So I’m just kind of thinking ahead. Especially, predicting and anticipating, the point in which MSTR 10x’s,  in which you could turn $1 million investment into a $10 million one. Also thinking about once bitcoin hits $500,000 a Bitcoin, 1 million of bitcoin, 1.2 million of bitcoin, 10 million bitcoin, 21 million a bitcoin, 55 million a bitcoin and beyond.

you don’t want the time machine

so if you could just wave a magic wand, and have the next 30 years gone on by in a heartbeat, and then the century your family will be worth $200 billion or whatever… Would you make the trade? Probably not. I’m turning 38 years old, and if I was suddenly 68 years old, I mean I’m still happy with it I’m sure that’ll be still super strong and have my six pack in my traps, but probably will not be lifting 1000 kg anymore.

Seneca will be 35 years old, primetime.

My mom will be like 100 years old, hopefully still healthy. But you never know.

Anyways, thinking ahead, 10X, I think the tricky thing is, everyone is always in such a rush to become super insanely turbo rich. But, the tricky thing is… I think for most Americans the desire is to become rich in order to spend the money and consume more. Or changing certain lifestyle things.

House

So one thing off of my checklist or our checklist is getting the big ass single-family house, huge lot, lots of great dirt in the backyard, and also my new beloved detached to car garage which I’ve been using as more of a creative studio for myself. Also my mobile off the grid gym.

Certain things which have improved dramatically for myself, in our new home is that I just been sleeping far better, when I wake up early in the morning I’m less likely to wake up Cindy and Seneca, Senic has been sleeping well through the night, like a champ… And also, finding some good grocery store options close to our house and home which is good because I’ve been able to go ham,… hard as a mofo on my great 80% ground beef chili recipe… I think I ate almost 5 pounds of it last night, my secret recipe:

Just buy five bricks of the 80% ground beef, Amazon fresh is pretty good,,, if you’re lucky enough to get the 30% off clearance discount, and it is typically $4.99 a pound. , Just take out all of the ground beef and first stirfry it all inside a big pot nonstick, cook it thoroughly, then drain the fat, you could save the fat in a plastic container if you want to cook with it later maybe your eggs… And anyways, add soy sauce, fish sauce, cumin, coriander seeds, whole black peppers, they leaves, cut up Mexican chilies, curry powder, and some tomato paste not too much. And later you could chop up some raw onions, cilantro, and squeeze in some fresh limes on top. Really good.

Anyways, certainly to eat well sleep well, and even this morning, I woke up feeling amazing, I didn’t even drink that much coffee and I feel insanely great!

First health

So I think the first obvious idea is, ideally… It is desirable to have insanely great health.

First, no pain. Which is pretty easy assuming that you do a yoga hot yoga and good mobility training, and also weightlifting on the daily.

So then take that off your checklist, no physical bodily pain pains.

Then, having a phenomenal and great physique that you love. Also another good idea.

Third, having insanely great strength physical strength, and also… Knowing that you will indefinitely increase your strength and physical power.

Then what after that?

Travel?

So then it seems that like another thing that people don’t want to do is once they have the dream house or whatever is to travel. But also the tricky thing… Whether you just want to keep indefinitely living on the road automatically and keep traveling for the rest of your life… Or just intermittent travel, intermittent living nomadically?

Cambodia is calling

So for myself, one of my huge passions is Phnom Penh Cambodia. I literally love everything about the place the culture the food environment the weather the people the language etc. And while I love my Los Angeles life, and frankly speaking LA life is kind of perfect for me as well… Still, my soul yearns for Phnom Penh.

It’s also tricky because once you leave the states or your home or whatever… Certainly there are many downsides. For example, you will probably have less space, you’re not gonna have access to the same outdoor spaces as Asya do back home, etc. Typically when you’re on the road, on a superficial level, everything is a disadvantage and a downside.

Yet, I think the thing that is extremely rewarding is a sense of discovery.  and I think this is a big life lesson that I’ve learned is, I think when we are searching for novelty and joy and whatever… What in fact we are actually seeking is discovery. Not the loser Range Rover, but true discovery. I think this is the joy of the traveler the explorer, as well as the scientist.

Even a lot of the creative stuff that I’ve been doing with AI, I love it because to me it is all amazing discovery! To discover new interpretations and things and stuff, blows my mind in a good way.

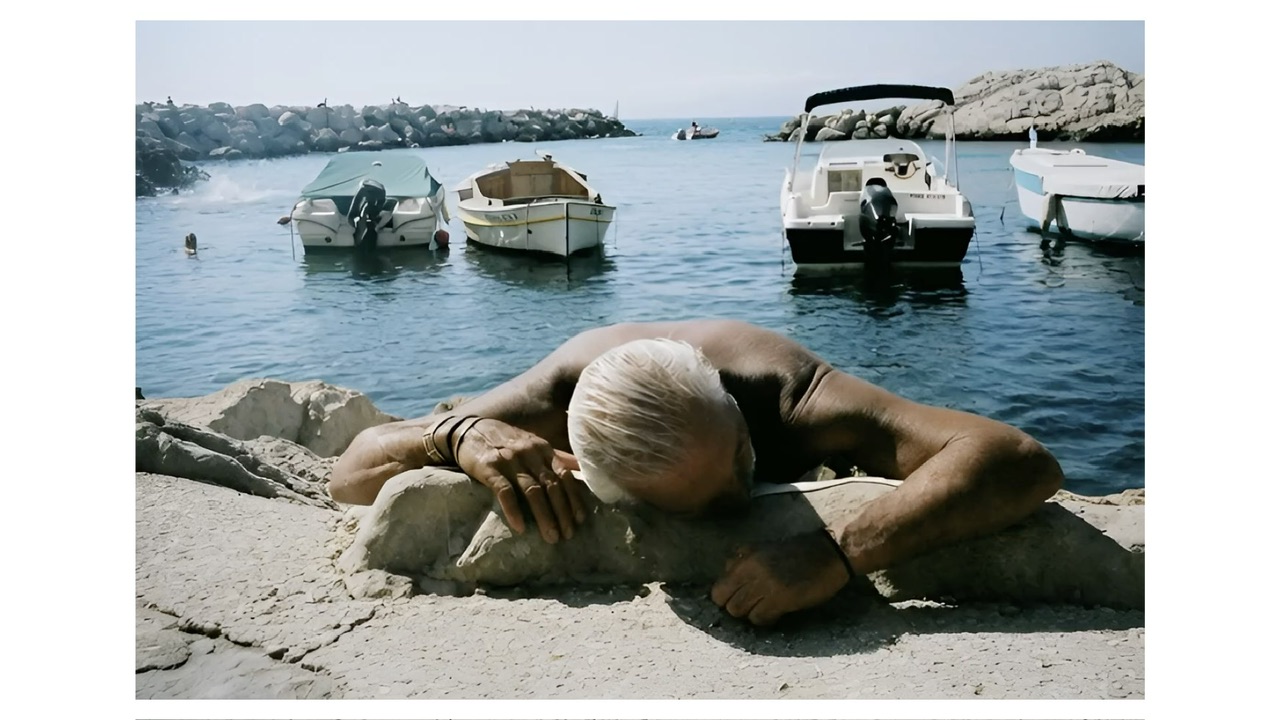

Photo

Also this is kind of a hilarious idea, everyone is ringing the alarm bell saying that humans are no longer necessary being replaced whatever. I say ignore the noise. It might have also been similar in which people thought that photography was “cheating”, because it was like 1 trillion times faster and more efficient than old-school oil paintings.

The truth is with creativity art life and everything in between… Being able to make things more seamless, less friction, as well as less paralysis by analysis is a good idea.

And this is still wearing photography, having a simple pocketable camera like a RICOH GR still kind of makes the most sense because if you could just snap something out of your front pocket turn it on take a picture, that is the most pure expression of the creative act.

Photo visions and new years

So I think a big thing is that we all want to move around. Even if you have the world’s best mansion on top of the hill… You still just want to go out! And it is my general believe that humans are hardwired to want to go out and walk hike see new vistas travel go on hiking , ride the Tokyo subway, shoots street photography in the famous Shibuya Crossing,  enjoy street photography in Hong Kong like my favorite TST tsim tsa tui… and the riverfront, shout out to Kaiman Wong, aka by and lok… good memories. And also insanely friendly Cambodian people of Phnom Penh.

ERIC KIM WORKSHOPS >

AI is just suggestions

SO ultimately you the human agent are the ultimate decider.

AI is just an option, the real deal is you.

Now what

I mean honestly if your goal is to retire early, live happily ever after it never have to worry about money so we can just focus on your artistic creative stuff, living and moving to Phnom Penh Cambodia probably your best bet. To live happily ever after in perfect bliss, to never have to worry about nothing, and to be surrounded by the happiest people of all time.

are there any upsides to America?

So then the trillion dollar question, why live in America why are we wasting all of our time here?

Well there are certainly a certain things which are very very good for Americans, like a simple one… Assuming you want to be a professional weightlifter or bodybuilder or whatever, America has the best access to beef.  so if you want to become super insanely muscular and jacked, and also… Access to having the privilege to purchase certain weightlifting equipment. For example, my 905.8 kilogram (1,997 pounds) god lift …  simply having the privilege of having access to purchase all this weightlifting equipment and steel plates, my gratitude for being able to purchase this equipment online and having it shipped directly to my house for free via Titan.fitness., Specifically having the ability to buy a bunch of the 50 kg steel plates, which is roughly 110 pounds each, so I could max out my Texas power squat bar.

The truth is if you’re outside of America, there are a lot of very very extremely specific things that you probably don’t have the ability to have the access to. In terms of purchasing.

Do you really want to purchase it anyways?

Once again, there’s a difference between having $10 million in the bank, or having $10 million worth of bitcoin, locked up in cold storage versus going out and spending $10 million.

Everyone wants to expensive vehicle of their dreams, but, this is kind of a silly pursuit because once again, it’s probably better and more fun to transform your body to look like a Lamborghini, rather than to drive it.

Also a real concern is, especially in America… You actually don’t want the Lamborghini or whatever because it’s kind of like positively putting your life on the line. If you want to be robbed at gunpoint, or put your kids wife family at risk, armed robbery with a gun, probably not a good idea.

So, actually… Even if somebody were to offer you a Lamborghini for free, the intelligence strategy would to be to smile politely, ask to just test drive it around the block, and politely refuse.

but what about the Porsche 911 GT3 RS?

Or the new Porsche 911 turbo or whatever?

Once again, I think my big epiphany is, it is probably positively a poor idea because, the truth of the matter is it will probably make your life worse than better?

And also the bigger idea is that, any sort of situation in which you are sitting and seated rather than just being on your own two legs and walking, is actually a non-desirable situation. I think we have been sold the sucker idea of somehow… Wanting to drive some sort of high-powered vehicle to feel the pleasure of power thrust and thrills? But actually a more fun and safer version is actually just go to the local go karting K1 speed, and enjoy it there!

What else?

Yeah once again guys, I think it just comes down to like creative, creativity, having the privilege to create creative stuff.

And frankly speaking, now that I have achieved pretty much all of my financial in life and house goals, and also physical strength goals….. what’s next? To me it just comes down to autotelic stuff, –

I actually really enjoyed teaching photography and inspiring and motivating people, the joy of seeing people transformed through photography it’s just like an intrinsic joy. Even if I was worth $100 trillion, certainly I would still enjoy photography for the sake of it.

Also, blogging writing and being creative and also using cutting edge technology for everything! For example, I have infinite joy blogging writing thinking, making videos vlogging,,, experimentation with digital technologies, and AI… ChatGPT ChatGPT pro, SORA 2 pro.

Digital Eric

The thing that’s still the most shocking to me is that it looks like it is official, ERIC KIM, digital ERIC will live forever.

Why? I suppose the benefit of being on YouTube for like 16 years is that, it looks like it got insanely good at scanning all of my videos and making a digital me. I’m actually really really shocked, digital ERIC looks like at least 80% me, less buff, because the old videos that the AI is trained on is before I got into hard-core weightlifting and meat eating.

for the sake of what?

Once again the big idea is kind of getting to the point in life in which everything becomes autotelic, … in which you do stuff for the sake of it. Without needing some sort of vague notion of reward?

Simple, simplicity?

Autotelic, doing things for the sake of it?

Maybe marching into the new year… Just keep it autotelic, which means, do and pursue things simply for the sake of it, without that much concerned for momentary economic reward?

For example with bitcoin, my primary driver is just the whole ethos of it. Decentralized open source true money, isn’t this like super interesting? Only 21,000,000 coins.,, forever? A true hard cap scarcity? If Fernandinho Galliani, we’re alive today… He would love it.

philosophy future

So I also think there’s lots of new opportunities for philosophy us philosophers of the future.

Good opportunities:

- Ethics of AI

- Fitness, bodily, physiological philosophy

- Philosophy of aesthetics

Much more soon!

EK WORKSHOPS 2026

Become a new you:

Some exciting incoming workshops:

FEBRUARY 21st, 9:00–11:00 AM PACIFIC. ERIC KIM AI ONLINE WORKSHOP. Essentially the idea is how to use AI to augment your photography and creative self , info TBA

traveling workshops 2026

So this is where it is actually super exciting, some international travel workshops that have… good for you to travel to, and or… If you live in Asia, a good place to go, .. two reinspire yourself your photography and your life:

- Phnom Penh Cambodia, June 26,27,28 2026 (Friday-sun)

- Hong Kong, July 25-26 2026, sat-sun

- TOKYO, AUGUST 8-9, 2026 sat- sun

Essentially, I love Phnom Penh Cambodia to death,,, to me it’s probably like one of the most underrated or even unknown interesting places on the planet that I feel that everyone should know exists. This one will be epic, and also if you want to fly out to Cambodia, you could even make it into a longer trip and go Angkor wat which is close by.

Hong Kong, July 25 to the 26th…. Hong Kong is like one of the most dynamic places to shoot street photography and to experience the beautiful controlled chaos, it’s like ghost in the shell, meets the matrix, but real life.

Tokyo, the perfect place to go … especially if you’ve never been to Japan or just want to go again. All the super insanely awesome camera shops and opportunities! August 8 to the 9th,,, and also the good thing is because their economy is down right now, that means if you’re an American with US dollars… Everything is like a 50% discount right now.

Also, if you check google flights or kayak.com… There’s so many cheap travel deals to Asia right now. Have you seen some flight flights round-trip from LA for only like $750 bucks?

Anyways, stay updated on the newsletter and the workshops page, and I’ll send another email when they are live.

Another reason not to buy the sports car or even a Tesla or a second vehicle?

Randomly woke up this morning with a flat in my Prius?

ultimately when it comes out to it… Reliability is number one. Randomly pulling up to the driveway on my house, and being insanely annoyed that the rear back tire of my Prius was totally flat?

And then I thought to myself, if you actually had two cars, that’s an additional four tires… The chance of one of them becoming flat as well as even higher?

And then, thinking about the really fun joyride I had with my friend Don Dillon, in his Porsche 911 GT three, and also… Randomly accidentally getting stranded in the middle of nowhere, because I think we accidentally hit a nail in the road? And then him having to tow it all the way to the Porsche dealership, and having a very very expensive tire job. And he told me that he had to replace all four tires because “that’s the way they go”.

And even a bigger thought, the thing that’s very annoying is that, apparently if you have a Tesla, the price to change the tire tires is super expensive?

But I think ultimately, the number one annoyance is, when it comes down to it, you need to be somewhere or you need a reliable car to get somewhere on time, 100% reliability is your number one desire?

Wealth is different than currency

The last thought to ponder on is this:

–> try to critically think what you define wealth as, as it is different than currency.

ERIC

More fire on the blog, get some free books, get some fire products!

Happy 2026!

START HERE >