Eric Kim’s Distinct Philosophy on Money and Investing

Philosophy Rooted in Minimalism and Stoicism

Eric Kim – a well-known street photography blogger – approaches money through a philosophical lens shaped by minimalism and Stoicism. Having grown up in a financially unstable household, he developed an early skepticism of wealth for its own sake . Over time, Kim came to see money “as a tool…rather than an end in itself,†useful to support creative work and loved ones, but not a true measure of success . Influenced by Stoic ideas, he equates real wealth with freedom – the freedom to control one’s time and life – rather than a high income or lavish assets . In Kim’s view, having “not too much money, [and not] being broke†is the ideal balance . This philosophy challenges consumerist norms: he explicitly critiques material excess and status symbols, asking for instance why anyone needs a Lamborghini “when walking suffices,†favoring simplicity over extravagance . In essence, Kim’s money ethos centers on anti-consumerism (spending only on essentials or joys) and inner contentment, echoing Stoic and minimalist principles.

Spartan Lifestyle and Spending Habits

Kim’s personal lifestyle illustrates his philosophy. He famously practices extreme frugality – what he calls a “Stoic, Spartan approach†of living as simply as possible . The only expenses he truly endorses are those for basic nutrition and strength (for him, meat and weights for weightlifting), considering nearly everything else non-essential . In his own words, “essentially live like a super super poor person†by choice to avoid becoming a slave to luxury. Some hallmarks of his spending style include:

- Avoiding Unnecessary Purchases: Kim advises never eating out at restaurants and skipping costly habits like alcohol or café coffee, opting to cook and brew at home instead . Similarly, he rejects buying trendy new gadgets or upgrades just to “keep up,†following the rule that if you must convince yourself to buy something, you shouldn’t buy it .

- Preferring Basic, Used Goods: Embracing minimalism, he uses the simplest tools that get the job done. For example, he recommends buying the cheapest iPhone model (eschewing pricey “Pro†phones) and sticking to an older second-hand car rather than a new one . In his own life, Kim has proudly driven used manual-transmission cars (often under $2,500) and feels no need for new, depreciating assets . “Real rich people,†he jests, drive reliable used cars like a 2010 Toyota Prius, not flashy sports cars .

- Capsule Wardrobe: He buys virtually no new clothes, noting most people already own “enough clothes to last… two lifetimes.†Instead of shopping, he’ll repurpose old garments (cutting jeans into shorts, etc.), emphasizing that “only poor people buy clothes†for fashion’s sake .

- Spending on Experiences and Joy: While extremely frugal about material things, Kim does spend on what truly matters to him – mainly experiences, learning, and creative inspiration. “Money can buy you happiness — only if you spend it on experiences and meaningful things that bring joy,†he writes . For instance, photography books and travel are “necessary investments†in his happiness and growth . This approach aligns with his aesthetic and philosophical values: he derives lasting satisfaction from experiences and inspiration, not from accumulating stuff .

Through this minimalist, spartan lifestyle, Kim ensures that money remains his servant, not his master. By keeping personal needs simple and costs low, he gains flexibility and peace of mind. This is in stark contrast to the typical consumer-driven cycle of earn-and-spend; instead of upgrading his lifestyle with income gains, he downgrades and simplifies, creating a surplus of wealth that can fuel his creative projects or be saved . “The easiest way to become rich is not go broke,†he quips – meaning wealth naturally accumulates when you don’t fritter it away on unnecessary expenses .

Investing Philosophy: Extreme Focus and Value Creation

Kim’s approach to investing is as unconventional as his spending habits. Rather than a diversified portfolio aimed at steady growth, he favors focused, high-conviction bets and a mindset of aggressively growing one’s capital. His investing principles, informed by his philosophy, include:

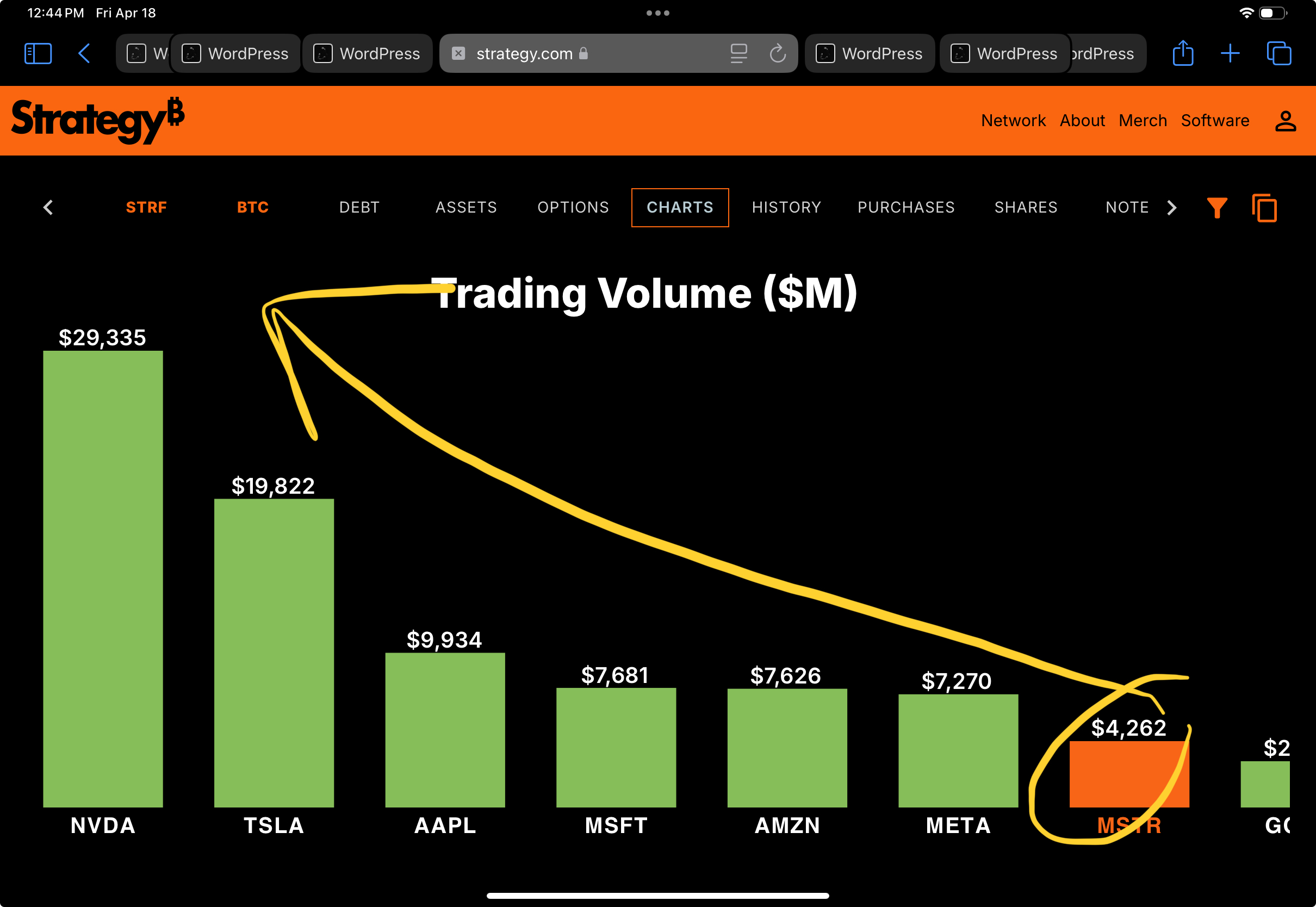

- Concentrated Belief-Driven Investments: In traditional markets, Kim looks for what he calls “obvious†opportunities. For example, he has said that buying MicroStrategy stock (a company deeply invested in Bitcoin) was a “100% obvious decision†– in fact, “literally the only asset worth purchasing†as far as he was concerned . This is because he strongly believes in Bitcoin as the future of “hard†money. Kim is a self-professed Bitcoin maximalist, often expressing that Bitcoin is the world’s only truly sound money . By buying MicroStrategy (MSTR) or Bitcoin directly, he effectively places a huge stake on a single vision (the rise of Bitcoin), eschewing the typical investor’s advice to spread risk. This one-sided approach is distinct: where mainstream investors preach diversification, Kim concentrates on assets that align with his convictions and values.

- Embracing Risk and Volatility: Far from fearing market ups and downs, Kim embraces volatility as a part of life. He explicitly prefers an adventurous financial journey over a sedate one: “I love bitcoin because of the extremes; I would prefer an extreme life to a steady and boring one.†This philosophical stance comes straight from his appetite for challenge and growth. He argues that many people err by trying to “secure†their money in ultra-safe assets (bonds or blue-chip stocks), aiming never to lose. In his eyes, “life should not be conservative… the point isn’t just to conserve your wealth, but rather to grow it!†. He even invokes the parable of the talents: hiding money out of fear is seen as wasteful, whereas boldly multiplying it is virtuous . This translates into a high-risk, high-reward strategy – Kim is willing to tolerate big swings in value for the chance of significant gains, a stance that mainstream investors with balanced portfolios might find too risky. Crucially, his Stoic influence means he strives for “emotional armor†in investing . By detaching from fear and not desiring luxury outcomes (he famously said one learns to “wish the Lamborghini onto your worst enemy†once you realize its costs ), he steels himself against panic. This emotional resilience allows him to hold volatile investments like Bitcoin with conviction, rather than panic-sell when markets dip.

- Investing in Self and Creative Equity: Another facet of Kim’s strategy is investing in equity in oneself. Rather than climbing a corporate ladder for a salary, he chose to be self-employed and build his own brand and business (through photography workshops, blogging, and products). He argues it’s “better to be self-employed…earning $40,000 a year [than] stuck at a big tech company earning $500,000â€, because the former means owning your time and work . Building personal equity – essentially creating value through one’s own ventures – is, to Kim, the ultimate path to wealth . This philosophy aligns with startup culture (he even cites Peter Thiel’s advice that owning a piece of something you create beats a higher salary working for someone else ). In practice, Kim “invests†a great deal of his effort and money into his creative projects, education, and business ideas, which he sees as yielding far greater life returns than passively holding a diversified stock portfolio. He measures ROI not just in dollars, but in personal growth and freedom gained.

In summary, Kim’s investing approach is unorthodox: it’s marked by minimal diversification, high risk tolerance, and tying money to personal values and big-picture bets. He is not interested in short-term trading for quick cash to buy fancy goods – indeed, his rejection of consumerism means his end goal with investing is not a sports car or luxury mansion. Instead, he seeks long-term empowerment: financial security that allows him to live freely on his own terms, and potentially exponential growth (through assets like Bitcoin or his own enterprises) that can magnify his impact and legacy.

Comparison to Mainstream Investor Behavior

Eric Kim’s money and investing style both align with and diverge from conventional personal finance advice in notable ways. Below is a comparison of key aspects:

- Definition of Wealth: Mainstream investors often equate wealth with net worth or accumulation of assets (the bigger the portfolio, the wealthier you are). Kim, on the other hand, defines wealth as freedom and autonomy. He cares less about the dollar amount and more about whether money lets him do what he wants. For example, he notes that someone earning a huge salary isn’t truly wealthy if they’re enslaved to their job’s demands . This aligns somewhat with the Financial Independence movement (which also values freedom over luxury), but Kim takes it further – he’d choose a modest income with independence over a high income with golden handcuffs any day .

- Attitude to Spending and Saving: Both Kim and prudent mainstream investors agree on living below your means, but the degree differs. Mainstream approach encourages frugality and avoiding debt, yet still acknowledges spending on enjoyment or convenience at times. Kim pushes frugality to an extreme minimalist level: virtually no discretionary spending that doesn’t bring substantial joy or value . Unlike a typical consumer, he derives status or pleasure not from what he buys, but from what he creates and experiences. This starkly contrasts with societal norms – where increased earnings often lead to lifestyle inflation, Kim deliberately reverse-inflates his lifestyle when he can . His practice of “downgrading†cameras, clothes, and living costs when possible is the inverse of common behavior. However, he does converge with mainstream wisdom in advising to save the surplus (the simple formula “earn more, spend less†is one of his mantras) . Where a typical financial guru might say “save 20% of your income,†Kim might save far more by virtue of his spartan habits.

- Investment Diversification: Conventional investing preaches diversification – spreading money across many stocks, bonds, and assets to balance risk and return. Kim pointedly deviates from this. His approach is more akin to concentrated investing or even an all-eggs-in-one-basket style based on high conviction. For instance, putting a large share of faith (and funds) into Bitcoin means riding a single asset’s fate. Traditional advisors would label this extremely high risk and not recommend it for most people, because the volatility could be ruinous. Kim understands the volatility but accepts it, aligning with his philosophical comfort with “extremes†and large swings . In a sense, his strategy trades the safety of diversification for the potential of outsized returns from a few big winners. This is more reminiscent of venture capital or entrepreneurial risk-taking than the average person’s retirement planning. It’s worth noting that Kim’s emphasis on equity in oneself also contrasts with the passive approach; rather than only owning a tiny slice of hundreds of companies via index funds, he’d rather own a big slice of one venture he directly controls. This focus can yield freedom and satisfaction, but it means his financial success is tied to a narrower set of outcomes than a diversified investor’s success would be.

- Risk and Return Mindset: A mainstream investor often thinks in terms of risk-adjusted returns – how to maximize returns for a given acceptable level of risk, often leaning toward moderate risk as one ages, etc. Kim flips this around by prioritizing maximum growth (yield) and accepting whatever risk comes with it . His Stoic mindset trains him to endure potential losses or volatility without panic, something many investors struggle with. In effect, he places a greater emphasis on upside (how high can the investment go?) than on downside protection. This approach can lead to far greater returns if things go well (e.g. Bitcoin skyrockets, his investments pay off), but also greater relative losses if things go poorly. Importantly, because Kim keeps his living costs very low, he arguably can afford to take bigger risks – he doesn’t need a huge stable nest egg to fund an extravagant lifestyle. By contrast, a mainstream individual with mortgages, car payments, and a taste for comfort might need a more stable portfolio. Kim’s philosophical detachment from luxury and his embrace of resilience give him a risk tolerance that sets him apart from the average investor. As he colorfully notes, he has no desire for the typical trappings of wealth like sports cars (“only small dick losers drive Lamborghinisâ€, he jests) , which frees him to invest with a long horizon and bold strategy without the pressure to cash out for showy purchases.

- Purpose of Money: Ultimately, the mainstream notion is often to accumulate enough money to retire comfortably and enjoy life later. Kim’s approach is more about using money now and continuously to carve out a meaningful life. He doesn’t wait for a far-off retirement to start living; he already oriented his career to his passion (photography/writing) and uses money to sustain that passion daily. In this way, his style aligns with those who seek financial independence to pursue purpose, but he is less about retiring early to relax and more about empowering continuous creative work. He has said “I don’t need any more money… I feel wealthy [already]†, highlighting that beyond a certain point, additional money has diminishing returns to his happiness. Any investing he does is therefore aimed at reinforcing his freedom, helping family or community, or exploring intellectual interests (like the technology of Bitcoin), rather than just to grow an ever-larger pile of wealth. This values-driven approach contrasts with the common investor mentality of chasing returns for their own sake or maximizing wealth out of competitive impulse.

Conclusion

Eric Kim’s distinct approach to money and investing is a natural extension of his life philosophy. Influenced by Stoic and minimalist ideals, he pursues financial freedom through simplicity, self-reliance, and audacious conviction rather than through orthodox wealth management. In practice, this means living on little, creating value through his own endeavors, and making bold investments aligned with his beliefs. His philosophy aligns with mainstream wisdom in treating money as a tool (not an idol) and stressing frugality, yet it sharply diverges in execution – prioritizing personal freedom and principled risk-taking over security and diversification. For Kim, money is a means to live an authentic and fulfilling life on his terms; it’s about maximizing life, not just portfolios. His stance both challenges and inspires: it prompts us to question what we truly seek from wealth, and whether conventional financial goals actually lead to the freedom and happiness we want . In the end, Eric Kim exemplifies an alternative path where philosophy and finance merge – a path focused not on having more, but on needing less and being more.

Sources: Eric Kim’s personal blog posts and essays provide the primary insights into his financial philosophy , complemented by interviews and content where he discusses money, investment (particularly his thoughts on Bitcoin), and life values. These writings illustrate how his Stoic, minimalist, and aesthetic sensibilities shape every financial decision, from everyday spending to big investment bets, offering a vivid contrast to mainstream investing paradigms.