Consume more steroids ,,, and yes,,, the steroids are your food!

- Organ meats

- Cholesterol high foods (liver, heart, kidney, intestines, marrow etc)

- Pasture raised eggs

- etc

Consume more steroids ,,, and yes,,, the steroids are your food!

My new entrepreneurial direction?

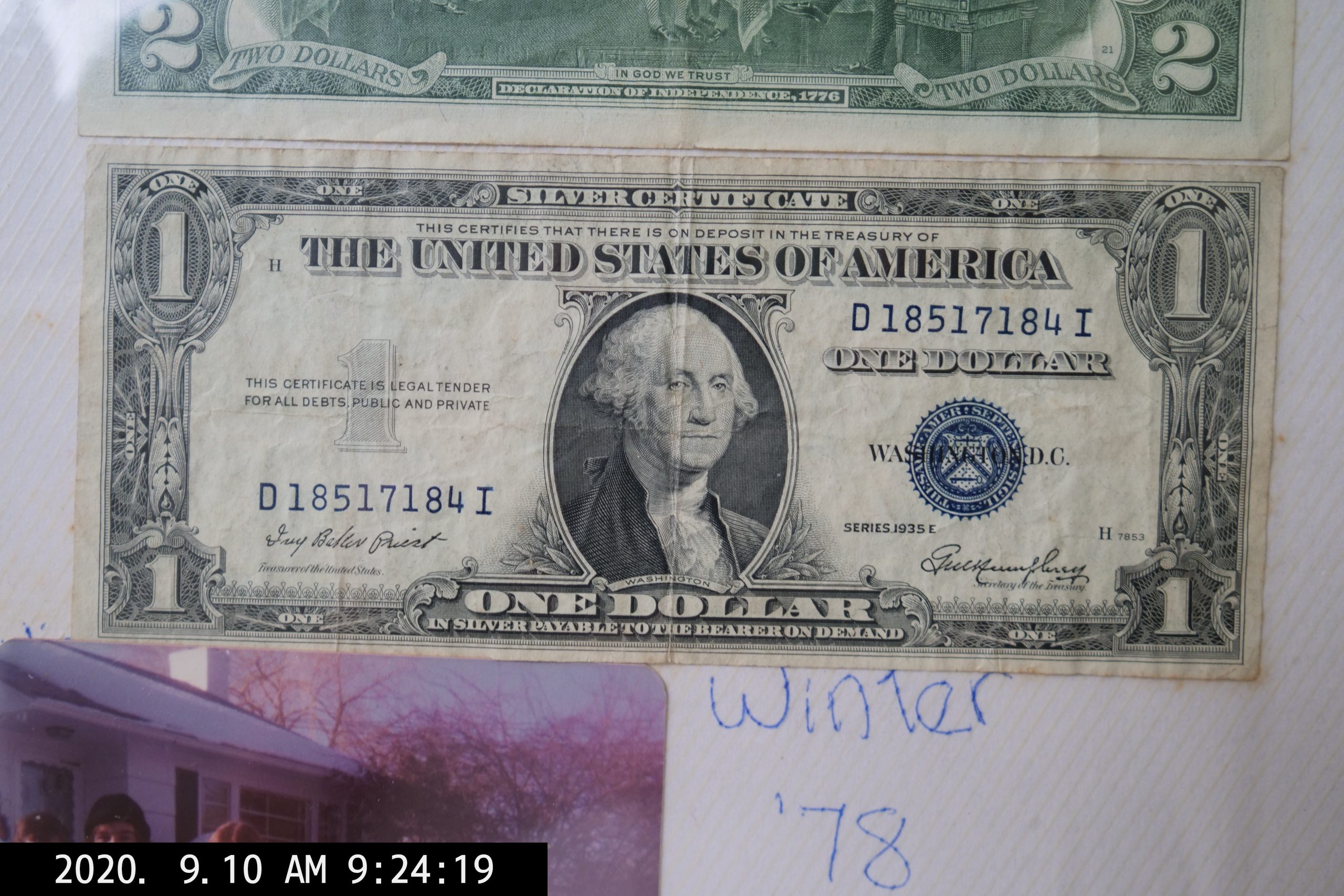

Money thoughts:

Fuck the banks — owning crypto or Bitcoin, you no longer need the banks as a custodian of your money?

Also,,, having to send simple wire transfers of 105k, 125k etc,,, why does this require me to waste 3 hours on a phone with a real life human being, verification whatever,,, when simply on a Bitcoin or crypto wallet, I can easily send 1 or 2 Bitcoins (currency valued at around $69k, $138k—),,, in a matter of seconds or minutes?

Perhaps stoic people are boring — better to be a volatile person, than always morose?

Bitcoin as the most important thing since the advent of the internet?

Right now in 2024– moving money, wire transfers are even 1000x *slower* than an AOL 3.0 38.8k dial up modem. Bitcoin is like upgrading to cable internet .,, early days of Comcast,,, a big deal!

Lightning Network, like a ghetto early gigabit fiber internet connection?

Long Bitcoin, Short Dollars:

Brave new world for photographers and crypto:

If it goes up, I’m happy, if it goes down, I’m happy (I can buy more at a discounted price!)

For example only my iPad Pro M1 chip ,,, the FaceID is already busted???

Hyper nourishment

This is what “hyper trophy†(hypertrophia) is—

Each and every man desires a son. At least one. If you were blessed with a son, either as your first or a second; shouldn’t you be perpetually blessed happy grateful and overjoyous?

A father who is absentee from his son; certainly a sign that the father has some serious brain broken issues.

I am the happiest, proudest and most joyful father alive !

To provide a service, value.

100% pure bliss.

1. The grandest good is grand food … to power you and your children?

2. Outdoors is free and best!

Individual — personal economy

“Expenditure must not exceed the income“***

Homes and health:

With a view to 30

well-being and health, the house ought to be airy in

summer and sunny in winter. This would be best secured

if it faces north and is not as wide as it is long.

Attend to everything yourself

no one looks after the property of

others as well as he looks after his own, so that, as far as

!34511 possible, a man ought to attend to everything himself.

Acquire wealth, and guard it!

“A slaves reward is his foodâ€

Woman is more prone to fear than men

Work, punishment and food — to slaves

Three things make up

the life of a slave, work, punishment, and food.

Freemen do not drink wine:

since the drinking of wine makes even freemen inso

lent, and many nations even of freemen abstain therefrom

(the Carthaginians, for instance, when they are on military

service), it is clear that wine ought never to be given to

35 slaves, or at any rate very seldom.

Slaves: overseer and worker

Sex: man should be content with it or without it

Man: well constituted for outdoor activities

Aristotle — Oeconomia

In the performance of work, she made one sex able

to lead a sedentary life and not strong enough to endure

exposure, the other less adapted for quiet pursuits but well 5

constituted for outdoor activities ; and in relation to offspring

she has made both share in the procreation of children, but

each render its peculiar service towards them, the woman by

nurturing, the man by educating them.

Better to be hot tempered:

“For it is better for a father to be hot-tempered than sullen, for to continue hostile and irreconcilable looks like hating one’s sonâ€

Excerpt From

Plutarch’s Morals

Plutarch

https://books.apple.com/us/book/plutarchs-morals/id511195428

Whether positive or negative,,, whether to do something or even *NOT* to do something.

You know how we got landlords who rent out their properties and apartments and buildings and houses and homes and stuff, or these mega condo associations that rent out the units? Maybe the same—

Buying and owning Bitcoin like owning a mega skyscraper, or a new luxury condo building but in cyberspace?

Long Bitcoin, Short Dollars:

Brave new world for photographers and crypto:

The future is digital property —

If you’re a man, and the other party is a woman; the ethics here are different!

Also, better to do some light daily exercise than no exercise!

Seek to have more self-control than Zeus!

Better to be silent and give the silent treatment than to say something

Stoic wisdom

Bitcoin’s price has shown significant fluctuations surrounding its halving events, influenced by a mix of investor speculation, market dynamics, and broader economic factors. The pattern observed around these events has generally seen an increase in volatility before and after the halving, with notable price movements:

First Halving (November 2012): Before the first halving, Bitcoin’s price was relatively low, hovering around $11. In the months that followed, the price experienced a significant increase, eventually reaching over $1,000 by November 2013. This dramatic rise was partly due to increased awareness and adoption of Bitcoin, although it was followed by a substantial correction.

Second Halving (July 2016): Leading up to the second halving, Bitcoin’s price gradually increased from about $230 in July 2015 to approximately $660 by July 2016. After a brief dip right after the halving, the price continued to climb, contributing to the bull run that peaked at around $20,000 in December 2017. This period saw heightened media attention and a surge in interest from retail and institutional investors.

Third Halving (May 2020): The price was around $8,787 at the time of the most recent halving in May 2020. In the months leading up to it, the price had recovered from a significant drop in March 2020, related to the global financial uncertainty at the onset of the COVID-19 pandemic. After the halving, Bitcoin entered a bull market, reaching new all-time highs above $60,000 in April 2021.

This rally was driven by factors including increased institutional investment, adoption by major corporations, and widespread media coverage.The price movements around these halving events illustrate Bitcoin’s volatility and the speculative nature of the cryptocurrency market. While halvings reduce the rate at which new Bitcoins are generated, leading to expectations of increased scarcity and higher prices, the actual impact on the market can be influenced by a wide range of factors. These include investor sentiment, macroeconomic trends, regulatory developments, and technological advancements in the cryptocurrency space.It’s crucial for investors to consider these dynamics and conduct thorough research before making investment decisions, especially in a market as unpredictable and volatile as cryptocurrency. Remember, past performance is not necessarily indicative of future results, and investing in cryptocurrencies involves significant risk, including the potential loss of principal.

Bitcoin halving events have garnered significant press coverage and attention from the cryptocurrency community due to their substantial impact on Bitcoin’s economics and market price. These events, which halve the reward for mining new blocks, effectively reduce the rate at which new bitcoins are generated and introduced into circulation. This scarcity mechanism is a fundamental part of Bitcoin’s value proposition as a digital store of value.Historically, halving events have led to increased market volatility, a surge in public interest, and speculation about Bitcoin’s price trajectory. For instance, past halvings in 2012, 2016, and 2020 were each followed by significant price rallies, though the immediate effects on Bitcoin’s price varied. The anticipation surrounding these events often leads to increased trading activity, speculation, and media coverage, contributing to the broader narrative of Bitcoin as a deflationary digital asset oai_citation:1,What Is Bitcoin Halving? Here’s Everything You Need to Know About BTC Halving oai_citation:2,Bitcoin Halving: How it works and Why it matters .The press and analysts closely monitor these events, speculating on their potential impact on Bitcoin’s price and the broader cryptocurrency ecosystem. This speculation is driven by the expectation that reducing the supply of new bitcoins entering the market could lead to price increases if demand remains constant or grows. However, it’s important to note that Bitcoin’s price is influenced by a wide array of factors beyond the halving, including market sentiment, regulatory developments, and macroeconomic trends oai_citation:3,Bitcoin Halving: How it works and Why it matters .Recent coverage leading up to the 2024 halving has highlighted several key themes, including the impact of institutional investment on mining, the potential for price volatility, and broader implications for network security and miner profitability. Analysts and commentators are examining how changes in the mining landscape, such as the introduction of Wall Street funding, could alter the dynamics of Bitcoin mining post-halving. Additionally, there is considerable interest in how the halving might affect Bitcoin’s role in the growing

Bitcoin’s halving events have historically been significant milestones for the cryptocurrency, typically leading to substantial price movements. The halving event, which occurs approximately every four years, halves the reward that miners receive for adding new blocks to the Bitcoin blockchain. This effectively reduces the rate at which new bitcoins are created and introduced into the circulating supply, making bitcoin scarcer.Here’s a brief historical overview of what has happened to Bitcoin prices during and after the halving events:First Halving (November 2012): The first Bitcoin halving occurred when the mining reward was reduced from 50 BTC to 25 BTC. Leading up to the halving, there was a noticeable increase in the price. After a short period of volatility immediately following the halving, the price began a long-term upward trend, culminating in a significant price increase a year later.Second Halving (July 2016): The second halving reduced the mining reward from 25 BTC to 12.5 BTC. Similar to the first halving, the price of Bitcoin saw a gradual increase in the months leading up to the halving. After the event, there was a period of relative stability followed by a significant bull run starting approximately 6 months later, which eventually led to the 2017 peak.Third Halving (May 2020): The reward dropped from 12.5 BTC to 6.25 BTC during the third halving. Leading up to the halving, Bitcoin’s price saw considerable growth. Following the halving, after a brief adjustment period, the price began to increase significantly, contributing to the bull run that peaked in late 2020 and early 2021.It’s important to note that while historical data shows a pattern of price increases following halving events, these periods also coincided with growing mainstream acceptance of Bitcoin, increased institutional investment, and broader financial market dynamics. Therefore, while the halving events are theoretically bullish due to the reduced supply of new bitcoins, the actual impact on price also depends on a variety of other factors, including market sentiment, demand, macroeconomic indicators, and regulatory developments.Investors often look at halving events with a mix of anticipation and caution, as they can lead to both opportunities and increased volatility. As with all investments, past performance is not indicative of future results, so it’s essential to conduct thorough research and consider a wide range of factors when making investment decisions related to Bitcoin or other cryptocurrencies.

Long Bitcoin, Short Dollars:

Brave new world for photographers and crypto:

OK assuming that iPhone Pro can now shoot spatial videos; shouldn’t it be able to shoot AR, augmented reality videos?

Like me becoming a Bitcoin Tycoon?