a massive untapped market. Let us consider, to own a .com domain is only maybe $12-$20 a year, which is less than one dollar or two dollars a month. Let us consider that even if you buy a $3 million house in all cash, your property taxes will still look like around $12,000 USD a month.

The reason why it is so difficult to think digitally is that we disdain the digital, we prefer the physical. But, if you think about the greatest drivers of wealth created the last 10 or 20 years, it is all technology, digital, internet.

For example, Amazon web services, Facebook, Twitter, etc.

So the first very simple thing you do is build your own website, blog, or web platform. My simple suggestion is try to enter a field or market in which you could do all the work and labor yourself. For example, I do not know how to code, and honestly speaking I have zero aspiration to learn how. But, writing and blogging and vlogging is second nature to me, I don’t even have to think about it. Therefore, it seems that perhaps the most intelligent strategy is to identify your archimedes lever, and maximize your leverage intelligently rather than trying to get good at something you’re not that good at.

How do I identify what my Archimedes lever is?

I would say the simplest strategy is first figure out what your passionate about what you love, and what you’re really good at, which others find difficult. Then, doubling down or 10X’ing down on it.

Then, the best way to move the world or change the world is to exploit your leverages to the maximum!

ERIC

Weather & Investments?

I have a funny theory; I wonder if the weather or climate of a certain day and time and place influences and effects investing behavior?

For example, when I bought or consolidated a lot more of my assets into bitcoin and back into bitcoin, I ensure to do it when the weather was insanely good, lots of beautiful light on my face and my naked body, that good mood was a good inspiration for making a big bet and a big trade.

So just think, when you’re about to make a big trade, how is the weather? Is it better to invest when the weather is good or bad, or something else?

That new new shit

START HERE

BOOKS

- March 2nd, 2024: ERIC KIM CREATIVE AI & PHOTOGRAPHY WORKSHOP — Culver City, LA

- April 20th, 2024: SF ZEN STREET PHOTO WORKSHOP

TIME TO DOMINATE >>

NOW WHAT?

Read:

- The Iliad by Homer

- The Odyssey by Homer

Watch:

- John Wick (all) // philosophy of wick

- Matrix (all of them, not the 4th) // life lessons

- Movie 300;

What else?

- Buy weight lifting equipment (titan.fitness)– workout at home or in your garage or back yard parking lot off the grid Eric Kim style.

- Strive to make your body look demigod

- Hot yoga, stop coffee or caffeine consumption past breakfast, try to sleep 8-12 hours a night

For more thoughts more fire always on ERIC KIM BLOG >

When in doubt, just blog it!

ERIC

“I shall make a monument more lasting than bronze!†– HORACE