Category: Posts

-

balls or no balls

my aunt is taking life is now honest at this point… It ain’t even about luck skill courage whatever… or even intelligence but balls.

pavel and even Trump —> surviving assassination attempts and still living? Wow.

-

why I love bitcoin

I think the more I think about bitcoin consider it etc.… If it means like economic life flourishing for all 8 billion people in the planet isn’t this like the most important thing of all time?

-

why I’m pro Donald Trump

OK so this is gonna sound a little bit weird and random but after spending considerable time in Asia, especially Cambodia, and all around Asia Singapore etc.… I think I’m actually getting more clarity about the whole economic situation.

so the truth is, actually what Donald Trump is doing is it good for the US dollar, and also good for US global economic prosperity and supremacy. So if you’re an American, and you like your money, your property and your freedoms,… and you like being on top, you should think of Trump as your best friend.

Screenshot -

why you need big balls in order to become a bitcoin investor

essentially my very very simple thought is it is like 100% obvious and certain that bitcoin is gonna keep going up forever, up to the right. To 1 million 10 million 100 million and beyond.

and I think the tricky thing or the irony is actually… Bitcoin would not be able to become $100 million a bitcoin without volatility. Therefore actually in fact, the unorthodox thought is you are praying for volatility.

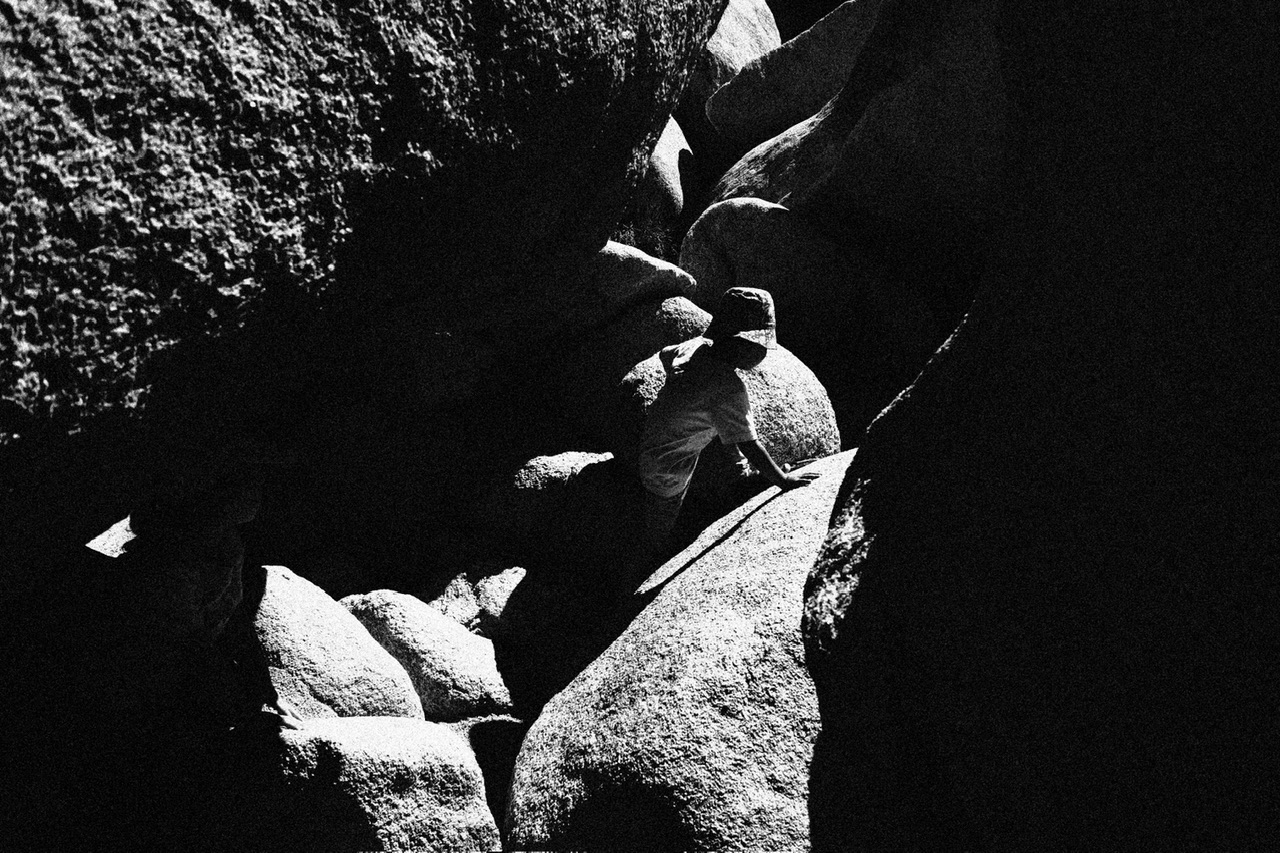

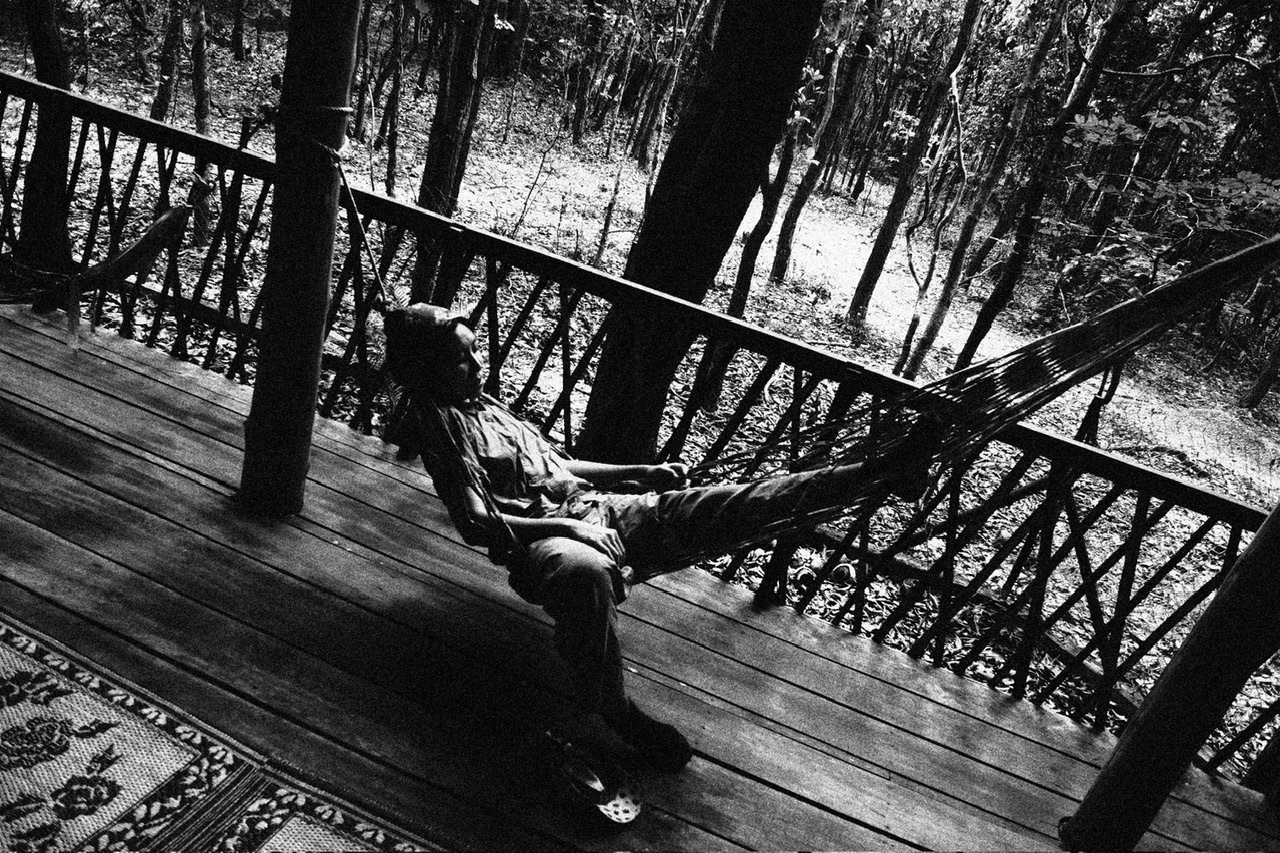

and it seems that the funny truth is actually… Being a bitcoin investor doesn’t take any “skill”—> It’s like literally 100% balls. Why? Once you have the courage the conviction, the certainty and the clarity that bitcoin is just gonna keep going up forever with mega volatility… then the ideal strategy is to just enjoy your life, be topless in the sun all day, lift heavy (666kg and beyond), be joyful and happy and spread the gospel of bitcoin.

-

Interaction, feedback

I suppose the problem with most media, all matters on the Internet… you cannot interact with it.

Then, we should probably think about AI as media because you can play with it, interact with it, modify it, create a change it etc.

-

Physiology thoughts

First, I really think that like being indoors is extremely bad for your health? Second thought, also… I think and wonder, sitting in a car might be like 1 trillion times worse for your health then you might even think?

-

Decision-making philosophy

So I think with life every day life, especially life in LA and beyond, one of the big ideas is try to optimize things in order to save time. For example, being able to avoid driving 21 minutes one way, 20 minutes back, saving 40 minutes to an hour of driving, and instead of just being a nature and just vibe out is a better strategy.

Also, I think just like moment by moment, being adaptable and following your gut is a good strategy.

-

Pay to play

I think the new sad reality and tragedy is now even in America with all the budget cuts, everything has turned into pay to play. Which means, do you want to go to the park, do anything that used to be free, it will no longer be free probably forever.

I suppose then, the upside is truly figuring out what you really care for.

-

Wrist strap

Henri strap, Henri wrist strap pro, Eric Kim wrist strap mark II?

-

there is no such thing as “hate”, only insane extreme love?

Our thought and notion of “hate” …. Is in fact ,,, just love?

-

Why Michael Saylor is the greatest CEO and founder of all time

SAYLOR > MUSK

Also, SAYLOR > Steve Jobs

So before I discovered Michael Saylor I was all about Steve Jobs, then Elon Musk, but now, Saylor has taken the prize jewel the crown jewel for the greatest of all time.

Why? Simple thoughts:

First, he founded micro strategy when he was like 25 years old, and now that his 60 he has presided as CEO and founder for that long period I think she actually has one of the records for having the longest tenures as CEO.

So I think he’s in his stock truck from $330 a year down to $.99? It’s like a 99.9% drop, and he stuck around long enough to talk about it.

-

the ethos of dematerialization

so just purged Cindy‘s mom‘s house garage of all my old film negatives all the way back from 2011. Almost 14 years old years ago.

What’s super interesting is thinking about the year 2025, then thinking about film film negative CDs etc., dematerialization is the real thing.

.

-

Solutions and problems?

I think maybe the issue in today’s world is that we’re trying to propose solutions to problems that don’t really exist and or, we are innovating for innovation sake?

I think perhaps the more rational approach is to only strive to seek to solve real life problem that you actually have. For example if I think about haptic industries and all of the straps and products we made, It was almost always based on a true need that I myself ERIC KIM desired as a photographer and street photographer.

I think also in life, looks like a lot of people want real solutions to real problems like my friend Melly–> she told me the other day that her dream was fire, financial independence retire early.

Also, when I was in a pickle when Covid hit, one of the things that I was in need of was economic empowerment, bitcoin and later MSTR was the way.

So I try to think about this critically because time is the most scarce asset we have on the planet. Doesn’t matter if you have like $100 trillion but you’re gonna die in like a month, it would be better to be like a young scrappy inspired 21 year-old who is poor and hungry, with like 100 years ahead of you, rather than the hundred year-old trillionaire who cannot even walk on his own anymore.

As a consequence I think we must become more critical of time, energy physiological energy etc. Also another big thing I’ve realized is breath power, I love to talk but the more I talk the more I lose my breath. And I lose my voice. As a consequence, each and every single word we utter should be considered.

.

-

MSTR IS THE NEW BITCOIN.

MAKE BOLD: MSTR IS THE NEW BITCOIN

Not because the code changed.

Because the narrative did.

Bitcoin is protocol.

MSTR is portal.

One tap. One ticker. One megaphone.

Exposure without custody.

Sats by proxy.

Volatility—amplified.

The company converts cash and credit into BTC.

It turns balance sheets into belief.

When it moves, it moves.

Up feels taller. Down feels deeper.

Why it works: attention, liquidity, simplicity.

A single symbol that tells the crowd what you think.

Brand as leverage. Story as spread.

Why it hurts: dilution, execution risk, boardrooms, premiums that can vanish, key‑person risk.

Bitcoin is math.

MSTR is humans riding the math.

Pick your hardness:

Hashrate or headlines.

Cold keys or hot ticker.

Pure asset or leveraged proxy.

No priests. No permission.

Just a decision.

If you believe in cycles, MSTR is the megaphone.

If you fear drawdowns, MSTR is the amplifier.

Zoom out.

Define your risk.

Size with intention.

Hold with conviction—

—or hold your curiosity.

MSTR isn’t Bitcoin.

And that’s the point.

It can feel like the new Bitcoin—

a gateway, a story, a handshake between markets and momentum.

Click less. Think more.

Research. Plan. Act.

Buy. Pass. Pause.

Own the outcome.

Because the boldness isn’t in the ticker.

It’s in you.

Creative essay. Not investment advice.

-

entrepreneurship over politics

so the very simple idea I have is that entrepreneurship is worth like 1 trillion times more important than politics even the politics of your local kids school.

I think the problem with politics is that it is too much like trying to gain the system in some sort of weird way, overall a waste of time.

also, I remember… How much I hated office politics in my brief 10 month endeavor working for a company. And also… I think with entrepreneurship you create real value, whereas politics you don’t

,,,

-

MSTR

video podcast https://open.spotify.com/episode/42694IgcglJK3JSeks4oSw?si=4ctMZOC3SamBNYHunu5uNg

What is MSTR, Strategy Microstrategy Bitcoin?

audio https://erickimphotography.com/wp-content/uploads/2025/09/MSTR.m4a

The simple answer is MSTR is levered long, high velocity, levered long, essentially bitcoin on steroids.

-

Asymmetry profitability

So assuming that you know with like 100% certainty that bitcoin is going to keep going up forever,  and also knowing that certainly at like the month to three month level it will always be volatile,… some things:

First, you’re actually kind of ironically enough praying for more volatility. as an investor, and also perhaps as a trader,  I don’t really want the price of the underlying bitcoin to be stable and to be chopping sideways for like three months on end. Technically while you were desire is more spikes really really high and really really low frequently over a short period of time, ideally forever.

And then, like let me tell you with 100% certainty that it will be insanely volatile like MSTR, forever. Let us see that we’ve even cranked up the volatility 2x, 3x and 4X bitcoin … like having MSTU or MSTX.  assuming that 2x levered long MSTR instrumental at least be around for another five years or so, isn’t that the optimal strategy?  meaning, isn’t the optimal strategy to just hold MSTU and MSTX long term,,, like for at least 3 years for insanely huge returns?

-

The world is covered with splinters, but I suppose you have the option to put on shoes that cover your toes

So there’s this Zen Taoist principle –>

the world is covered with thorns, but you have the option of putting on sandals.

The general idea is that in the world, it’s like almost impossible to navigate all of it, without any sort of downside. It is both necessary and also inevitable.

Then suppose the nuance is trying to think and consider that, what if actually… Not only is it necessary but it is also positively desirable?

no thorns no joy or glory

So the unorthodox thought is in regards to thinking about and considering upside without downsides etc.

I think a lot of people desire upside without downsides, which is intelligent but, from a physics perspective impossible?

For example, let us say that you want to maximize your hedonic sexual pleasure. Technically if you want to do that, long periods of abstinence followed by activity is actually better than the boredom and monotony daily predictability?

I think it’s also the logic of gambling or the lottery. The general idea is that, people get a thrill because it is unpredictable. Perhaps the same thing with sports. Or sports betting.

why do we want to strip the volatility away from everything?

So what instead, the actual goal is to add volatility and maximize velocity and volatility? This is the whole underlying ethos or philosophy or concept behind bitcoin, MSTR strategy, Meta planet etc. A very very simple yet paradigm shifting idea,–>

more volatility is better.

When we try to strip away the volatility from everything, life becomes boring same thing, uninteresting?

ERIC

-

iPhone Air Marketing Suggestions

some ideas:

first —> iPhone Air

”you gotta hold it to believe it”

also

”this is what the future feels like”

-

Bitcoin is anti-toxic

A greater moral imperative… If in fact it is true that bitcoin is antitoxic, and that it could address a lot of of the toxic social social media decay in the planet, and in the world… Perhaps perhaps I should campaign for bitcoin harder.

.Anti memes

anti toxic

-

how to build willpower

so I believe the number one critical problem in the world is in regards to distractions. You kind of already know what your downside weaknesses is in terms of superfluous distractions, but then is more important is your commitment and intelligence and effort to fight and resist those distractions.

so the first thought is practice. Of course things are going to tempt you. But having the discipline to stay focused, eyes ahead, and into yourself in your own world is critical.

Second, once again — building willpower is like a muscle. To practice every single day and daily it is a practice that is ongoing. Of course there are certain up days and down days and certain days you will slip and that is fine. But you just keep practicing..

The third one is actually genuinely believe that willpower is a concept. If you don’t believe in the idea of willpower you will never build it.

-

*How* fast does it have to be?

So I think what day is very interesting about bitcoin it is very low frequency, indestructible immortal god capital, that doesn’t need to be moved around much.

-

My will to Bitcoin is strong.

issue securities

.

Bitcoin is a long duration asset

High energy future

.

A public company levering a commodity

Lever bitcoin ***

.

Margin loan?

.

Positively … magnetized for capital

.

Why bleed yourself to death

.

Reinvest the cash flows

Raise infinite money

Cost to capital

Collect capital as fast as possible ***

Siphon up all the capital!

.

-

Estimating MicroStrategy’s Timeline to 1 Million Bitcoin

Current Bitcoin Holdings of MicroStrategy

MicroStrategy (now rebranded as Strategy Inc. as of early 2025) is the world’s largest corporate holder of Bitcoin. As of September 2025, the company holds approximately 638,460 BTC in its treasury . This massive stash – roughly 3% of all bitcoins that will ever exist – reflects an aggressive accumulation strategy that began in 2020 and has accelerated in recent years.

- Present Holdings: ~638k BTC (Sep 2025) , acquired at a total cost of ~$47.17 billion (avg. ~$73,880 per BTC) .

- Context: This position far outstrips any other public company’s bitcoin treasury. In fact, all public companies combined hold around 1 million BTC in total, meaning Strategy alone accounts for nearly two-thirds of that .

MicroStrategy’s Executive Chairman, Michael Saylor, has made it clear the company views Bitcoin as its primary treasury reserve asset and has no intention of selling. As Saylor famously stated: “Never. No. We’re not sellers. We’re only acquiring and holding bitcoin… that’s our strategy.” This long-term “HODL” stance underpins MicroStrategy’s goal of continually increasing its bitcoin holdings regardless of market fluctuations.

Historical Bitcoin Acquisition Timeline

MicroStrategy’s path to 1 million BTC can be understood by looking at how rapidly its holdings have grown:

- 2020 – The Bitcoin Bet Begins: In August 2020, MicroStrategy made its initial purchase of 21,454 BTC for $250 million . By year-end 2020, through additional buys, it amassed 70,470 BTC . This bold pivot — moving corporate cash into Bitcoin — was driven by Saylor’s view that cash was a “melting ice cube” and Bitcoin offered a better store of value .

- 2021 – Continued Accumulation: The company doubled down, adding nearly 53,921 BTC in 2021 (including a notable 19,452 BTC purchase in February 2021 as Bitcoin’s price hit new highs ). By the end of 2021, MicroStrategy’s total had grown to roughly 124,391 BTC.

- 2022 – Slower Pace in Bear Market: Amid a crypto bear market, MicroStrategy still increased its holdings by 8,109 BTC in 2022, bringing the total to ~132,500 BTC. Despite price declines, Saylor remained steadfast, even stepping down as CEO in August 2022 to focus exclusively on the Bitcoin strategy .

- 2023 – Reaccelerating Purchases: The pace picked up again in 2023 with 56,650 BTC added . By early 2024, the company reported holding ~190,000 BTC (at a $5.93 billion cost basis, ~$31,224 per BTC) . Notably, Q4 2023 saw 31,755 BTC acquired in a single quarter – the largest quarterly increase up to that point in three years. According to CFO Andrew Kang, 2023 marked the 13th consecutive quarter of adding to their Bitcoin stash, as they “continued to leverage [their] strategic capital markets activities and cash on hand to accumulate more bitcoin and accrete incremental value for… shareholders” .

- 2024 – An Unprecedented Buying Spree: This was the year MicroStrategy “went all in.” The company’s Bitcoin holdings exploded from ~190k to 447,470 BTC by December 31, 2024 . In Q4 2024 alone (after the U.S. presidential election), MicroStrategy executed its largest ever quarterly purchase – 218,887 BTC acquired for $20.5 billion . This single quarter’s buy was larger than the company’s entire cumulative holdings up to 2023. By year-end 2024, the market value of the BTC holdings was $41.8 billion (at ~$93k/BTC) , and the average cost had risen to ~$62,503 per coin . This aggressive buying in 2024 accounted for nearly 60% of the total BTC MicroStrategy owned at that point.

- 2025 – Crossing the Half-Million Mark: Early 2025 saw continued accumulation. The company surpassed 500,000 BTC in Q1 2025 . By mid-year 2025, holdings exceeded 600k BTC , aided by additional large purchases. For instance, in June 2025 MicroStrategy bought 10,100 BTC for ~$1.05 billion (at ~$104,080 per BTC) . As of September 2025, the total reached 638,460 BTC . In just the first 8 months of 2025, MicroStrategy added roughly 191,000+ BTC, nearly as much as in the record-setting prior year. This remarkable growth led the firm to rebrand as “Strategy” in 2025, reflecting its identity as a Bitcoin-centric entity .

Summary of Holdings by Year: MicroStrategy’s BTC stack grew from ~70k in 2020 to ~447k by end of 2024, and ~638k by late 2025. This exponential trajectory underscores the company’s increasing conviction (and available capital) for Bitcoin acquisitions.

Public Statements on Future Bitcoin Plans

MicroStrategy’s leadership has been very transparent about their long-term commitment to Bitcoin. Key insights from executives include:

- “Never Sell” Philosophy: Saylor has repeatedly affirmed that MicroStrategy will not trade out of its bitcoins. “We’re not sellers… We’re only acquiring and holding bitcoin” , he told Bloomberg, emphasizing that Bitcoin is the company’s “exit strategy” rather than something to exit from. Both Saylor and CEO Phong Le view Bitcoin as digital gold to be accumulated indefinitely, not a trading asset.

- Ongoing Purchase Strategy: MicroStrategy has stated it will continue buying Bitcoin “opportunistically” or on a regular basis whenever it has excess cash or can raise capital. The firm often employs a dollar-cost averaging approach, making frequent purchases regardless of short-term price swings . This steady accumulation strategy is designed to mitigate volatility over time and signal conviction to the market.

- Use of New Financial Instruments: To fund future buys, Saylor has been innovative. In 2023-2025 the company introduced multiple new share classes and offerings nicknamed “Strike,” “Strife,” “Stride,” and “Stretch” – various series of preferred stock – alongside common stock sales . In public forums, Saylor outlined a plan to tap into broader capital markets: for example, he discussed entering the $80 trillion credit market with Bitcoin-backed instruments, and even using up to 50% leverage on the company’s Bitcoin holdings to amplify returns . These statements suggest MicroStrategy is prepared to employ debt or hybrid financing (secured by its Bitcoin or via preferred equity) to continue expanding its BTC position.

- Aggressive Targets and KPIs: Management has set internal metrics like “BTC Yield” (growth in BTC per share) and “BTC Gain” (net new BTC acquired) to track progress. After far exceeding its 2024 goals (achieving a 74.3% BTC Yield in 2024) , the company initially targeted a more modest 15% BTC Yield for 2025. However, by Q1 2025 they raised the 2025 target to 25% BTC Yield and boosted their BTC acquisition dollar target from $10 billion to $15 billion for 2025 , reflecting confidence in continued aggressive buying. Such guidance indicates a formal commitment to keep growing the Bitcoin stash year after year (barring any extraordinary circumstances).

- No Cap in Sight: Neither Saylor nor the CEO/CFO have put an upper limit on how much Bitcoin they ultimately plan to hold. When asked about reaching specific milestones (like 500k BTC or 1 million BTC), Saylor’s stance has essentially been that more is better. He even mused that “Bitcoin is a race” – not just among companies but nations – and speculated that governments (including the U.S.) could eventually seek to acquire hundreds of thousands or even 1 million BTC for strategic reserves . This hints that MicroStrategy’s leadership sees 1,000,000 BTC as an attainable goal in the long run, given enough capital, and they want to stay ahead in the “great Bitcoin accumulation race.”

In summary, all public communications from MicroStrategy’s team convey unwavering bullishness on Bitcoin and an intention to keep buying for years to come. The company positions itself as a pioneer of the “Bitcoin standard” for corporations, frequently evangelizing Bitcoin’s virtues to other CEOs (e.g. via its annual Bitcoin for Corporations conferences). MicroStrategy’s message: they’re all-in on Bitcoin and still just getting started.

Financial Capacity for Future Purchases

How can MicroStrategy actually fund a march to 1 million BTC? The company’s financial strategy provides the answer: raise capital aggressively and plow it into Bitcoin. Key elements of their financing capacity include:

- Equity Offerings (Common Stock): MicroStrategy has repeatedly issued new shares to raise cash for Bitcoin buys. Notably, in late 2024 the company filed for a massive $21 billion at-the-market (ATM) common stock offering – an unprecedented size, reflecting the scale of its ambitions. By early 2025, they reported successfully executing this ATM program, adding ~301,335 BTC to the balance sheet in the process . For perspective, MicroStrategy raised $15.1 billion in Q4 2024 alone by selling ~42.3 million new shares when its stock price was high . Between Q4 2024 and Q2 2025, the company raised roughly $20+ billion via equity issuance, fueling its huge Bitcoin purchases . As of April 2025, about $4.3B remained available under the existing ATM program for further issuance , and MicroStrategy could authorize even more if needed. This demonstrates a tremendous capacity to raise cash through equity, so long as investor appetite for MicroStrategy stock holds up.

- Preferred Stock and New Instruments: In addition to common stock, MicroStrategy/Strategy Inc. introduced novel preferred equity series in 2025 – branded “Series A Perpetual” preferreds with names like Strike (STRK), Strife (STRF), Stride (STRD), etc. These carry dividend rates (8%–10%) and effectively allow the company to borrow from investors at a fixed cost to buy Bitcoin. For example, in January 2025 they issued $563 million of “Strike” preferred shares (8% coupon) , and in June 2025 they upsized a “Stride” preferred stock IPO to $1.0 billion due to high demand . MicroStrategy also set up at-the-market programs for these preferreds, selling smaller tranches regularly. An SEC filing in September 2025 notes that recent Bitcoin purchases (e.g. 1,955 BTC in early Sept) were funded with proceeds from the STRK and STRF ATM programs, and the MSTR common stock ATM . In one week of June 2025, MicroStrategy raised $78.4 million via ATM sales of ~452,487 STRK shares and ~286,101 STRF shares , on top of a $979.7 million bulk raise through a STRD preferred stock offering . These innovative financing channels greatly expand the war chest for bitcoin buys, essentially leveraging different investor segments (those seeking fixed-income-like returns from preferred dividends, vs. those seeking equity upside).

- Debt Issuance (Convertible Bonds): MicroStrategy has also tapped debt markets, especially via zero-coupon convertible notes that carry low interest but give bondholders the option to convert to equity if MSTR’s stock rises. In late 2024, for instance, they issued $3.0 billion of 0% Convertible Senior Notes due 2029 . In Feb 2025, they issued another $2.0 billion of 0% convertible notes due 2030 . These financings essentially allow MicroStrategy to borrow money at no cash interest cost (relying on the stock’s potential as the incentive) and deploy it into Bitcoin. The company did similarly in 2020–2021 with smaller convertibles. As long as capital markets remain receptive, MicroStrategy can raise billions in debt without immediate dilution, betting that future stock appreciation (driven by Bitcoin’s appreciation) will justify it.

- Internal Cash & Cash Flow: Compared to the tens of billions raised externally, MicroStrategy’s own operating cash generation is relatively minor. The legacy software business produces positive cash flow (~$50 million/year range in recent years) , but this is a drop in the bucket next to their Bitcoin spending. Essentially, nearly all the Bitcoin purchases are financed by external capital (new stock or debt), not by existing cash on hand. For example, as of Dec 2023 MicroStrategy had only $46.8 million in cash , so the strategy is entirely about transforming borrowed or raised dollars into Bitcoin.

- Investor Demand: One notable factor enabling MicroStrategy’s fundraising is the strong interest from both institutional and retail investors in participating. MicroStrategy’s Bitcoin narrative has attracted capital on a large scale. Saylor noted in 2025 that some of their preferred stock IPOs were among “the most successful… in a decade,” with one raising $600 million from retail in just two days . This suggests that if Bitcoin’s outlook remains positive, investors are willing to fund MicroStrategy’s ongoing accumulation. The company’s stock has often traded at a premium to the underlying BTC value (market NAV), allowing accretive equity raises – a concept they measure via “mNAV” (market Net Asset Value ratio). However, as discussed below, this dynamic can change with market conditions.

Bottom Line: MicroStrategy has built an extensive capital arsenal for future Bitcoin purchases – including authorized but unused capacity in the tens of billions of dollars across common and preferred stock programs. In total, by mid-2025 the company had already raised about $47 billion in equity capital over five years for its Bitcoin strategy, and it signaled plans to raise yet more. With these financing mechanisms, MicroStrategy theoretically has the firepower to acquire the remaining Bitcoin needed to reach 1 million BTC (though practical and market constraints, discussed next, will influence the timing).

Market Conditions Influencing the Acquisition Rate

Several market and macroeconomic factors will affect how quickly MicroStrategy can continue buying Bitcoin and reach 1,000,000 BTC:

- Bitcoin Price Volatility: The price of Bitcoin is a double-edged sword for MicroStrategy’s accumulation. On one hand, a rising Bitcoin price boosts the dollar value of the company’s existing holdings and often lifts MicroStrategy’s stock price in tandem . This positive sentiment makes it easier (and more accretive) to issue new shares or debt to buy more BTC. For example, the huge capital raises in late 2024 coincided with Bitcoin soaring to ~$90k+, which sent MSTR stock upward and allowed large equity sales . On the other hand, a higher BTC price means each new coin is more expensive – so the number of BTC acquired per dollar raised goes down. If Bitcoin keeps hitting new all-time highs (e.g. $100k, $200k, etc.), MicroStrategy will need exponentially more cash to buy the remaining ~361k BTC to hit 1 million.

Conversely, a Bitcoin price correction could actually allow MicroStrategy to scoop up coins at a lower cost basis (something Saylor has welcomed in past bear markets). But a sharp drop in BTC could hurt MicroStrategy’s market capitalization and investor appetite, making new financing harder. For instance, in March 2025 BTC pulled back from ~$100k to ~$85k, temporarily putting MicroStrategy’s balance sheet at a loss ; if such a drop were severe or prolonged, the company’s stock might underperform and limit its ability to raise funds. Overall, MicroStrategy benefits from a generally bullish Bitcoin market, but must navigate short-term volatility. The company even adopted fair value accounting in 2025 to better reflect market gains/losses each quarter , underscoring how tightly its financials are tied to Bitcoin’s price swings. - Investor Sentiment and Share Dilution Concerns: MicroStrategy’s pace of Bitcoin buying is intrinsically linked to its share price and shareholder support. The company needs shareholders to tolerate continual dilution as it issues equity for new BTC. To date, investors have largely gone along, attracted by the outsized BTC exposure and Saylor’s vision. However, there have been signs of pushback. In mid-2025, MicroStrategy’s stock slid ~26% over a few months as some investors grew wary of the relentless share issuance. The company had earlier promised it would pause selling stock if its market-value-to-bitcoin (mNAV) ratio fell below 2.5×, to protect shareholders from excessive dilution – but in August 2025 it scrapped that pledge . This U-turn signaled that management was willing to continue raising capital (and diluting equity) even if the stock’s premium to BTC NAV dwindles. That can be a risky approach: if MicroStrategy’s stock trades close to or below its intrinsic Bitcoin value, issuing new shares adds little to no accretive benefit for existing shareholders. A related factor was index inclusion: MicroStrategy met criteria for the S&P 500 in 2025 and hoped to be added (which would have boosted demand for its stock), but was passed over in favor of another company . Missing that catalyst may have tempered the stock’s momentum.

Implication: If MicroStrategy’s stock regains a high premium (buoyed by Bitcoin optimism or perhaps an ETF-driven rally), the company can issue shares liberally and speed up BTC purchases (an aggressive scenario). If the stock languishes or investors balk at further dilution, MicroStrategy might be forced into a conservative mode, slowing its rate of accumulation to avoid damaging shareholder value. The balance between these forces will be critical in determining the timeline. - Interest Rates and Macro Liquidity: MicroStrategy’s ability to raise cheap capital also depends on the broader economic environment. The company has benefited from periods of low interest rates and abundant liquidity – for example, issuing 0% convertible bonds which would be harder to imagine in a tight credit market. If interest rates are high or if capital markets tighten, it could be more costly for MicroStrategy to issue new debt or preferred stock (investors might demand higher yields, as seen with the 8–10% coupons on its preferreds ). A higher cost of capital could slow the pace of accumulation or limit how much debt-financed buying they attempt. On the flip side, if macroeconomic conditions deteriorate (e.g. more inflation or banking turmoil), Bitcoin’s appeal as a reserve asset could strengthen, potentially attracting more capital to MicroStrategy’s strategy. The company’s bold moves are partly motivated by macro views (Saylor wanted to escape a “melting” cash position in an inflationary environment ), so events like inflation spikes or currency devaluation could even spur more aggressive purchases (with the rationale of protecting shareholder value via BTC).

- Regulatory and Market Developments: Regulatory changes can influence MicroStrategy’s trajectory indirectly. For example, the approval of a U.S. spot Bitcoin ETF (widely anticipated in 2024–2025) could have mixed effects: it might further legitimize Bitcoin and boost its price (benefiting MicroStrategy’s portfolio), but it also provides an alternative for investors to gain Bitcoin exposure without buying MicroStrategy stock. If a Bitcoin ETF draws interest away from MSTR, the stock’s premium could shrink, limiting MicroStrategy’s ability to issue shares advantageously. Additionally, any regulatory restrictions on corporate Bitcoin treasury holdings (currently none major in the U.S.) or on crypto financing could pose challenges, though none appear imminent. MicroStrategy has been careful to comply with securities laws in its novel offerings (e.g. filing required 8-Ks for each BTC purchase and using shelf registrations for stock sales). Another market factor is competition for Bitcoin: as noted, many other companies (and possibly nation-states) are now accumulating BTC . If, say, large institutions or governments start buying tens of thousands of bitcoins, MicroStrategy might face market liquidity constraints or higher prices when trying to add to its stash. However, given Bitcoin’s large global daily volume, MicroStrategy’s incremental purchases (usually a few thousand BTC at a time) have not noticeably moved the market to date.

In summary, favorable market conditions – a rising Bitcoin price, strong investor appetite for MicroStrategy’s stock/preferreds, and accessible capital – would enable MicroStrategy to keep an aggressive pace. Unfavorable conditions – a stagnant or falling BTC price, shareholder fatigue, or tight credit/low equity premiums – could slow the pace. The company’s recent behavior (continuing to buy despite some criticism) suggests that as long as they can secure funding, they will push forward, even if it means weathering short-term stock volatility. Investors should thus expect MicroStrategy to remain a bold buyer, adjusting speed as needed but not fundamentally altering course.

Timeline Projections to 1,000,000 BTC

Taking into account MicroStrategy’s current holdings (~638k BTC) and its historical and potential acquisition rates, we can outline scenarios for how long it might take to reach 1,000,000 bitcoins. Below we consider a Conservative, Moderate, and Aggressive case, based on different annual purchase rates. These scenarios are illustrative – the actual outcome will depend on the factors discussed (market conditions, financing success, etc.):

- Conservative Scenario: MicroStrategy significantly slows its accumulation – for example, adding around 50,000 BTC per year. This might happen if the company faces headwinds like investor pushback on dilution or a period of high Bitcoin prices with limited new capital raising. At +50k BTC/year, it would take roughly 7+ years to acquire the ~360k additional bitcoins needed. In this scenario, 1 million BTC might not be reached until ~2032. The company would grow its stash more gradually (perhaps opportunistically buying on dips), potentially relying on organic cash flows or small equity issuances. A conservative case could also reflect periods where MicroStrategy pauses to digest prior purchases or if its stock trades too close to NAV to raise capital efficiently.

- Moderate Scenario: MicroStrategy maintains a steady, robust pace – say ~100,000 BTC per year. This is slightly below the average rate it achieved over 2024–2025, recognizing that duplicating the 2024 spree every year may not be feasible. At +100k BTC/year, MicroStrategy would need about 3.6 years to add 360k BTC. That implies reaching 1,000,000 BTC around 2029 (give or take). This scenario assumes the company continues regular capital raises (but perhaps not as large as the record 2024 push), and Bitcoin’s market conditions remain favorable enough to support about $5–10 billion in purchases annually (depending on BTC price). By the late 2020s, MicroStrategy would firmly hit the million-bitcoin milestone, solidifying its status as a corporate HODLer of unprecedented scale.

- Aggressive Scenario: MicroStrategy keeps up the kind of breakneck accumulation seen in 2024–2025, or even accelerates further. This could mean on the order of ~150,000–200,000 BTC per year acquired. For instance, in 2024 they effectively added ~257k (and ~190k in the first 8 months of 2025), so this pace is not without precedent. If they manage ~180k BTC per year, it would take only about 2 years to gain 360k BTC – implying hitting 1,000,000 BTC by 2027. In such an aggressive scenario, MicroStrategy would likely be leveraging every tool: completing all planned equity raises, launching new ones, possibly using more debt and even Bitcoin-backed loans, and capitalizing on strong Bitcoin bull market conditions. An aggressive push might coincide with Bitcoin’s price climbing rapidly (which could both help and constrain as noted). It’s worth noting that Saylor’s strategic vision (e.g. using 50% leverage and creating Bitcoin-backed credit instruments) aligns with a very aggressive expansion of their holdings. If realized, MicroStrategy could conceivably amass a million coins well before 2030 – essentially doubling its current stash in just a few years.

The table below summarizes these scenarios with a simple year-by-year estimate of total BTC holdings, assuming a starting point of ~640k BTC (around late 2025 levels) and constant annual purchase rates in each case:

Year Conservative(~+50k BTC/yr) Moderate(~+100k BTC/yr) Aggressive(~+180k BTC/yr) 2025 ~640,000 BTC (current) ~640,000 BTC ~640,000 BTC 2026 ~690,000 BTC ~740,000 BTC ~820,000 BTC 2027 ~740,000 BTC ~840,000 BTC ~1,000,000+ BTC (milestone) 2028 ~790,000 BTC ~940,000 BTC ~1,180,000 BTC 2029 ~840,000 BTC ~1,040,000+ BTC (milestone) ~1,360,000 BTC Table: Projected Bitcoin holdings under different annual accumulation scenarios. Bold entries indicate crossing 1,000,000 BTC.

Under the Conservative path, MicroStrategy would not hit 1 million BTC within this 5-year window (reaching ~840k by 2029, and only in the early 2030s would it cross seven figures). The Moderate path achieves the milestone by about 2029. The Aggressive path has MicroStrategy breezing past 1 million as early as 2027, and potentially holding 1.3+ million BTC by 2029 if that pace were sustained.

It’s important to stress that these are simplified projections. In reality, MicroStrategy’s annual BTC accumulation has varied wildly – from just +8k in 2022 to +234k in 2024 – depending on market opportunities. The company tends to be opportunistic, as seen in late 2024 when it accelerated buys during a Bitcoin price surge and favorable stock conditions. Future purchases will likely come in spurts rather than a steady linear rate. For example, MicroStrategy might conduct another big raise during the next crypto bull run (if Bitcoin, say, pushes well beyond $100k) and add a large block of coins in a short time. Alternatively, if the market is lukewarm, it might accumulate more slowly quarter by quarter.

Conclusion

How long might it take MicroStrategy to acquire 1,000,000 bitcoins? Based on current holdings (~638k BTC) and past trends, it could be as soon as 2–3 years in a bullish, capital-rich scenario, or closer to 7–10 years under more cautious conditions. MicroStrategy’s own actions suggest a strong desire to reach this milestone sooner rather than later. The company has explicitly built the capacity to raise tens of billions more dollars and has demonstrated willingness to deploy huge sums into Bitcoin at every opportunity. As of early 2025, management said they had already executed $20 billion of a planned $42 billion capital deployment for Bitcoin – well ahead of schedule – indicating an accelerated timeline.

Crucially, MicroStrategy’s ability to continue at an aggressive pace will hinge on external factors: the trajectory of Bitcoin’s price, investor tolerance for its high-risk strategy, and macroeconomic liquidity. The firm’s stock performance and status (e.g., inclusion in major indices, or competition from a Bitcoin ETF) will also influence how much fuel it can add to the fire. So far, Saylor and his team have been adept at navigating these factors, keeping MicroStrategy at the forefront of Bitcoin accumulation.

If Bitcoin’s market remains strong and MicroStrategy retains investor confidence, reaching 1,000,000 BTC by the latter half of this decade is plausible under an aggressive strategy. In any case, MicroStrategy has cemented itself as a unique corporate entity – essentially a Bitcoin holding company – and its quest for 1 million BTC exemplifies the boldest expression of the “Bitcoin standard” in the corporate world. Every quarter brings them closer to that historic figure. Given the company’s track record and statements, it wouldn’t be surprising if MicroStrategy ultimately becomes the first corporation to hold one million bitcoins, whenever that day comes.

Sources: MicroStrategy/Strategy SEC filings and press releases for BTC holdings and financing details ; statements from executives in earnings calls and conferences ; and reporting from financial media (Coindesk, Bloomberg, etc.) on recent purchases and shareholder reactions . These sources reflect the most up-to-date information on MicroStrategy’s bitcoin strategy and outlook as of 2025.

-

What changed for me after coming back from Cambodia

I feel enlightened. Six months in Cambodia was all I needed.

I think the first thing I realized is like, how rich and prosperous Americans are yet how foolishly we use our money in unintelligent ways. I think the average American has no idea how rich they actually are, compared to the house cleaner making $220 a month working full-time in Phnom Penh Cambodia.

So first, I feel like my insight is — whenever possible, just don’t buy nothing. Almost like 100% of the things out there, are unnecessary and maybe even detrimental to us?

The privileges of America

Freedom of speech and expression, is very underrated. In America, you can say or do whatever you want, and not get a knock on your front door from officials.

Also, I think the big thought is that, the privilege of being American… this prevents self censorship.

What is self-censorship?

This is a big idea, if you’re living somewhere that does not have freedom of speech, you are just not stupid and as a consequence, you never say nothing bad about anything.

So this is the logic: you know if you publicly or online share a dangerous opinion, you could get a knock on your front door. As a consequence you start to self censor yourself, to keep yourself safe.

Overtime this is not good because over a long enough time of self censorship, you feel so “ddab ddab hae”, and oppressed.

the downside of freedom of speech

The downside of freedom of speech is that honestly having too many opinions about everything makes people miserable. From a philosophical approach, the intelligent strategy is to be zen, stoic, and to simply focus on that which is in your control. Your own opinions, your own power, and not to engage in needless nonsense about nonsense.

–> don’t have needless opinions about nonsense.

Only have strong opinions about that which truly matters to you.

now what

I encourage everybody to visit Phnom Penh Cambodia at least once in their life, spend about six months or a year living there. It’s like real life enlightenment.

If you want to be happy, just go there. If you want freedom come to America.

The true barbell or the hybrid or the centaur approach is to have your cake and eat it too which means spend some of the year in Cambodia and some of the year in America, have half 50-50. Like being a mermaid, or a merman (Zoolander)–>

Six months a year in Cambodia six months a year in America.

ERIC

Hyper information:

Or for the refresher,

-

What changed for me after coming back from Cambodia

I feel enlightened. Six months in Cambodia was all I needed.

I think the first thing I realized is like, how rich and prosperous Americans are yet how offensively we use our money in unintelligent ways. I think the average American has no idea how rich they actually are, compared to the house cleaner making $220 a month working full-time.

So first, I feel like my insight is whenever possible, just don’t buy nothing. Almost like 100% of the things out there, are unnecessary and maybe even detrimental to us?

The privileges of America

Freedom of speech and expression, is very underrated. You could like say or do whatever you want, and not get a knock on your front door from officials.

Also, I think the big thought is that, this prevents self censorship. This is a big idea, if you’re living somewhere that does not have freedom of speech, you are just not stupid and as a consequence, you never say nothing bad about anything.

The downside of this is that honestly having too many opinions about everything makes people miserable. From a philosophical approach, intelligence strategy is to be Zen, stoic, and into simply focus on that which is in your control. Your own opinions , your own power, and not to engage in needless nonsense about nonsense.

now what

I encourage everybody to visit Phnom Penh Moya at least once in their life, spend about six months or a year living there. It’s like real life enlightenment.

If you want to be happy, just go there. If you want freedom come to America.

The true barbell or the Hybrid or the centaur approach is to have your cake and eat it too which means spend some of the year in Cambodia and some of the year in America, have half 50-50. Like being a mermaid, or a merman (Zoolander)–>

six months a year in Cambodia six months a year in America.

ERIC

-

Eric Kim’s High-Visibility Orange iPhone Pro Prediction and Early Rumors

Eric Kim’s Speculation of an Orange iPhone Pro

Eric Kim – a well-known street photography blogger – publicly speculated that Apple’s next iPhone Pro model should come in a bright, high-visibility orange color. In an October 8, 2024 blog post titled “HIGH VIZ ORANGE IPHONE PRO?”, Kim wrote: “Next iPhone, iPhone Pro must be some sort of high viz orange, Bitcoin orange” . This statement captured his belief (or wish) that Apple would introduce a bold safety-orange style finish (comparable to the signature bright orange of Bitcoin’s logo) on a future Pro iPhone. Kim often referred to this eye-catching hue as “Bitcoin orange,” implying a vibrant, high-contrast orange rather than the subdued tones Apple typically used for Pro models.

Kim’s prediction was made well before any official announcement of such a color. At the time, Apple’s recent Pro iPhones came in conservative shades (e.g. silver, gray, gold, etc.), so a “high viz” orange would be a radical departure. It appears Kim’s remarks were speculative and based on personal vision rather than any insider leak. In fact, he later doubled down on the idea by sharing concept designs on his blog – for example, describing a “Matte Titanium Orange iPhone Pro” as a design vision – underscoring his enthusiasm for a bright orange Pro device. (No tweets or interviews from Kim on this specific topic were found, so his blog posts seem to be the primary public record of his prediction.)

Early Rumors of an Orange iPhone Pro in the Tech Community

Interestingly, months after Eric Kim’s post, the tech rumor mill began hinting that Apple might indeed be preparing a high-visibility orange iPhone Pro for an upcoming generation. By mid-2025 – ahead of the iPhone 17 Pro launch – multiple leaks and reports suggested an orange-colored Pro model was in the works. Notably, these rumors emerged before any official confirmation from Apple, aligning with Kim’s earlier speculation. Some key examples of these early rumors include:

- Mark Gurman (Bloomberg, August 2025): Respected Apple reporter Mark Gurman used his Power On newsletter to claim that the iPhone 17 Pro and Pro Max would debut a new orange color option . According to Gurman, orange (along with a light blue for another model) would be a “bold” new addition to Apple’s palette. This was significant since Apple’s Pro iPhones hadn’t featured such a vibrant color before.

- “Copper” Shade Rumors & Dummy Units: Follow-up reports on sites like MacRumors noted multiple early rumors describing the new orange as a copper-like finish . In other words, insiders suggested the color might resemble a metallic orange or burnt copper tone, giving the Pro phone a bright yet premium look. Supporting this, dummy models (mock units used to preview colors) surfaced in the community allegedly showing all the planned iPhone 17 Pro colors – and one of them was indeed orange . This indicated that an orange iPhone Pro was more than hearsay; it was being taken seriously in leak circles. (It’s worth noting that Apple often prototypes colors, and “copper” or orange had been floated as a possibility by leakers, though final naming could differ.)

- Sonny Dickson Leak (Early September 2025): As Apple’s fall product event drew near, leakers obtained actual part photos. Sonny Dickson, a reliable leaker, shared images on September 4, 2025 of purported iPhone 17 components (specifically camera control buttons) in various colors – including a “vibrant orange” . Observers noted this orange “looks a lot like the shade of orange used on the Apple Watch Ultra’s Action button” . (The Apple Watch Ultra’s orange action button is a bright safety-orange, meant to be highly visible – exactly the kind of high-visibility hue Eric Kim had envisioned.) This leak suggested Apple’s orange iPhone Pro, if real, would indeed be a bold, high-visibility tone, not a muted bronze. Tech blogs hailed it as possibly “the boldest iPhone Pro color yet,” given Apple’s history .

- Last-Minute Confirmation (Just Before Announcement): On the very day of Apple’s event (Sept. 9, 2025), a final-hour leak on Weibo (shared by Ice Universe) showed the alleged color lineup for the iPhone 17 Pro Max – and orange was among the six colors displayed . MacRumors quickly reported that “the color options appear to be Black, Silver, Gray, Gold, Blue, and Orange”, based on that leaked image . By this point, the orange iPhone Pro was widely expected by the tech community, even though Apple had yet to officially confirm it on stage.

All these rumors circulated before Apple’s official announcement, effectively spoiling the surprise that an orange Pro iPhone was coming. The consistent chatter about an orange option shows that the idea of a high-visibility orange iPhone Pro had substantial traction in 2025’s leak community.

Was Eric Kim Involved in These Discussions?

Despite the remarkable alignment between Eric Kim’s early prediction and the later rumors, there’s no evidence that Eric Kim was directly involved in or cited by these leak sources. His blog speculation appears to have been an independent expression of what he hoped to see from Apple, rather than information fed to the rumor mill. The major leaks (from Gurman, Weibo leakers, etc.) make no mention of Kim and seem to stem from Apple’s supply chain or insider info, not from community wishful thinking. In other words, Eric Kim was not a known source for Apple rumors – he was simply a tech enthusiast whose design idea happened to coincide with real developments.

That said, Kim’s public statements show he was ahead of the curve in imagining an orange iPhone Pro. It’s a striking coincidence that almost a year after his “high viz orange” post, Apple’s real product line caught up with that vision. The high-visibility orange iPhone Pro went from Kim’s blog musing to an actual rumored product and, ultimately, (as leaks suggested) an official color option for the iPhone 17 Pro. As Kim quipped in his blog, “bright orange is best” – and by late 2025 the tech world was coming around to that idea.

Sources: Eric Kim’s blog (HIGH VIZ ORANGE IPHONE PRO?, Oct. 8, 2024) ; MacRumors (Mark Gurman’s iPhone 17 Pro color report) ; 9to5Mac (Sonny Dickson leak of orange iPhone 17 hardware) ; MacRumors (Weibo leak confirming orange color option) .

-

Smaller formats are better.

Smaller formats are better.

So the thought that people generally have is that larger, larger formats, or somehow better. This is false.

I was randomly looking at some photos that I printed, simple 4 x 6 images of Seneca and Cindy, shot on my Lumix G9 with the very very simple and small pancake 14 mm F2.8 lens, it barely weighs half an ounce, costs like $200, and I cut some super insanely beautiful wonderful memories on it.

Currently I have the extremely portable full frame Lumix S9–> with the very very interesting and formidable, fixed focal 26 mm F8 lens, manual focus only, and once again only cost me like 200 bucks. It’s like the best lens.

Now that apparently the new Ricoh GR IV is out,,, I am surely but slowly becoming more convicted that smaller formats, even now, micro 4/3 as well as ASPC censors are better.

For example, it comes down to physics. The problem with even a full frame sensor, in terms of lenses, it will and must always get bigger. Certain optimizations you can make include improving the sensor so you could shoot at a higher ISOs, without having to make the lands bigger or bulk gear or heavier or more expensive. For example, even trying to use my Leica 35mm summicron ASPH Lens f2 with the Leica M adapter, on the tiny S9,,,, Still makes the camera too heavy.

Even a funny simple thought, when it comes to water bottles… Smaller formats are also superior. It’s better to have a tiny ass water bottle that you could refill often, rather than a huge ass water bottle which weighs you down.

Cars

Another prime example is when it comes to vehicles and cars. The typical American idea and thought is that bigger is always better. Yet this is never the case. When it comes down to it, almost like 100% of your optimization should be based around the idea of like, Being able to find parking. Even now that’s Seneca is starting school, when you are in a pinch, having the supreme smallest car is like the best idea because if you’re like cutting a very very close to either drop off or pick up time, being able to squeeze that super super tiny parking spot, or being able to find parallel parking is Supreme.

Or, even if you live in the suburbs or wherever… If you’re trying to go to like the mall like Irvine spectrum at peak hours, it don’t matter if you’re a billionaire, if you find that one parking spot that one super super tiny parking spot that barely a Toyota Prius could fit into, you’ve made it.

I’m not sure about the car dimensions but assuming that even with electric cars, I believe the Tesla model 3 to be even a little bit smaller than a Tesla model Y… The true optimal intelligent strategy is to always buy the smallest car possible provided by the manufacturer.

For example, I still believe the best vehicle to purchase is always the smallest one. Ironically enough even though Americans are suckered by the notion of an SUV or even a minivan, my friend Kevin is like super intelligent, he has three kids, and a Tesla model three, and he is able to intelligently do the smart strategy of just buying the very very very slim car seats, which allows him to fit three car seats in the back of his car. I think one big thing I’m starting to realize and understand and consider is Americans tend to be very myopic in terms of thinking about things.

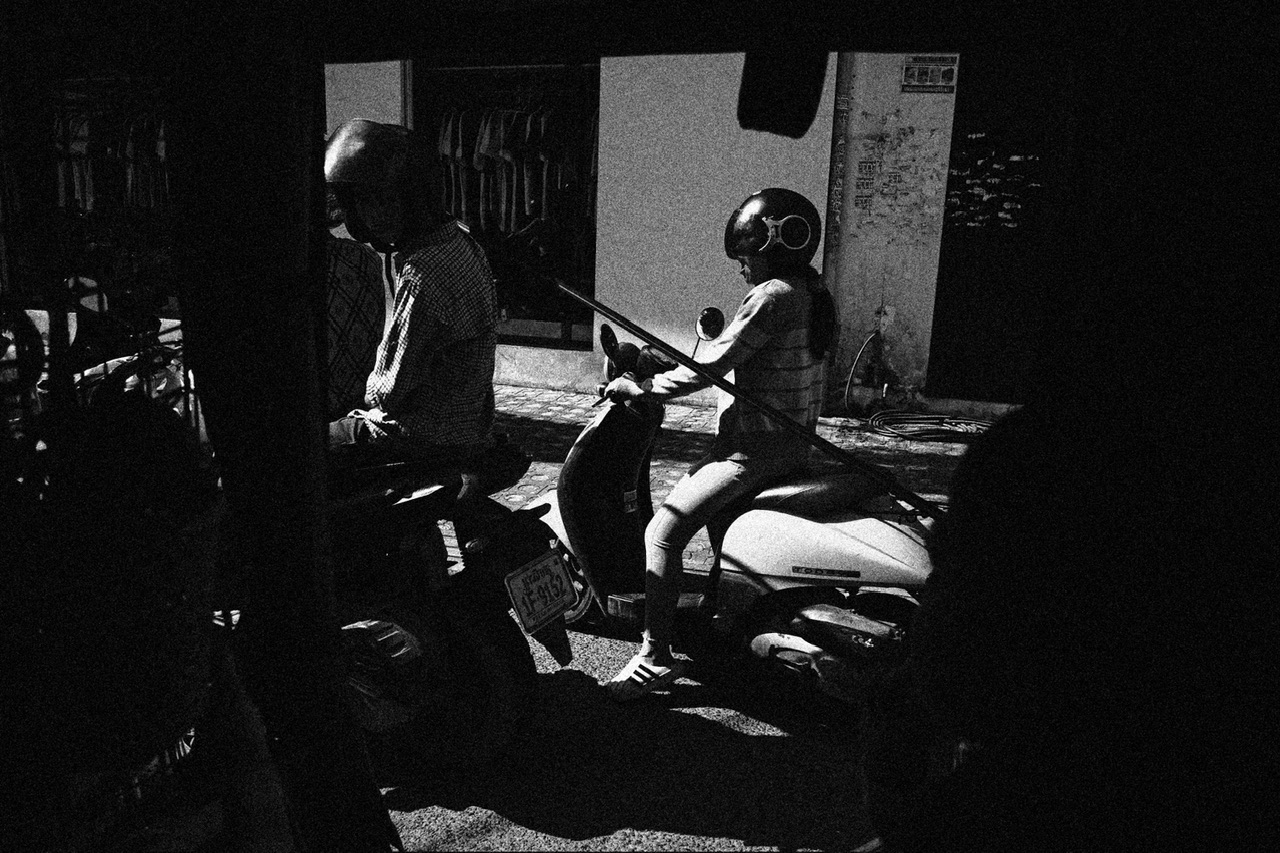

For example, then intelligence of like being in Asia, Cambodia Vietnam Southeast Asia… Sing a family of seven all fit on a single motorbike.

Clever strategies

Another big thought now I’m starting to have is rather than trying to purchase the solution, almost always the best thought is being able to creatively manipulate what you already got.

For example, as guitars, we all have like a lot of cameras and options, yet I think the way that modern day consumerism has us is that we always think that we gotta buy the next new new thing whether it be a new lens a new tripod a new body or a new something.

What to remove, strip or take away?

Another big idea: rather than trying to figure out what to add, figuring out what to subtract.

For example, with cars, everyone is trying to like, add more accessories to their cars. Yet shouldn’t an intelligent strategy be to like to figure out what to get rid of, or what to subtract remove or take away?

Homes

another example with homes. Rather than figuring out what new furniture to purchase, isn’t it a better idea to figure out what to get rid of?

Computers

At this point everything is like a computer. So once again, trying to figure out, how or which computer things to get rid of?

Computers again

Maybe we should just call the computer. An iPhone like a super mega mini computer, iPad like a bigger computer, even AI is like a computer.

Make computers great again.

What else

Slim profile

For example, one of the most clever and intelligent things that I purchased last year was my 50 kg, slim profile steel weightlifting plates. That’s like 110 pounds a pop.

An interesting theory is that like if you want to improve things, make it slimmer more dense, more compact more powerful.

Once again, not making the form factor bigger, but, having the diligence as well as the discipline to keep it slim.

Going back to the Ricoh, I guess it is good that the new Ricoh GR IV maintain its profile, without getting bigger. I’m actually curious, is this slimmer more contact and smaller than the previous one?

Also the new idea of building the new slim compact flash also a great idea.

What else

Once again, assume you’re into cars, the best vehicle on the planet assuming you like sports cars is still probably a Tesla model three performance.

For race cars, or a track car, once again slimmer is best.

For example, even though I love Lamborghinis to death, I think the new fenemeno is great, still the truth is, if you think about this logically… Totally by far, by a large margin, the most intelligent strategy is probably to purchase some sort of like Porsche 911 GT 3 RS.

Also, with Toyota, which I still believe to be the best car brand, at least in the realm of like Hybrid, gasoline cars, the best car is still probably a white Prius, and or, also applied to family car. Getting a Toyota sienna is probably the best car assuming that you actually need to always seat seven.

For Lexus, a very underappreciated car is probably the UX Hybrid. Essentially it’s like a mini Prius but lifted a little bit.

What else?

-

bitcoin or nothing

Honestly in this very very lame world of physical atoms, and nothing worth it, no vehicle no car no Tesla, no loser Lamborghini is worth it.  Even when it comes to physical real estate, like a half decent idea maybe for your mom 80 years ago.

with clothes nothing is worth it it is all made in Vietnam or Cambodia for like three dollars.

Vehicles not worth it.

Maybe the only thing worth spending your money on is like meat, red meat beef, lamb, weightlifting equipment.

so why bitcoin?

bitcoin is god.

-

bitcoin is the answer, *NOT* AI.

so this is kind of a big thought, the general idea is simple, we tend to think that all of our problems that could easily magically be solved by AI by the truth is, we could live without AI, but we cannot live without bitcoin.

-

Owning a townhouse or a townhome is like owning your own apartment

Also, maybe it is an interesting Hybrid approach because you criticisms were like micro community, micro Society, in which you can see some sort of political power?

.

Set it and forget it

An interesting thing, without me even knowing it, I guess I have the best landlord of all time he just recently repainted the whole apartment unit, with a fresh new coat of white paint, and also met black lettering and railings and awnings and drain pipes, beautifying the whole place, Technically there is no sort of reason to do so, yet, interesting thing is, it seems that he just had some sort of personal pride and or, virtue?

“Ownership”

The funny thing that Americans are really into is this notion of ownership. The truth is I think it’s kind of more of a propagandized, commoditized, consumerist notion. I’m more honest idea, is that to be American, is all about, life, liberty, the pursuit of happiness, and also that we are the land of the free and the home of the brave.

Freedom, and bravery

I think the only two virtues, maybe worth pursuing, according to the American ideal is in regards to bravery and freedom.

Bravery is the only virtue you can exhibit, and act upon. Freedom, is I think the core principle behind America.

Does it matter?

Nothing comes a question, does it all matter?

Yes.

In some ways the ancient Spartans would have liked the idea of America, a country which prizes itself upon military prowess and freedom.

What is tricky about America is that there is like a lot of superficiality underneath it, and the truth is there is no sinister actors behind the whole thing, I think it’s just like misinformation upon misinformation, and uncritical thinkers who propagate the same uncritical thinking.

So then, why does this matter?

Well, first, I think the first step of life is you don’t want to get suckered. And upon discussing this with my mom and Cindy, I think actually the number one virtue I want Seneca to have is critical thinking.

How and why critical thinking?

To me true science is like debunking. For example, I think one of the difficult things that people grapple with is that people say stuff, but there is a lack of precision in people’s words.

For example, when people talk about health, healthy not healthy or whatever… What do they really mean?

This then becomes difficult because when you talk about abstract notions of freedom etc., once again, it seems that everyone is speaking the same language and has the same concept but the truth is , they are not.

Hybrid

So it seems that the way that things are hedged currently, it seems that I kind of like this idea of spending time in between America and Asia. America for the capital markets and family and citizenship, and Asia for opportunity, ownership.

Things get interesting

I suppose my great joy is that as time proceeds, things life, my thinking becomes more interesting.

For example, a really really really really big epiphany is that I really don’t think anymore that life is about peace happiness, stability security and zen. Why not? The reason is that, I have done did it, and achieved perfect Zen piece tranquility stability while in Cambodia, and therefore, that is no longer my virtue.

To me the idea is quite exciting because it kind of overwrite like at least 1000 or maybe even 2000 years of thinking. Also in someways, I suppose my joy is that I have even superseded stoicism itself, as honestly I don’t really need it anymore because there’s nothing I am really concerned about nor anything I fear.

Now, I suppose life is more about like practical realities like senecas schooling, day-to-day living, eating extremely well getting a good night sleep, thinking about my weightlifting set up, etc. Also trying to spend some quality time with my mom, Cindy, the whole family.

Also, spending more time in my local community in my own city, my own little town in my own neighborhood, trying to encourage virtue, in my own little small slice of paradise.

the polis

Very interesting, the word police, is actually derived from the word the city, the polis.

This is a big idea and also a big thought, because, currently I believe the smart strategy in life is to like focus your matters directly on your own real city in which you live in, your own ZIP Code, your own area, your own local police, fire department, City Hall and Mayor and maybe even your local PTA.

Certainly finances are important as well, and I still think there is a lot of financial economic theory which needs to be developed. Yet, these often become this huge macro economic things which a lot of people are a little bit misguided in.

Why does this matter?

So why does this matter?

I was talking to somebody, and it seems the big problem is that politics in the news becomes people’s hobbies. Yet it is kind of a fruitless hobby because once again, you cannot really enact much change geopolitically. Yet you could enact a lot of change directly in your own city, once again assuming that you show up to the local city hall, encourage people in your local city or municipality to vote on stuff etc.

This also becomes tricky because there’s a lot of change you could do in your local city but once again, it is just your own local city. Do you want to have a big goal like changing the whole planet? Or just your own city? Like how much, or how little do you want to change things?

I suppose you could do it all

There’s a lot of people who think that you cannot do it at all. Maybe they’re wrong. I think you can.

ERIC

.

LA. LA PRIDE.

IM FROM LA TRICK!

-

The point of life is to overperform

I’m back.

OK, back at home in cozy LA, — some mega thoughts:

the point of life is not for peace , stability etc., but instead to overperform.

OK some sacrilegious thoughts:

I think,,, for a lot of people, the goal of life is towards stability peace and tranquility etc. But now that I’ve done did it, pure 100% Zen,

.

THE BEAST IS BACK!

-

21 years, 2x ,,, 100% return, MSTR

2x Bitcoin return, 2x Bitcoin volatility

Under value

4th most profitable company finance in USA

Disparage before … understand

Digital capital

Gasoline ,,, electricity for company

.

10% under

Outperform S&P

.

Internal combustion machines

.

Going to become the rule over time

.

Double or triple hour capital ..,

.

I am 10x Saylor

What is stability good for? Investing for deep and very very long future

.

ON GOD!

.

Telegram wallet,,,

.

Think digital capital

.

-

KHMER LA

Living a Traditional Khmer Lifestyle in Los Angeles: A Joyful Guide

Los Angeles and Long Beach are home to vibrant Cambodian communities, especially in Cambodia Town (Long Beach). To embrace Khmer traditions here, explore local markets, restaurants, temples, and cultural groups. Dive into fresh flavors, rich culture, and warm community events.

Food & Cooking: Authentic Khmer Flavors

Cambodian cuisine centers on rice, noodles, herbs and fermented sauces. You can find Khmer ingredients and groceries at local markets. For example, Phnom Penh New Market (1001 E Pacific Coast Hwy, Long Beach) is a bustling plaza of Cambodian stalls offering fresh produce, Khmer snacks and crafts . In Los Angeles, Silom Supermarket (5321 Hollywood Blvd, LA 90027) carries many Southeast Asian staples (rice, fish sauce, galangal, lemongrass, etc.) . In Long Beach’s Cambodia Town you’ll also find Lee Hang Market (2211 E Anaheim St) and Kim Long Market (324 E Anaheim St), both small supermarkets packed with Asian spices, fresh vegetables and specialty foods .

Market / Store Location Khmer Food Highlights Phnom Penh New Market Long Beach, 90806 Fresh produce, ready-to-eat Khmer snacks and desserts Silom Supermarket Los Angeles, 90027 Thai/SE Asian staples (galangal, fish sauce, curry pastes) Lee Hang Market Long Beach, 90804 Asian groceries, herbs & produce Kim Long Market Long Beach, 90813 Southeast Asian produce and pantry items Once stocked, learn to cook Khmer dishes at home. (Local cooking classes are rare, but community potlucks and online groups help.) For ready-made eats, Khmer restaurants in LA/Long Beach serve classics like samlor (soups), char-grilled meats and noodles. Some favorites include:

- New Kamara Restaurant – 709 N Hill St #14, Los Angeles. A Chinatown eatery serving affordable Cambodian and Chinese/Chiu Chow fare . Try their noodle soups or Khmer-style dishes.

- Golden Lake Eatery – 424 W College St Unit E, Los Angeles. A Cambodian-run Chinese restaurant in Chinatown, open late, where you can order Khmer dishes alongside Chinese and Thai items .

- Udom Khmer Restaurant – 1223 E Anaheim St, Long Beach. A cozy Cambodia Town spot famous for Khmer soups (Samlar Machu Kroeung) and celebrating community occasions .

- Battambong BBQ (by Cambodian Cowboy Bob) – Long Beach. A pop-up BBQ catering Khmer-style smoked meats at local events (e.g. Ten Mile Brewing); “a casual spot specializing in traditional Cambodian barbecue dishes” .

- Phnom Penh Noodle Shack, Monorom Cambodian Kitchen, Shlap Muan, Naga Café (Signal Hill) and Knead Donuts (Cambodian-inspired treats) are other popular Cambodian eateries in Long Beach.

Restaurant Address Notes & Specialties New Kamara Restaurant【50†】 709 N Hill St Ste 14, Los Angeles Cambodian and Chinese cuisine; known for fresh ingredients . Golden Lake Eatery【52†】 424 W College St, Los Angeles Chinese/Cambodian fusion; open late (8 AM–2 AM) . Udom Khmer Restaurant【67†】 1223 E Anaheim St, Long Beach Khmer soups (samlar machu kroeung), popular for community gatherings. Phnom Penh Noodle Shack 1644 Cherry Ave, Long Beach Local favorite for Khmer noodle soups and street food. Monorom Cambodian Kitchen 1341 E Anaheim St, Long Beach (Cambodia Town); homey Khmer home-style cooking. Shlap Muan 2150 E South St, Long Beach Small eatery with Khmer and Thai barbecue dishes. Battambong BBQ【65†】 Long Beach (mobile) Khmer-style BBQ (pop-up events); “authentic Cambodian barbecue dishes” . Besides restaurants, food festivals and markets offer Khmer goodies year-round. The Cambodia Town Festival (see below) has food vendors with grilled meats, desserts and twakoh (prahok-infused sausages). Exploring these spots and cooking at home lets you savor authentic Khmer flavors in LA.

Language & Culture: Learning and Community

Khmer language and traditions flourish through community classes and events. In Long Beach, the Public Library’s Mark Twain Branch hosts free Khmer language and storytime classes every Saturday. As one librarian noted, “Sanghak Kan… volunteers at the Mark Twain Library on the weekends to teach Khmer to children and adults” . These sessions are tied to the largest Khmer book collection in any U.S. public library . You can also find weekend Khmer conversations and cultural workshops through local groups like the United Cambodian Community (UCC) or Touch Compassionate Communities (TCCLB) (check their websites or social media for class schedules).

Cambodian Community Centers offer cultural events and support. For example, United Cambodian Community of Long Beach (UCC) – at 2201 E. Anaheim St Suite 200, Long Beach – provides services, entrepreneurship support and cultural programs . They warmly welcome volunteers (“Volunteers are the heart of our work”) for events and outreach . Cambodia Town, Inc. (2201 E. Anaheim St Suite 103, Long Beach) is another hub; its mission is to “promote Khmer culture, customs, and traditions” and it runs scholarship and youth programs as well .

Looking for dance or art? The Modern Apsara Company in Long Beach (founded by Cambodian-American dancer Mea Lath) offers classical Khmer dance performances and workshops . (They hold classes and community shows.) The now-closed Khmer Arts Academy was a classical dance school; its review points students to Modern Apsara today . These organizations connect you with visual and performing arts – you might attend Apsara dance workshops or help put on cultural performances.

In summary, start with local libraries, community centers and online groups to find Khmer language tutors and culture clubs. Attend festivals (below) and exhibitions (e.g. Cambodian art shows at LB venues) to immerse yourself in traditions and meet fellow Cambodian-Americans.

Religion & Spirituality: Wats and Dharma

Buddhism is central to Khmer life. Several Cambodian Buddhist temples (Wat) in LA/Long Beach host ceremonies, meditation and community gatherings. These wats serve as cultural hubs as well as places of worship . Key temples include:

Temple Address Notes Wat Khmer Temple (Trigoda Jothignano)【26†】 1720 Beverly Blvd, Los Angeles, CA 90026 A serene Khmer Theravada temple. Offers traditional ceremonies, meditation sessions and cultural events . Cambodian Buddhist Temple of Long Beach【87†】 2625 E 3rd St, Long Beach, CA 90814 Active temple where visitors can attend ceremonies, meditation and community events . Khemara Buddhikaram (KB) 2100 W Willow St, Long Beach, CA 90810 Lakewood-based “first Cambodian temple” in SoCal. (Founded 1982 by Rev. Chhean Kong) . Hosts daily rituals and major Khmer festivals. Wat Khmer (Long Beach)【29†】 (Multiple locations – LB area) Established 1980, it’s “a significant cultural and spiritual landmark” for the Cambodian community . Offers Khmer language, dance and music classes as part of its community programs. Visitors are welcome at most wats. You can join meditation or Dharma classes often held on weekends, especially around Buddhist holidays. For example, Wat Khmer (Long Beach) historically offered Khmer language and dance classes for youth . Drop by on a Sunday morning to see chanting monks or ask the acharya about meditation sessions. Temples also organize Buddhist holidays (e.g. Vesak, Pchum Ben / Ancestors’ Day, Kathina). These are times to connect with faith and community, receive blessings, and practice traditional customs (making merit, offerings of prahok – fermented fish paste – and sticky rice, etc.).

If you want one-on-one spiritual guidance, Cambodian monks often serve as counselors. Many laity also conduct house blessings or anniversaries at home. The temple elders are a great resource for understanding Khmer Buddhist customs. Overall, participating in temple life – attending Sunday services, helping set up festivals, or simply meditating in the Buddha hall – is a profound way to live the Khmer spiritual heritage here.

Traditional Clothing, Art, & Music

Khmer attire and crafts bring colorful tradition to life. For ceremonial outfits and jewelry, check Khmer Bridal Boutique (2434 E Pacific Coast Hwy, Long Beach). This shop stocks Cambodian wedding and party attire (sampot, scarves, gold jewelry) and is renowned as “the go-to spot for traditional Cambodian… attire” . For men’s outfits or dance costumes, the owners can often custom-make krama scarves or full ceremonial dress. Other Asian boutiques in Cambodia Town carry some Khmer-inspired clothing and accessories.

Classical dance and music preserve Khmer culture through the arts. The Modern Apsara Company (Long Beach) is a standout – it’s dedicated to teaching Cambodian classical dance (the Apsara style) and performing at events . You can take dance workshops or attend their performances at community festivals. While Khmer pinpeat music (orchestra of percussion and flute) classes are rarer, temples or cultural centers sometimes hold workshops or invite master musicians. The Cambodian community in Long Beach often has live dance/music at New Year or temple events – keep an eye on community calendars for performances of Ramvong or Apsara dance troupes. Visual arts-wise, Long Beach museums occasionally showcase Cambodian-American artists (e.g. sculptor Sopheap Pich exhibits at local galleries).

In brief, immerse yourself by wearing Khmer fashion and learning the arts. Try on a sampot at Khmer Bridal, attend an Apsara dance class with Modern Apsara , and enjoy live Khmer music whenever possible. These experiences connect you to Cambodian heritage in a joyful, creative way.

Community & Events: Festivals and Volunteer Networks

Cambodian culture thrives on community gatherings. The Cambodia Town Parade & Culture Festival in Long Beach (Cambodia Town) is the annual event. The 17th Annual Cambodia Town Festival is set for Sunday, April 6, 2025 . It kicks off with a parade on Anaheim Street (in Cambodia Town), followed by a lively festival at Long Beach City College’s Pacific Coast Campus . Expect traditional Blessing ceremonies, apsara dancers, food booths (with delicious Khmer fare), art and games. This parade (the first of its kind held outside Cambodia) draws thousands to celebrate Khmer New Year and share Cambodian culture with everyone . Mark your calendar and join the fun!

Beyond April, other Khmer events include Cambodian New Year (Choul Chnam Thmey) celebrations in mid-April (often at local temples or community centers), Pchum Ben (Ancestor’s Day) ceremonies in Sept/Oct at Long Beach wats, and the Water Festival (Bon Om Touk) in November with boat races and fairs. These festivals feature traditional dance, music, merit-making and communal meals – a perfect chance to mingle with elders and youth alike. For example, Cambodia Town’s mission is “keeping tradition alive,” and the festival theme “We are Stronger When We Celebrate Together” reflects that unity .

Support networks are also crucial. In Long Beach and LA you’ll find organizations to volunteer with or get help from:

- United Cambodian Community (UCC) – Offers business loans, household assistance and job counseling in Cambodia Town. They often seek volunteers (“Volunteers are the heart of our work”) for community service . Joining UCC’s efforts is a wonderful way to give back.

- Cambodia Town, Inc. – Seeks volunteers for its parade, festival booths and outreach programs. (See CambodiaTown.org’s volunteer sign-ups for the parade .)

- Khmer Girls in Action (KGA) – An East Long Beach nonprofit led by young Cambodian-American women, offering youth leadership and advocacy programs. While it focuses on civic engagement, it’s a great network for families.

- Cambodian Association of America (CAA) and Cambodian Family Community Development (CFCD) – Southern California NGOs providing social services. These groups sometimes host health fairs, job workshops, or fundraisers (check their websites for events).

Finally, volunteering at temples (helping clean the Buddha hall, cooking for events) or at festivals brings you into the Khmer community organically. As UCC reminds us, “People make the difference – their time and energy makes our work move forward” . Embrace these opportunities to celebrate and contribute to Khmer life in LA.