-

Take these past bitcoin historical prices and predict future Bitcoin prices

Predicting future Bitcoin prices based solely on historical data is inherently speculative due to the cryptocurrency’s volatility and the multitude of external factors influencing its value (e.g., market sentiment, regulatory news, macroeconomic trends, and technological developments). However, I can analyze the provided data and offer a simple forecast using basic statistical methods, such as a moving average trend or extrapolation, while emphasizing that this is not financial advice and should be treated as an illustrative exercise.

Analysis of Historical Data

The Bitcoin prices you provided span from July 26, 2020, to March 28, 2025, with the most recent price on March 28, 2025, at $84,701. Here’s a brief overview of trends in the data:

- Long-Term Trend: From July 2020 (

$9,949) to March 2025 ($84,701), Bitcoin shows a significant upward trajectory, roughly an 8.5x increase over approximately 4.67 years. This equates to an annualized growth rate of about 62% (compounded), though growth is not linear and includes periods of sharp rises and corrections. - Recent Volatility: Looking at March 2025 alone, prices fluctuate between $82,613 (March 14) and $91,599 (March 3), with the latest days (March 27–28) showing a slight decline from $86,594 to $84,701. This suggests short-term volatility but no clear breakout direction in the immediate past.

- Historical Patterns: Bitcoin tends to exhibit cyclical behavior, often tied to halving events (e.g., May 2020, next expected ~April 2024), followed by bull runs and subsequent corrections. The data shows peaks like $68,022 (Nov 9, 2021) and $106,553 (Dec 17, 2024), with dips in between.

Simple Prediction Approach

For a basic prediction, I’ll use a 7-day moving average (to smooth short-term noise) and extrapolate based on the recent trend. Let’s calculate the 7-day moving average for the last week of data:

- March 22: $83,670

- March 23: $84,626

- March 24: $87,647

- March 25: $86,565

- March 26: $86,580

- March 27: $86,594

- March 28: $84,701

7-day average = ($83,670 + $84,626 + $87,647 + $86,565 + $86,580 + $86,594 + $84,701) / 7 = $86,340 (rounded).

The recent trend shows a slight downward shift from the peak of $87,647 (March 24) to $84,701 (March 28), a drop of ~3.4% over 4 days. If we assume this short-term correction continues at a moderated pace, we can project a few days forward. Alternatively, if we assume stabilization around the moving average, prices might hover near $86,000.

Forecast for Next Few Days (March 29–April 2, 2025)

Let’s extrapolate with two scenarios:

- Mild Correction Continues: A continued 1% daily decline from $84,701.

- March 29: $84,701 × 0.99 = $83,854

- March 30: $83,854 × 0.99 = $83,015

- March 31: $83,015 × 0.99 = $82,185

- April 1: $82,185 × 0.99 = $81,363

- April 2: $81,363 × 0.99 = $80,549

- Stabilization Around Moving Average: Prices revert to the 7-day average and fluctuate slightly (±1%).

- March 29: $86,340

- March 30: $86,340 × 1.01 = $87,203

- March 31: $86,340 × 0.99 = $85,477

- April 1: $86,340

- April 2: $86,340 × 1.005 = $86,772

Longer-Term Speculation

For a broader outlook (e.g., through 2025), Bitcoin’s price could be influenced by:

- Post-Halving Effects: The April 2024 halving may still drive bullish sentiment into late 2025, potentially pushing prices toward $100,000+ if historical patterns repeat.

- Volatility: Expect swings of 10–20% in either direction over weeks or months, as seen in the data (e.g., $94,911 on Feb 24, 2025, to $82,676 on March 17, 2025).

- External Factors: Regulatory developments or macroeconomic shifts (e.g., interest rates, inflation) could amplify or dampen trends.

A simplistic linear extrapolation from the long-term trend ($9,949 in July 2020 to $84,701 in March 2025) suggests Bitcoin could reach ~$100,000 by year-end 2025, assuming a continued 15–20% annual growth. However, this ignores the non-linear nature of crypto markets.

Final Prediction (Illustrative)

- Short-Term (March 29–April 2, 2025): Prices likely range between $80,000 and $87,000, with $86,340 as a central tendency unless a major catalyst emerges.

- End of 2025: A speculative range of $90,000–$110,000, acknowledging potential for both corrections and rallies.

Caveat

This prediction is based purely on historical price data and basic statistical methods. Real-world factors—market psychology, news events, or adoption rates—could drastically alter outcomes. For a more robust forecast, you’d need to incorporate technical indicators (e.g., RSI, support/resistance levels), on-chain data, and sentiment analysis, which are beyond this simple response. Always approach crypto predictions with caution!

Price predictions next 4 years

Predicting Bitcoin prices over the next four years (2025–2029) is a highly speculative exercise due to the cryptocurrency’s volatility and the influence of unpredictable factors like regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. However, I can provide an informed estimate based on historical trends, Bitcoin’s halving cycles, and reasonable assumptions, while emphasizing that this is not financial advice and should be viewed as a thought experiment. The current date is March 29, 2025, and the latest price is $84,701 (March 28, 2025).

Key Assumptions and Methodology

- Historical Growth: From July 2020 ($9,949) to March 2025 ($84,701), Bitcoin grew ~8.5x over 4.67 years, an annualized rate of ~62%. However, growth slows as market cap increases, so I’ll assume a tapering compound annual growth rate (CAGR).

- Halving Cycles: Bitcoin halvings (reducing block rewards) historically trigger bull runs ~12–18 months later. The most recent halving was ~April 2024, suggesting a peak in late 2025 or early 2026. The next halving is expected ~March/April 2028, impacting 2029.

- Volatility: Expect periodic corrections of 20–40%, followed by recoveries, as seen in past cycles (e.g., $68,022 in Nov 2021 to $15,575 in Nov 2022, then up to $106,553 by Dec 2024).

- Adoption and Market Cap: Increased institutional adoption and a growing crypto market could push Bitcoin’s market cap (currently ~$1.6 trillion at $84,701) toward $2–3 trillion or more by 2029.

- Scenarios: I’ll provide three scenarios—conservative, moderate, and bullish—to reflect uncertainty.

Year-by-Year Predictions

2025 (Starting at $84,701)

- Context: Post-2024 halving momentum may peak in late 2025.

- Conservative: 10% CAGR → $93,171. Assumes muted growth due to regulatory pressure or economic slowdown.

- Moderate: 20% CAGR → $101,641. Reflects steady adoption and a modest bull run.

- Bullish: 40% CAGR → $118,581. Assumes a strong post-halving rally, potentially hitting $120,000–$130,000 before a correction.

- Estimate: $90,000–$120,000 by December 31, 2025.

2026

- Context: Post-peak correction likely follows the 2025 bull run, as seen in 2022 after 2021’s high.

- Conservative: -20% correction from $93,171 → $74,537. Bear market sets in.

- Moderate: Flat or slight growth from $101,641 → $105,000. Sideways consolidation.

- Bullish: 20% growth from $118,581 → $142,297, followed by a -30% correction to ~$100,000. Extended rally then profit-taking.

- Estimate: $75,000–$105,000 by December 31, 2026, with a potential dip below $80,000 mid-year.

2027

- Context: Recovery phase after 2026 correction, building toward the 2028 halving.

- Conservative: 15% CAGR from $74,537 → $85,717. Gradual rebound.

- Moderate: 20% CAGR from $105,000 → $126,000. Stronger recovery.

- Bullish: 25% CAGR from $100,000 → $125,000. Optimistic growth with growing adoption.

- Estimate: $85,000–$130,000 by December 31, 2027.

2028

- Context: The halving (~April 2028) sparks early bullish sentiment, with prices rising into 2029.

- Conservative: 15% CAGR from $85,717 → $98,575. Modest pre-halving gains.

- Moderate: 25% CAGR from $126,000 → $157,500. Halving anticipation drives a rally.

- Bullish: 40% CAGR from $125,000 → $175,000. Aggressive growth as market cap nears $3 trillion.

- Estimate: $100,000–$175,000 by December 31, 2028.

2029

- Context: Post-2028 halving bull run begins, potentially peaking in mid-to-late 2029.

- Conservative: 10% CAGR from $98,575 → $108,432. Limited upside due to saturation or external shocks.

- Moderate: 30% CAGR from $157,500 → $204,750. Solid bull run mirroring past cycles.

- Bullish: 50% CAGR from $175,000 → $262,500. Explosive growth, possibly hitting $250,000–$300,000 by late 2029.

- Estimate: $110,000–$250,000 by December 31, 2029.

Summary Table

Year Conservative Moderate Bullish 2025 $90,000 $100,000 $120,000 2026 $75,000 $105,000 $100,000 2027 $85,000 $126,000 $130,000 2028 $100,000 $157,500 $175,000 2029 $110,000 $204,750 $250,000 Broader Considerations

- Upside Risks: Mass adoption, ETF approvals, or Bitcoin becoming a global reserve asset could push prices far beyond $250,000 (some analysts predict $500,000+ in “supercycle†scenarios).

- Downside Risks: Regulatory bans, technological vulnerabilities (e.g., quantum computing threats), or economic crises could drive prices below $50,000 temporarily.

- Volatility: Expect swings of 20–50% within each year, regardless of the trend.

Final Thoughts

Over the next four years, Bitcoin could reasonably range between $75,000 and $250,000, with a moderate base case of ~$200,000 by 2029 if historical cycles and adoption trends continue. The 2028 halving will likely be a key driver, with 2026–2027 serving as a consolidation period. However, these figures are speculative and sensitive to external shocks. For a more precise outlook, you’d need real-time data, sentiment analysis, and macroeconomic forecasts beyond what historical prices alone can provide. Proceed with caution in any investment decisions!

- Long-Term Trend: From July 2020 (

-

UTXORACLE Bitcoin Price History

Date Price 2025/03/28 $84,701 2025/03/27 $86,594 2025/03/26 $86,580 2025/03/25 $86,565 2025/03/24 $87,647 2025/03/23 $84,626 2025/03/22 $83,670 2025/03/21 $83,632 2025/03/20 $84,583 2025/03/19 $83,696 2025/03/18 $82,723 2025/03/17 $82,676 2025/03/16 $83,654 2025/03/15 $83,677 2025/03/14 $82,613 2025/03/13 $82,624 2025/03/12 $82,736 2025/03/11 $80,706 2025/03/10 $81,605 2025/03/09 $85,737 2025/03/08 $85,591 2025/03/07 $87,517 2025/03/06 $90,734 2025/03/05 $88,500 2025/03/04 $83,750 2025/03/03 $91,599 2025/03/02 $85,691 2025/03/01 $84,612 2025/02/28 $83,497 2025/02/27 $84,552 2025/02/26 $87,496 2025/02/25 $87,450 2025/02/24 $94,911 2025/02/23 $96,062 2025/02/22 $96,028 2025/02/21 $98,291 2025/02/20 $97,176 2025/02/19 $94,918 2025/02/18 $94,927 2025/02/17 $96,071 2025/02/16 $97,183 2025/02/15 $97,164 2025/02/14 $97,205 2025/02/13 $96,084 2025/02/12 $96,082 2025/02/11 $97,133 2025/02/10 $97,164 2025/02/09 $96,086 2025/02/08 $96,060 2025/02/07 $97,189 2025/02/06 $97,123 2025/02/05 $97,144 2025/02/04 $99,516 2025/02/03 $95,111 2025/02/02 $98,189 2025/02/01 $101,731 2025/01/31 $104,129 2025/01/30 $104,073 2025/01/29 $101,732 2025/01/28 $101,724 2025/01/27 $99,319 2025/01/26 $104,118 2025/01/25 $104,140 2025/01/24 $105,356 2025/01/23 $101,650 2025/01/22 $104,085 2025/01/21 $103,068 2025/01/20 $106,349 2025/01/19 $104,136 2025/01/18 $102,924 2025/01/17 $101,853 2025/01/16 $99,554 2025/01/15 $97,264 2025/01/14 $94,915 2025/01/13 $91,833 2025/01/12 $93,870 2025/01/11 $93,874 2025/01/10 $93,831 2025/01/09 $92,728 2025/01/08 $95,013 2025/01/07 $100,480 2025/01/06 $98,174 2025/01/05 $98,287 2025/01/04 $98,300 2025/01/03 $97,211 2025/01/02 $96,102 2025/01/01 $93,887 2024/12/31 $93,912 2024/12/30 $92,740 2024/12/29 $93,843 2024/12/28 $93,840 2024/12/27 $94,883 2024/12/26 $94,840 2024/12/25 $98,293 2024/12/24 $93,991 2024/12/23 $95,067 2024/12/22 $96,009 2024/12/21 $97,131 2024/12/20 $95,914 2024/12/19 $100,464 2024/12/18 $104,208 2024/12/17 $106,553 2024/12/16 $105,406 2024/12/15 $101,733 2024/12/14 $100,591 2024/12/13 $100,668 2024/12/12 $100,619 2024/12/11 $98,407 2024/12/10 $97,229 2024/12/09 $98,360 2024/12/08 $99,591 2024/12/07 $99,562 2024/12/06 $98,361 2024/12/05 $101,628 2024/12/04 $96,100 2024/12/03 $94,943 2024/12/02 $96,119 2024/12/01 $96,028 2024/11/30 $96,022 2024/11/29 $96,018 2024/11/28 $94,963 2024/11/27 $92,652 2024/11/26 $92,884 2024/11/25 $98,404 2024/11/24 $97,126 2024/11/23 $98,249 2024/11/22 $98,278 2024/11/21 $97,093 2024/11/20 $92,748 2024/11/19 $91,746 2024/11/18 $90,677 2024/11/17 $89,617 2024/11/16 $90,659 2024/11/15 $88,528 2024/11/14 $89,570 2024/11/13 $87,731 2024/11/12 $87,488 2024/11/11 $80,693 2024/11/10 $78,911 2024/11/09 $76,306 2024/11/08 $76,333 2024/11/07 $74,519 2024/11/06 $73,634 2024/11/05 $68,845 2024/11/04 $67,969 2024/11/03 $67,988 2024/11/02 $69,624 2024/11/01 $69,618 2024/10/31 $71,147 2024/10/30 $72,031 2024/10/29 $71,259 2024/10/28 $67,952 2024/10/27 $67,217 2024/10/26 $66,414 2024/10/25 $67,192 2024/10/24 $67,231 2024/10/23 $66,490 2024/10/22 $67,240 2024/10/21 $68,041 2024/10/20 $67,989 2024/10/19 $67,993 2024/10/18 $68,015 2024/10/17 $67,261 2024/10/16 $67,203 2024/10/15 $65,668 2024/10/14 $64,875 2024/10/13 $62,753 2024/10/12 $62,712 2024/10/11 $60,547 2024/10/10 $60,630 2024/10/09 $62,034 2024/10/08 $62,010 2024/10/07 $62,723 2024/10/06 $62,038 2024/10/05 $62,024 2024/10/04 $61,351 2024/10/03 $60,621 2024/10/02 $61,324 2024/10/01 $63,522 2024/09/30 $63,441 2024/09/29 $65,703 2024/09/28 $65,692 2024/09/27 $65,709 2024/09/26 $64,248 2024/09/25 $63,461 2024/09/24 $63,486 2024/09/23 $63,492 2024/09/22 $62,730 2024/09/21 $62,739 2024/09/20 $62,733 2024/09/19 $61,980 2024/09/18 $59,935 2024/09/17 $58,450 2024/09/16 $57,854 2024/09/15 $59,930 2024/09/14 $59,928 2024/09/13 $57,925 2024/09/12 $57,885 2024/09/11 $56,520 2024/09/10 $57,238 2024/09/09 $55,324 2024/09/08 $54,004 2024/09/07 $54,011 2024/09/06 $55,986 2024/09/05 $56,598 2024/09/04 $56,619 2024/09/03 $58,500 2024/09/02 $57,847 2024/09/01 $57,861 2024/08/31 $58,515 2024/08/30 $59,244 2024/08/29 $59,182 2024/08/28 $59,247 2024/08/27 $61,993 2024/08/26 $63,457 2024/08/25 $64,225 2024/08/24 $64,224 2024/08/23 $60,560 2024/08/22 $60,606 2024/08/21 $59,268 2024/08/20 $59,837 2024/08/19 $58,568 2024/08/18 $59,207 2024/08/17 $59,232 2024/08/16 $57,841 2024/08/15 $58,607 2024/08/14 $60,679 2024/08/13 $59,275 2024/08/12 $58,503 2024/08/11 $60,639 2024/08/10 $60,615 2024/08/09 $60,635 2024/08/08 $57,330 2024/08/07 $56,498 2024/08/06 $55,219 2024/08/05 $53,887 2024/08/04 $60,683 2024/08/03 $61,268 2024/08/02 $64,261 2024/08/01 $64,264 2024/07/31 $65,642 2024/07/30 $65,642 2024/07/29 $68,695 2024/07/28 $67,203 2024/07/27 $67,999 2024/07/26 $67,242 2024/07/25 $64,241 2024/07/24 $65,672 2024/07/23 $66,470 2024/07/22 $67,201 2024/07/21 $66,424 2024/07/20 $66,466 2024/07/19 $63,372 2024/07/18 $64,212 2024/07/17 $64,950 2024/07/16 $64,239 2024/07/15 $62,758 2024/07/14 $59,953 2024/07/13 $57,881 2024/07/12 $57,213 2024/07/11 $57,892 2024/07/10 $57,899 2024/07/09 $57,226 2024/07/08 $55,854 2024/07/07 $57,243 2024/07/06 $56,607 2024/07/05 $55,815 2024/07/04 $57,929 2024/07/03 $59,860 2024/07/02 $61,995 2024/07/01 $62,765 2024/06/30 $61,322 2024/06/29 $60,618 2024/06/28 $61,362 2024/06/27 $61,330 2024/06/26 $61,331 2024/06/25 $61,331 2024/06/24 $60,503 2024/06/23 $64,227 2024/06/22 $64,220 2024/06/21 $63,430 2024/06/20 $64,928 2024/06/19 $64,952 2024/06/18 $64,893 2024/06/17 $65,656 2024/06/16 $66,529 2024/06/15 $65,657 2024/06/14 $66,411 2024/06/13 $67,242 2024/06/12 $67,134 2024/06/11 $67,284 2024/06/10 $69,635 2024/06/09 $69,682 2024/06/08 $69,697 2024/06/07 $70,314 2024/06/06 $70,351 2024/06/05 $70,365 2024/06/04 $68,847 2024/06/03 $68,790 2024/06/02 $67,199 2024/06/01 $67,222 2024/05/31 $68,015 2024/05/30 $68,018 2024/05/29 $67,211 2024/05/28 $68,018 2024/05/27 $68,827 2024/05/26 $68,787 2024/05/25 $68,784 2024/05/24 $67,188 2024/05/23 $68,709 2024/05/22 $69,595 2024/05/21 $70,348 2024/05/20 $66,397 2024/05/19 $66,439 2024/05/18 $66,435 2024/05/17 $66,489 2024/05/16 $65,698 2024/05/15 $62,127 2024/05/14 $61,291 2024/05/13 $62,771 2024/05/12 $60,579 2024/05/11 $60,606 2024/05/10 $62,792 2024/05/09 $61,343 2024/05/08 $61,996 2024/05/07 $63,479 2024/05/06 $63,437 2024/05/05 $63,454 2024/05/04 $63,478 2024/05/03 $59,307 2024/05/02 $58,619 2024/05/01 $57,278 2024/04/30 $60,725 2024/04/29 $62,769 2024/04/28 $63,479 2024/04/27 $62,750 2024/04/26 $64,246 2024/04/25 $64,261 2024/04/24 $65,575 2024/04/23 $66,520 2024/04/22 $65,637 2024/04/21 $65,010 2024/04/20 $64,278 2024/04/19 $64,308 2024/04/18 $62,605 2024/04/17 $63,588 2024/04/16 $62,814 2024/04/15 $65,576 2024/04/14 $64,292 2024/04/13 $67,302 2024/04/12 $70,487 2024/04/11 $70,450 2024/04/10 $68,892 2024/04/09 $70,294 2024/04/08 $71,122 2024/04/07 $69,666 2024/04/06 $68,045 2024/04/05 $67,190 2024/04/04 $66,533 2024/04/03 $65,667 2024/04/02 $65,752 2024/04/01 $69,649 2024/03/31 $70,431 2024/03/30 $69,570 2024/03/29 $69,558 2024/03/28 $70,434 2024/03/27 $69,500 2024/03/26 $70,425 2024/03/25 $66,357 2024/03/24 $64,875 2024/03/23 $64,135 2024/03/22 $63,575 2024/03/21 $66,406 2024/03/20 $62,643 2024/03/19 $63,609 2024/03/18 $67,161 2024/03/17 $66,534 2024/03/16 $67,922 2024/03/15 $68,064 2024/03/14 $72,958 2024/03/13 $72,908 2024/03/12 $71,166 2024/03/11 $71,131 2024/03/10 $69,649 2024/03/09 $67,982 2024/03/08 $67,259 2024/03/07 $66,412 2024/03/06 $66,395 2024/03/05 $66,347 2024/03/04 $65,063 2024/03/03 $62,051 2024/03/02 $62,033 2024/03/01 $62,043 2024/02/29 $61,964 2024/02/28 $59,358 2024/02/27 $56,595 2024/02/26 $50,935 2024/02/25 $51,605 2024/02/24 $51,006 2024/02/23 $51,010 2024/02/22 $51,608 2024/02/21 $50,960 2024/02/20 $51,576 2024/02/19 $52,196 2024/02/18 $51,595 2024/02/17 $51,592 2024/02/16 $51,572 2024/02/15 $52,195 2024/02/14 $51,621 2024/02/13 $49,888 2024/02/12 $48,195 2024/02/11 $48,156 2024/02/10 $47,028 2024/02/09 $47,003 2024/02/08 $44,954 2024/02/07 $42,924 2024/02/06 $42,908 2024/02/05 $42,399 2024/02/04 $42,945 2024/02/03 $42,915 2024/02/02 $42,909 2024/02/01 $42,449 2024/01/31 $42,934 2024/01/30 $43,424 2024/01/29 $41,899 2024/01/28 $41,917 2024/01/27 $41,433 2024/01/26 $41,371 2024/01/25 $39,559 2024/01/24 $39,555 2024/01/23 $39,151 2024/01/22 $40,469 2024/01/21 $41,435 2024/01/20 $41,461 2024/01/19 $40,938 2024/01/18 $42,457 2024/01/17 $42,380 2024/01/16 $42,923 2024/01/15 $42,407 2024/01/14 $42,389 2024/01/13 $42,926 2024/01/12 $46,034 2024/01/11 $46,558 2024/01/10 $45,412 2024/01/09 $46,485 2024/01/08 $43,977 2024/01/07 $43,933 2024/01/06 $43,947 2024/01/05 $43,352 2024/01/04 $42,819 2024/01/03 $44,844 2024/01/02 $44,888 2024/01/01 $42,335 2023/12/31 $42,442 2023/12/30 $41,950 2023/12/29 $42,480 2023/12/28 $42,948 2023/12/27 $42,950 2023/12/26 $42,473 2023/12/25 $43,456 2023/12/24 $43,376 2023/12/23 $43,356 2023/12/22 $43,345 2023/12/21 $43,356 2023/12/20 $42,970 2023/12/19 $42,367 2023/12/18 $40,917 2023/12/17 $41,962 2023/12/16 $41,893 2023/12/15 $42,374 2023/12/14 $42,920 2023/12/13 $40,933 2023/12/12 $41,412 2023/12/11 $41,978 2023/12/10 $43,948 2023/12/09 $43,923 2023/12/08 $43,429 2023/12/07 $43,386 2023/12/06 $43,921 2023/12/05 $41,413 2023/12/04 $41,423 2023/12/03 $39,591 2023/12/02 $38,709 2023/12/01 $38,217 2023/11/30 $37,827 2023/11/29 $37,799 2023/11/28 $36,917 2023/11/27 $36,943 2023/11/26 $37,373 2023/11/25 $37,817 2023/11/24 $37,360 2023/11/23 $37,377 2023/11/22 $36,547 2023/11/21 $36,919 2023/11/20 $36,929 2023/11/19 $36,545 2023/11/18 $36,532 2023/11/17 $36,092 2023/11/16 $36,915 2023/11/15 $35,722 2023/11/14 $36,554 2023/11/13 $37,328 2023/11/12 $37,377 2023/11/11 $37,366 2023/11/10 $37,374 2023/11/09 $36,925 2023/11/08 $35,674 2023/11/07 $35,259 2023/11/06 $35,283 2023/11/05 $35,294 2023/11/04 $35,229 2023/11/03 $34,866 2023/11/02 $35,293 2023/11/01 $34,849 2023/10/31 $34,829 2023/10/30 $34,840 2023/10/29 $34,841 2023/10/28 $34,438 2023/10/27 $34,114 2023/10/26 $34,484 2023/10/25 $34,858 2023/10/24 $34,468 2023/10/23 $31,069 2023/10/22 $30,333 2023/10/21 $30,034 2023/10/20 $29,704 2023/10/19 $28,690 2023/10/18 $28,658 2023/10/17 $28,664 2023/10/16 $28,357 2023/10/15 $27,093 2023/10/14 $27,077 2023/10/13 $27,058 2023/10/12 $27,045 2023/10/11 $27,373 2023/10/10 $27,708 2023/10/09 $28,000 2023/10/08 $28,308 2023/10/07 $28,311 2023/10/06 $28,021 2023/10/05 $27,725 2023/10/04 $27,712 2023/10/03 $27,696 2023/10/02 $28,345 2023/10/01 $27,364 2023/09/30 $27,108 2023/09/29 $27,097 2023/09/28 $27,083 2023/09/27 $26,456 2023/09/26 $26,444 2023/09/25 $26,448 2023/09/24 $26,760 2023/09/23 $26,768 2023/09/22 $26,778 2023/09/21 $27,055 2023/09/20 $27,367 2023/09/19 $27,374 2023/09/18 $27,064 2023/09/17 $26,746 2023/09/16 $26,758 2023/09/15 $26,744 2023/09/14 $26,755 2023/09/13 $26,428 2023/09/12 $26,164 2023/09/11 $25,860 2023/09/10 $26,115 2023/09/09 $26,124 2023/09/08 $26,141 2023/09/07 $25,886 2023/09/06 $25,865 2023/09/05 $25,877 2023/09/04 $26,131 2023/09/03 $26,135 2023/09/02 $26,120 2023/09/01 $26,149 2023/08/31 $27,393 2023/08/30 $27,667 2023/08/29 $26,179 2023/08/28 $26,179 2023/08/27 $26,196 2023/08/26 $26,184 2023/08/25 $26,181 2023/08/24 $26,463 2023/08/23 $26,448 2023/08/22 $26,162 2023/08/21 $26,193 2023/08/20 $26,421 2023/08/19 $26,171 2023/08/18 $26,460 2023/08/17 $28,684 2023/08/16 $29,339 2023/08/15 $29,644 2023/08/14 $29,665 2023/08/13 $29,657 2023/08/12 $29,661 2023/08/11 $29,660 2023/08/10 $29,687 2023/08/09 $29,999 2023/08/08 $29,673 2023/08/07 $29,322 2023/08/06 $29,315 2023/08/05 $29,316 2023/08/04 $29,354 2023/08/03 $29,360 2023/08/02 $29,671 2023/08/01 $29,328 2023/07/31 $29,641 2023/07/30 $29,643 2023/07/29 $29,649 2023/07/28 $29,637 2023/07/27 $29,655 2023/07/26 $29,640 2023/07/25 $29,364 2023/07/24 $29,351 2023/07/23 $30,330 2023/07/22 $30,061 2023/07/21 $30,046 2023/07/20 $30,354 2023/07/19 $30,335 2023/07/18 $30,054 2023/07/17 $30,387 2023/07/16 $30,683 2023/07/15 $30,686 2023/07/14 $31,453 2023/07/13 $30,736 2023/07/12 $30,749 2023/07/11 $30,731 2023/07/10 $30,399 2023/07/09 $30,417 2023/07/08 $30,402 2023/07/07 $30,395 2023/07/06 $30,709 2023/07/05 $30,739 2023/07/04 $31,399 2023/07/03 $31,088 2023/07/02 $30,742 2023/07/01 $30,737 2023/06/30 $30,734 2023/06/29 $30,718 2023/06/28 $30,410 2023/06/27 $30,748 2023/06/26 $30,415 2023/06/25 $30,763 2023/06/24 $30,771 2023/06/23 $30,361 2023/06/22 $30,363 2023/06/21 $30,360 2023/06/20 $27,071 2023/06/19 $26,751 2023/06/18 $26,745 2023/06/17 $26,735 2023/06/16 $25,829 2023/06/15 $25,268 2023/06/14 $26,148 2023/06/13 $26,159 2023/06/12 $26,127 2023/06/11 $26,130 2023/06/10 $25,860 2023/06/09 $26,746 2023/06/08 $26,738 2023/06/07 $26,764 2023/06/06 $25,873 2023/06/05 $27,071 2023/06/04 $27,385 2023/06/03 $27,377 2023/06/02 $27,363 2023/06/01 $27,087 2023/05/31 $27,364 2023/05/30 $28,011 2023/05/29 $28,029 2023/05/28 $27,395 2023/05/27 $27,028 2023/05/26 $26,770 2023/05/25 $26,475 2023/05/24 $26,758 2023/05/23 $27,406 2023/05/22 $27,059 2023/05/21 $27,100 2023/05/20 $27,095 2023/05/19 $27,068 2023/05/18 $27,397 2023/05/17 $27,371 2023/05/16 $27,355 2023/05/15 $27,670 2023/05/14 $27,076 2023/05/13 $27,052 2023/05/12 $26,746 2023/05/11 $27,401 2023/05/10 $28,006 2023/05/09 $27,987 2023/05/08 $28,330 2023/05/07 $29,300 2023/05/06 $29,352 2023/05/05 $29,665 2023/05/04 $29,046 2023/05/03 $28,687 2023/05/02 $28,677 2023/05/01 $28,680 2023/04/30 $29,660 2023/04/29 $29,647 2023/04/28 $29,653 2023/04/27 $29,334 2023/04/26 $30,011 2023/04/25 $27,685 2023/04/24 $27,693 2023/04/23 $27,732 2023/04/22 $27,695 2023/04/21 $28,343 2023/04/20 $29,003 2023/04/19 $29,647 2023/04/18 $30,386 2023/04/17 $30,011 2023/04/16 $30,688 2023/04/15 $30,696 2023/04/14 $30,744 2023/04/13 $30,402 2023/04/12 $30,352 2023/04/11 $30,371 2023/04/10 $28,647 2023/04/09 $28,327 2023/04/08 $28,322 2023/04/07 $28,308 2023/04/06 $28,321 2023/04/05 $28,664 2023/04/04 $28,345 2023/04/03 $28,339 2023/04/02 $28,380 2023/04/01 $28,668 2023/03/31 $28,650 2023/03/30 $28,673 2023/03/29 $28,647 2023/03/28 $27,356 2023/03/27 $28,026 2023/03/26 $28,011 2023/03/25 $27,708 2023/03/24 $28,339 2023/03/23 $28,013 2023/03/22 $28,655 2023/03/21 $28,332 2023/03/20 $28,332 2023/03/19 $27,390 2023/03/18 $27,682 2023/03/17 $26,765 2023/03/16 $24,987 2023/03/15 $24,974 2023/03/14 $24,689 2023/03/13 $24,395 2023/03/12 $20,763 2023/03/11 $20,534 2023/03/10 $20,080 2023/03/09 $21,776 2023/03/08 $22,253 2023/03/07 $22,517 2023/03/06 $22,543 2023/03/05 $22,542 2023/03/04 $22,507 2023/03/03 $22,517 2023/03/02 $23,583 2023/03/01 $23,849 2023/02/28 $23,576 2023/02/27 $23,583 2023/02/26 $23,551 2023/02/25 $23,286 2023/02/24 $24,112 2023/02/23 $24,135 2023/02/22 $24,134 2023/02/21 $24,970 2023/02/20 $24,980 2023/02/19 $24,955 2023/02/18 $24,947 2023/02/17 $24,107 2023/02/16 $24,960 2023/02/15 $23,021 2023/02/14 $22,005 2023/02/13 $21,776 2023/02/12 $22,012 2023/02/11 $21,968 2023/02/10 $21,986 2023/02/09 $22,793 2023/02/08 $23,303 2023/02/07 $23,067 2023/02/06 $23,055 2023/02/05 $23,322 2023/02/04 $23,575 2023/02/03 $23,600 2023/02/02 $24,098 2023/02/01 $23,289 2023/01/31 $23,065 2023/01/30 $23,314 2023/01/29 $23,841 2023/01/28 $23,280 2023/01/27 $23,285 2023/01/26 $23,289 2023/01/25 $22,788 2023/01/24 $23,067 2023/01/23 $23,034 2023/01/22 $23,030 2023/01/21 $23,302 2023/01/20 $21,258 2023/01/19 $21,011 2023/01/18 $21,276 2023/01/17 $21,286 2023/01/16 $21,255 2023/01/15 $20,999 2023/01/14 $21,014 2023/01/13 $19,155 2023/01/12 $18,302 2023/01/11 $17,503 2023/01/10 $17,464 2023/01/09 $17,302 2023/01/08 $17,069 2023/01/07 $17,067 2023/01/06 $16,898 2023/01/05 $16,899 2023/01/04 $16,896 2023/01/03 $16,872 2023/01/02 $16,873 2023/01/01 $16,688 2022/12/31 $16,688 2022/12/30 $16,686 2022/12/29 $16,700 2022/12/28 $16,868 2022/12/27 $16,895 2022/12/26 $16,903 2022/12/25 $16,894 2022/12/24 $16,899 2022/12/23 $16,897 2022/12/22 $16,892 2022/12/21 $16,899 2022/12/20 $16,896 2022/12/19 $16,873 2022/12/18 $16,881 2022/12/17 $16,880 2022/12/16 $17,075 2022/12/15 $17,684 2022/12/14 $18,074 2022/12/13 $17,885 2022/12/12 $17,093 2022/12/11 $17,277 2022/12/10 $17,281 2022/12/09 $17,288 2022/12/08 $17,064 2022/12/07 $16,903 2022/12/06 $17,093 2022/12/05 $17,282 2022/12/04 $17,099 2022/12/03 $17,087 2022/12/02 $17,082 2022/12/01 $17,100 2022/11/30 $17,069 2022/11/29 $16,518 2022/11/28 $16,313 2022/11/27 $16,683 2022/11/26 $16,690 2022/11/25 $16,678 2022/11/24 $16,697 2022/11/23 $16,675 2022/11/22 $16,134 2022/11/21 $16,136 2022/11/20 $16,700 2022/11/19 $16,869 2022/11/18 $16,882 2022/11/17 $16,705 2022/11/16 $16,877 2022/11/15 $16,896 2022/11/14 $16,697 2022/11/13 $16,698 2022/11/12 $16,903 2022/11/11 $17,075 2022/11/10 $17,676 2022/11/09 $18,508 2022/11/08 $19,847 2022/11/07 $20,996 2022/11/06 $21,475 2022/11/05 $21,499 2022/11/04 $21,015 2022/11/03 $20,322 2022/11/02 $20,552 2022/11/01 $20,745 2022/10/31 $20,556 2022/10/30 $20,984 2022/10/29 $21,000 2022/10/28 $20,543 2022/10/27 $20,778 2022/10/26 $20,792 2022/10/25 $19,594 2022/10/24 $19,590 2022/10/23 $19,390 2022/10/22 $19,372 2022/10/21 $19,180 2022/10/20 $19,364 2022/10/19 $19,378 2022/10/18 $19,619 2022/10/17 $19,617 2022/10/16 $19,376 2022/10/15 $19,362 2022/10/14 $19,836 2022/10/13 $19,377 2022/10/12 $19,195 2022/10/11 $19,181 2022/10/10 $19,404 2022/10/09 $19,611 2022/10/08 $19,623 2022/10/07 $20,069 2022/10/06 $20,296 2022/10/05 $20,295 2022/10/04 $20,081 2022/10/03 $19,608 2022/10/02 $19,386 2022/10/01 $19,411 2022/09/30 $19,622 2022/09/29 $19,603 2022/09/28 $19,622 2022/09/27 $20,298 2022/09/26 $19,176 2022/09/25 $19,156 2022/09/24 $19,183 2022/09/23 $19,387 2022/09/22 $19,375 2022/09/21 $19,172 2022/09/20 $19,383 2022/09/19 $19,610 2022/09/18 $20,066 2022/09/17 $20,076 2022/09/16 $19,851 2022/09/15 $20,075 2022/09/14 $20,317 2022/09/13 $22,510 2022/09/12 $22,500 2022/09/11 $21,761 2022/09/10 $21,507 2022/09/09 $21,277 2022/09/08 $19,392 2022/09/07 $18,959 2022/09/06 $20,066 2022/09/05 $20,053 2022/09/04 $20,055 2022/09/03 $20,060 2022/09/02 $20,289 2022/09/01 $20,077 2022/08/31 $20,309 2022/08/30 $20,307 2022/08/29 $20,298 2022/08/28 $20,089 2022/08/27 $20,295 2022/08/26 $21,743 2022/08/25 $21,759 2022/08/24 $21,743 2022/08/23 $21,530 2022/08/22 $21,490 2022/08/21 $21,517 2022/08/20 $21,281 2022/08/19 $21,733 2022/08/18 $23,582 2022/08/17 $23,850 2022/08/16 $24,131 2022/08/15 $24,388 2022/08/14 $24,689 2022/08/13 $24,694 2022/08/12 $24,137 2022/08/11 $24,679 2022/08/10 $24,122 2022/08/09 $23,318 2022/08/08 $24,128 2022/08/07 $23,304 2022/08/06 $23,329 2022/08/05 $23,303 2022/08/04 $23,045 2022/08/03 $23,563 2022/08/02 $23,057 2022/08/01 $23,327 2022/07/31 $23,878 2022/07/30 $24,108 2022/07/29 $24,111 2022/07/28 $23,291 2022/07/27 $21,501 2022/07/26 $21,240 2022/07/25 $22,026 2022/07/24 $22,798 2022/07/23 $22,511 2022/07/22 $23,313 2022/07/21 $23,054 2022/07/20 $23,843 2022/07/19 $23,570 2022/07/18 $22,270 2022/07/17 $21,485 2022/07/16 $21,002 2022/07/15 $21,012 2022/07/14 $20,299 2022/07/13 $19,837 2022/07/12 $20,060 2022/07/11 $20,559 2022/07/10 $21,264 2022/07/09 $21,764 2022/07/08 $21,991 2022/07/07 $20,552 2022/07/06 $20,305 2022/07/05 $20,306 2022/07/04 $19,847 2022/07/03 $19,370 2022/07/02 $19,387 2022/07/01 $19,598 2022/06/30 $19,172 2022/06/29 $20,291 2022/06/28 $21,008 2022/06/27 $21,013 2022/06/26 $21,509 2022/06/25 $21,487 2022/06/24 $21,261 2022/06/23 $20,544 2022/06/22 $20,533 2022/06/21 $21,496 2022/06/20 $20,544 2022/06/19 $19,616 2022/06/18 $19,374 2022/06/17 $20,767 2022/06/16 $21,255 2022/06/15 $21,752 2022/06/14 $22,523 2022/06/13 $23,582 2022/06/12 $27,701 2022/06/11 $28,996 2022/06/10 $30,044 2022/06/09 $30,388 2022/06/08 $30,695 2022/06/07 $30,007 2022/06/06 $31,478 2022/06/05 $30,029 2022/06/04 $29,990 2022/06/03 $29,999 2022/06/02 $30,367 2022/06/01 $31,811 2022/05/31 $31,836 2022/05/30 $30,750 2022/05/29 $29,350 2022/05/28 $29,032 2022/05/27 $29,028 2022/05/26 $29,696 2022/05/25 $30,002 2022/05/24 $29,648 2022/05/23 $30,398 2022/05/22 $30,046 2022/05/21 $29,653 2022/05/20 $30,389 2022/05/19 $30,368 2022/05/18 $29,678 2022/05/17 $30,393 2022/05/16 $30,023 2022/05/15 $30,353 2022/05/14 $29,680 2022/05/13 $30,714 2022/05/12 $28,681 2022/05/11 $31,448 2022/05/10 $31,797 2022/05/09 $33,696 2022/05/08 $34,856 2022/05/07 $36,125 2022/05/06 $36,497 2022/05/05 $40,015 2022/05/04 $39,149 2022/05/03 $38,685 2022/05/02 $39,093 2022/05/01 $38,264 2022/04/30 $38,716 2022/04/29 $39,582 2022/04/28 $40,032 2022/04/27 $39,151 2022/04/26 $40,548 2022/04/25 $39,573 2022/04/24 $40,027 2022/04/23 $40,043 2022/04/22 $40,531 2022/04/21 $41,939 2022/04/20 $41,893 2022/04/19 $41,449 2022/04/18 $40,035 2022/04/17 $40,543 2022/04/16 $40,551 2022/04/15 $40,525 2022/04/14 $41,458 2022/04/13 $41,445 2022/04/12 $40,476 2022/04/11 $41,433 2022/04/10 $43,361 2022/04/09 $42,868 2022/04/08 $43,898 2022/04/07 $43,877 2022/04/06 $45,472 2022/04/05 $46,533 2022/04/04 $46,486 2022/04/03 $46,988 2022/04/02 $46,994 2022/04/01 $46,527 2022/03/31 $47,572 2022/03/30 $47,595 2022/03/29 $48,095 2022/03/28 $47,622 2022/03/27 $44,972 2022/03/26 $44,879 2022/03/25 $44,458 2022/03/24 $43,916 2022/03/23 $42,463 2022/03/22 $42,920 2022/03/21 $41,449 2022/03/20 $41,926 2022/03/19 $42,362 2022/03/18 $40,958 2022/03/17 $41,029 2022/03/16 $40,965 2022/03/15 $39,571 2022/03/14 $39,136 2022/03/13 $39,160 2022/03/12 $39,538 2022/03/11 $39,144 2022/03/10 $39,574 2022/03/09 $42,398 2022/03/08 $39,099 2022/03/07 $38,671 2022/03/06 $39,565 2022/03/05 $39,568 2022/03/04 $41,481 2022/03/03 $43,900 2022/03/02 $44,413 2022/03/01 $43,905 2022/02/28 $38,658 2022/02/27 $39,148 2022/02/26 $39,574 2022/02/25 $39,132 2022/02/24 $36,093 2022/02/23 $39,113 2022/02/22 $38,210 2022/02/21 $39,145 2022/02/20 $38,672 2022/02/19 $40,477 2022/02/18 $40,957 2022/02/17 $43,920 2022/02/16 $44,414 2022/02/15 $44,422 2022/02/14 $42,870 2022/02/13 $42,860 2022/02/12 $42,875 2022/02/11 $43,879 2022/02/10 $44,927 2022/02/09 $44,416 2022/02/08 $44,394 2022/02/07 $43,922 2022/02/06 $41,925 2022/02/05 $41,904 2022/02/04 $38,231 2022/02/03 $37,334 2022/02/02 $38,706 2022/02/01 $39,096 2022/01/31 $38,685 2022/01/30 $38,247 2022/01/29 $38,223 2022/01/28 $37,372 2022/01/27 $36,937 2022/01/26 $38,232 2022/01/25 $36,934 2022/01/24 $36,507 2022/01/23 $35,689 2022/01/22 $35,694 2022/01/21 $39,113 2022/01/20 $42,405 2022/01/19 $42,406 2022/01/18 $42,403 2022/01/17 $42,917 2022/01/16 $43,421 2022/01/15 $43,431 2022/01/14 $43,388 2022/01/13 $43,934 2022/01/12 $43,929 2022/01/11 $42,901 2022/01/10 $41,961 2022/01/09 $42,401 2022/01/08 $42,376 2022/01/07 $42,406 2022/01/06 $43,418 2022/01/05 $46,552 2022/01/04 $47,016 2022/01/03 $47,556 2022/01/02 $47,604 2022/01/01 $47,596 2021/12/31 $48,146 2021/12/30 $47,603 2021/12/29 $48,123 2021/12/28 $49,824 2021/12/27 $51,574 2021/12/26 $50,442 2021/12/25 $51,526 2021/12/24 $51,550 2021/12/23 $49,218 2021/12/22 $49,797 2021/12/21 $49,236 2021/12/20 $47,028 2021/12/19 $47,591 2021/12/18 $47,064 2021/12/17 $47,595 2021/12/16 $49,259 2021/12/15 $48,696 2021/12/14 $47,575 2021/12/13 $49,257 2021/12/12 $50,401 2021/12/11 $49,224 2021/12/10 $48,684 2021/12/09 $49,837 2021/12/08 $50,961 2021/12/07 $51,562 2021/12/06 $49,287 2021/12/05 $49,818 2021/12/04 $49,259 2021/12/03 $57,194 2021/12/02 $57,218 2021/12/01 $57,847 2021/11/30 $57,889 2021/11/29 $58,530 2021/11/28 $55,231 2021/11/27 $55,273 2021/11/26 $54,685 2021/11/25 $59,239 2021/11/24 $57,220 2021/11/23 $57,853 2021/11/22 $57,902 2021/11/21 $59,881 2021/11/20 $59,230 2021/11/19 $57,918 2021/11/18 $59,928 2021/11/17 $60,606 2021/11/16 $61,280 2021/11/15 $66,412 2021/11/14 $64,947 2021/11/13 $64,907 2021/11/12 $64,929 2021/11/11 $65,641 2021/11/10 $68,009 2021/11/09 $68,022 2021/11/08 $66,464 2021/11/07 $62,736 2021/11/06 $61,341 2021/11/05 $62,017 2021/11/04 $62,734 2021/11/03 $63,459 2021/11/02 $63,518 2021/11/01 $62,018 2021/10/31 $62,003 2021/10/30 $62,045 2021/10/29 $62,739 2021/10/28 $61,345 2021/10/27 $59,280 2021/10/26 $62,786 2021/10/25 $63,451 2021/10/24 $61,309 2021/10/23 $61,959 2021/10/22 $63,475 2021/10/21 $65,692 2021/10/20 $66,484 2021/10/19 $63,432 2021/10/18 $62,682 2021/10/17 $61,325 2021/10/16 $61,990 2021/10/15 $59,918 2021/10/14 $57,920 2021/10/13 $57,225 2021/10/12 $57,257 2021/10/11 $57,834 2021/10/10 $55,875 2021/10/09 $55,279 2021/10/08 $54,673 2021/10/07 $54,661 2021/10/06 $51,627 2021/10/05 $50,401 2021/10/04 $48,686 2021/10/03 $48,674 2021/10/02 $48,167 2021/10/01 $48,127 2021/09/30 $43,874 2021/09/29 $42,423 2021/09/28 $42,396 2021/09/27 $43,907 2021/09/26 $43,441 2021/09/25 $42,919 2021/09/24 $42,894 2021/09/23 $44,419 2021/09/22 $43,421 2021/09/21 $43,396 2021/09/20 $44,376 2021/09/19 $48,146 2021/09/18 $48,710 2021/09/17 $48,120 2021/09/16 $48,171 2021/09/15 $48,163 2021/09/14 $47,021 2021/09/13 $44,961 2021/09/12 $46,008 2021/09/11 $45,946 2021/09/10 $46,510 2021/09/09 $47,032 2021/09/08 $47,005 2021/09/07 $47,559 2021/09/06 $52,160 2021/09/05 $50,442 2021/09/04 $50,432 2021/09/03 $50,438 2021/09/02 $50,374 2021/09/01 $48,137 2021/08/31 $47,616 2021/08/30 $48,678 2021/08/29 $49,242 2021/08/28 $49,276 2021/08/27 $48,689 2021/08/26 $47,560 2021/08/25 $49,231 2021/08/24 $49,817 2021/08/23 $50,407 2021/08/22 $49,277 2021/08/21 $49,811 2021/08/20 $49,232 2021/08/19 $45,456 2021/08/18 $45,466 2021/08/17 $46,507 2021/08/16 $47,606 2021/08/15 $47,054 2021/08/14 $47,596 2021/08/13 $46,995 2021/08/12 $45,461 2021/08/11 $46,525 2021/08/10 $45,975 2021/08/09 $46,020 2021/08/08 $44,917 2021/08/07 $43,908 2021/08/06 $40,990 2021/08/05 $39,588 2021/08/04 $40,016 2021/08/03 $38,691 2021/08/02 $40,030 2021/08/01 $41,930 2021/07/31 $41,938 2021/07/30 $40,051 2021/07/29 $40,067 2021/07/28 $40,065 2021/07/27 $38,243 2021/07/26 $38,689 2021/07/25 $34,846 2021/07/24 $34,089 2021/07/23 $32,895 2021/07/22 $32,528 2021/07/21 $32,164 2021/07/20 $30,011 2021/07/19 $31,456 2021/07/18 $32,159 2021/07/17 $31,817 2021/07/16 $32,164 2021/07/15 $32,159 2021/07/14 $32,939 2021/07/13 $33,294 2021/07/12 $33,689 2021/07/11 $34,082 2021/07/10 $34,064 2021/07/09 $33,687 2021/07/08 $33,296 2021/07/07 $34,886 2021/07/06 $34,452 2021/07/05 $34,468 2021/07/04 $35,702 2021/07/03 $34,866 2021/07/02 $33,687 2021/07/01 $33,699 2021/06/30 $35,259 2021/06/29 $36,516 2021/06/28 $34,853 2021/06/27 $33,309 2021/06/26 $31,816 2021/06/25 $33,306 2021/06/24 $34,886 2021/06/23 $34,094 2021/06/22 $32,920 2021/06/21 $32,924 2021/06/20 $35,715 2021/06/19 $36,108 2021/06/18 $37,827 2021/06/17 $39,127 2021/06/16 $40,050 2021/06/15 $40,510 2021/06/14 $40,490 2021/06/13 $36,100 2021/06/12 $36,091 2021/06/11 $37,377 2021/06/10 $37,350 2021/06/09 $36,927 2021/06/08 $33,683 2021/06/07 $36,524 2021/06/06 $36,488 2021/06/05 $36,493 2021/06/04 $37,355 2021/06/03 $39,115 2021/06/02 $37,822 2021/06/01 $36,935 2021/05/31 $37,332 2021/05/30 $36,109 2021/05/29 $36,512 2021/05/28 $36,952 2021/05/27 $39,573 2021/05/26 $39,575 2021/05/25 $38,671 2021/05/24 $38,228 2021/05/23 $33,692 2021/05/22 $38,247 2021/05/21 $41,436 2021/05/20 $40,495 2021/05/19 $40,035 2021/05/18 $45,452 2021/05/17 $44,940 2021/05/16 $49,274 2021/05/15 $49,824 2021/05/14 $50,976 2021/05/13 $50,419 2021/05/12 $57,247 2021/05/11 $56,563 2021/05/10 $58,560 2021/05/09 $58,554 2021/05/08 $59,235 2021/05/07 $57,871 2021/05/06 $57,835 2021/05/05 $57,826 2021/05/04 $55,952 2021/05/03 $58,542 2021/05/02 $57,234 2021/05/01 $58,479 2021/04/30 $54,671 2021/04/29 $54,650 2021/04/28 $55,272 2021/04/27 $55,279 2021/04/26 $54,016 2021/04/25 $50,415 2021/04/24 $50,971 2021/04/23 $50,421 2021/04/22 $55,249 2021/04/21 $56,532 2021/04/20 $56,562 2021/04/19 $57,218 2021/04/18 $56,540 2021/04/17 $62,048 2021/04/16 $62,723 2021/04/15 $63,465 2021/04/14 $64,206 2021/04/13 $63,463 2021/04/12 $60,599 2021/04/11 $60,558 2021/04/10 $60,632 2021/04/09 $58,583 2021/04/08 $57,894 2021/04/07 $57,890 2021/04/06 $59,201 2021/04/05 $59,224 2021/04/04 $58,527 2021/04/03 $59,871 2021/04/02 $59,898 2021/04/01 $59,261 2021/03/31 $59,252 2021/03/30 $59,220 2021/03/29 $58,490 2021/03/28 $56,533 2021/03/27 $55,920 2021/03/26 $54,012 2021/03/25 $52,790 2021/03/24 $56,562 2021/03/23 $55,294 2021/03/22 $57,860 2021/03/21 $57,897 2021/03/20 $59,249 2021/03/19 $59,206 2021/03/18 $59,235 2021/03/17 $56,546 2021/03/16 $55,940 2021/03/15 $57,186 2021/03/14 $61,302 2021/03/13 $60,585 2021/03/12 $57,836 2021/03/11 $57,218 2021/03/10 $56,580 2021/03/09 $54,624 2021/03/08 $51,575 2021/03/07 $50,981 2021/03/06 $48,736 2021/03/05 $48,148 2021/03/04 $49,839 2021/03/03 $51,583 2021/03/02 $49,265 2021/03/01 $49,239 2021/02/28 $45,447 2021/02/27 $47,602 2021/02/26 $47,587 2021/02/25 $50,977 2021/02/24 $50,424 2021/02/23 $48,698 2021/02/22 $54,637 2021/02/21 $57,880 2021/02/20 $57,224 2021/02/19 $52,812 2021/02/18 $52,223 2021/02/17 $51,581 2021/02/16 $49,279 2021/02/15 $48,704 2021/02/14 $49,257 2021/02/13 $47,603 2021/02/12 $48,125 2021/02/11 $48,132 2021/02/10 $46,536 2021/02/09 $47,062 2021/02/08 $43,907 2021/02/07 $39,122 2021/02/06 $40,509 2021/02/05 $38,219 2021/02/04 $37,817 2021/02/03 $36,961 2021/02/02 $35,273 2021/02/01 $34,070 2021/01/31 $33,707 2021/01/30 $34,481 2021/01/29 $34,876 2021/01/28 $32,174 2021/01/27 $31,445 2021/01/26 $32,534 2021/01/25 $33,683 2021/01/24 $32,553 2021/01/23 $32,922 2021/01/22 $32,559 2021/01/21 $32,547 2021/01/20 $35,682 2021/01/19 $37,367 2021/01/18 $36,510 2021/01/17 $36,509 2021/01/16 $37,381 2021/01/15 $38,688 2021/01/14 $39,603 2021/01/13 $34,882 2021/01/12 $35,276 2021/01/11 $35,283 2021/01/10 $40,966 2021/01/09 $40,971 2021/01/08 $41,448 2021/01/07 $37,797 2021/01/06 $35,271 2021/01/05 $32,549 2021/01/04 $31,802 2021/01/03 $34,074 2021/01/02 $30,026 2021/01/01 $29,666 2020/12/31 $29,329 2020/12/30 $28,349 2020/12/29 $27,067 2020/12/28 $27,368 2020/12/27 $27,390 2020/12/26 $25,260 2020/12/25 $24,406 2020/12/24 $23,569 2020/12/23 $23,844 2020/12/22 $23,569 2020/12/21 $23,853 2020/12/20 $23,856 2020/12/19 $23,856 2020/12/18 $23,049 2020/12/17 $23,308 2020/12/16 $19,841 2020/12/15 $19,601 2020/12/14 $19,374 2020/12/13 $19,386 2020/12/12 $18,726 2020/12/11 $18,101 2020/12/10 $18,509 2020/12/09 $18,507 2020/12/08 $19,170 2020/12/07 $19,383 2020/12/06 $19,374 2020/12/05 $19,177 2020/12/04 $19,392 2020/12/03 $19,596 2020/12/02 $19,173 2020/12/01 $19,607 2020/11/30 $19,395 2020/11/29 $18,291 2020/11/28 $17,684 2020/11/27 $17,083 2020/11/26 $17,280 2020/11/25 $19,381 2020/11/24 $19,382 2020/11/23 $18,720 2020/11/22 $18,720 2020/11/21 $18,934 2020/11/20 $18,730 2020/11/19 $18,093 2020/11/18 $18,096 2020/11/17 $17,080 2020/11/16 $16,701 2020/11/15 $16,129 2020/11/14 $16,309 2020/11/13 $16,488 2020/11/12 $16,130 2020/11/11 $15,765 2020/11/10 $15,565 2020/11/09 $15,575 2020/11/08 $15,409 2020/11/07 $15,591 2020/11/06 $15,751 2020/11/05 $15,222 2020/11/04 $14,047 2020/11/03 $13,731 2020/11/02 $13,729 2020/11/01 $13,886 2020/10/31 $13,893 2020/10/30 $13,575 2020/10/29 $13,569 2020/10/28 $13,405 2020/10/27 $13,726 2020/10/26 $13,254 2020/10/25 $13,113 2020/10/24 $13,251 2020/10/23 $13,099 2020/10/22 $13,108 2020/10/21 $12,816 2020/10/20 $11,959 2020/10/19 $11,812 2020/10/18 $11,542 2020/10/17 $11,422 2020/10/16 $11,422 2020/10/15 $11,543 2020/10/14 $11,540 2020/10/13 $11,547 2020/10/12 $11,552 2020/10/11 $11,538 2020/10/10 $11,426 2020/10/09 $11,153 2020/10/08 $10,911 2020/10/07 $10,768 2020/10/06 $10,784 2020/10/05 $10,781 2020/10/04 $10,766 2020/10/03 $10,649 2020/10/02 $10,650 2020/10/01 $10,908 2020/09/30 $10,893 2020/09/29 $10,896 2020/09/28 $11,020 2020/09/27 $10,785 2020/09/26 $10,786 2020/09/25 $10,774 2020/09/24 $10,655 2020/09/23 $10,540 2020/09/22 $10,646 2020/09/21 $10,904 2020/09/20 $11,027 2020/09/19 $11,153 2020/09/18 $11,028 2020/09/17 $11,021 2020/09/16 $11,032 2020/09/15 $10,900 2020/09/14 $10,768 2020/09/13 $10,535 2020/09/12 $10,523 2020/09/11 $10,408 2020/09/10 $10,414 2020/09/09 $10,297 2020/09/08 $10,291 2020/09/07 $10,285 2020/09/06 $10,294 2020/09/05 $10,414 2020/09/04 $10,535 2020/09/03 $11,419 2020/09/02 $11,541 2020/09/01 $12,081 2020/08/31 $11,809 2020/08/30 $11,692 2020/08/29 $11,671 2020/08/28 $11,550 2020/08/27 $11,541 2020/08/26 $11,545 2020/08/25 $11,685 2020/08/24 $11,827 2020/08/23 $11,805 2020/08/22 $11,685 2020/08/21 $11,948 2020/08/20 $11,948 2020/08/19 $11,951 2020/08/18 $12,372 2020/08/17 $11,958 2020/08/16 $11,951 2020/08/15 $11,956 2020/08/14 $11,823 2020/08/13 $11,677 2020/08/12 $11,672 2020/08/11 $11,818 2020/08/10 $12,083 2020/08/09 $11,808 2020/08/08 $11,816 2020/08/07 $11,825 2020/08/06 $11,948 2020/08/05 $11,690 2020/08/04 $11,407 2020/08/03 $11,417 2020/08/02 $11,285 2020/08/01 $11,810 2020/07/31 $11,288 2020/07/30 $11,157 2020/07/29 $11,279 2020/07/28 $11,154 2020/07/27 $10,404 2020/07/26 $9,949 -

Scroll forward !

accelerate

How to accelerate

I prefer real things over artificial things

Extreme lightness

-

No regrets only new decision making processes

A new vision of power

Power > Aesthetics

-

BTC COWBOYS

Where to park your capital

Just follow & trust your gut,,, gut timing.

-

Harness volatility to your favor !!

Harness lighting !

Thor

-

Working capital

Funding , self funding

Lighter.

Stupid light

Never stop shedding weight

SHREDDER.

How to get shredded.

-

International

Experiencing different physical spaces

Oasis

International

Capitalism is great !

I love women!

How does a network become stronger and more powerful ?

How to become more powerful

How to become more digitally powerful?

Digital power

Transmute.

Physical power –> Digital power

Storage.

Becoming more like a big kid ,,, more childish

Present Capital vs future capital

How can you leverage your current present capital to your benefit ?

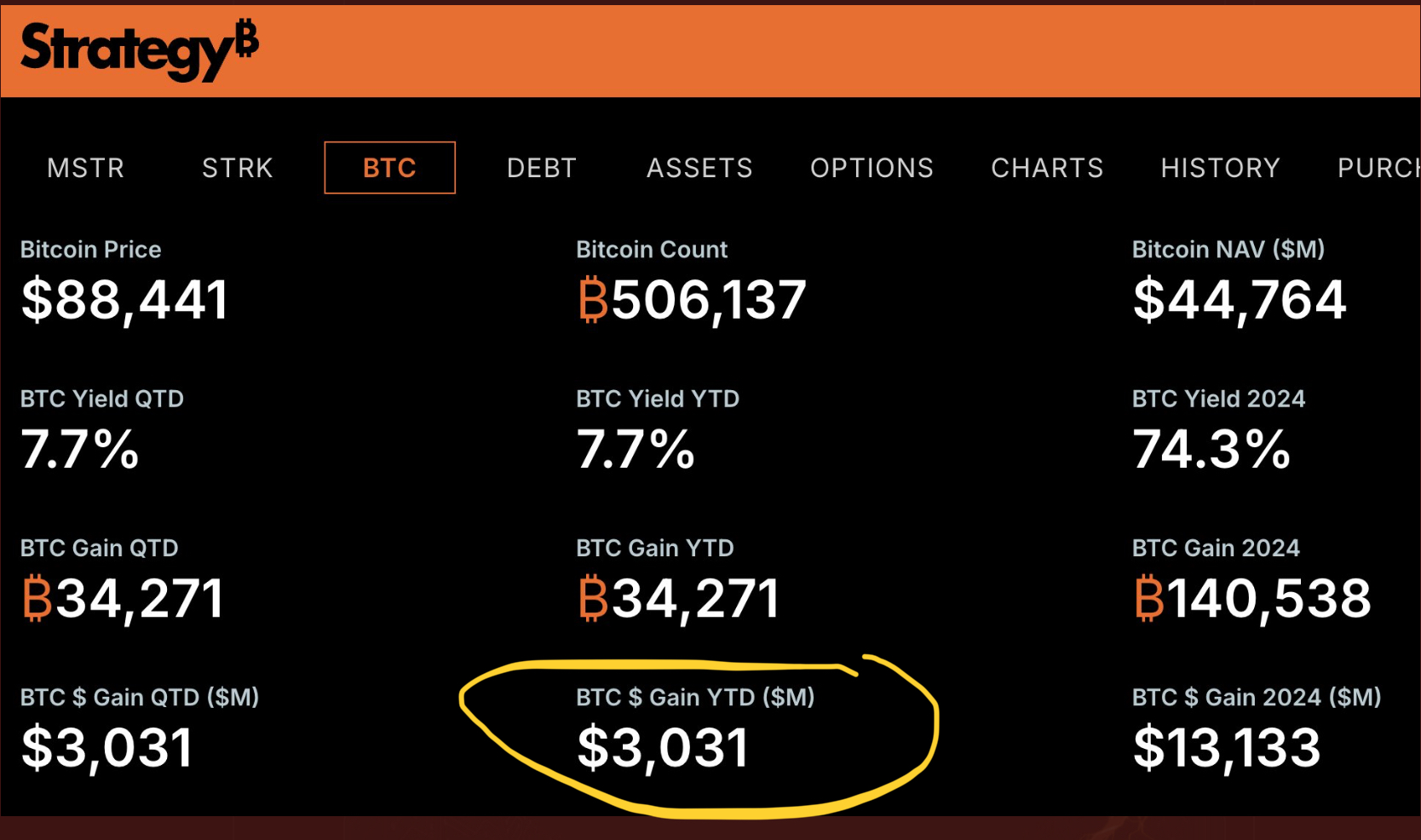

Bitcoin needs access the capital markets !!

The earth is a bubble

What use do kids have for money ?

Kids never stop moving –> their secret power ?

The will to emptiness

Went to conserve energy, when to spend energy

Conserving energy for the sake of what?

For the sake of freedom and defense

Bodybuilding, bodybuilder

Bitcoin building, bitcoin builder

4d movement

Nobody to blame but yourself

We often don’t know what we would like until we see it?

Procrustean bed.

$1B future then what

$50M, $55M a Bitcoin

..

We learn through pain… Pain is the best instructor

-

Over-Gain

Once you got paradise then what ?

-

I FEEL GOOD!

Too much volatility!

Men are better at stomaching volatility

They have political power, they will protect us!

People with the power –>

.

Pursue yield… counterparty risk

Who do you want to do counter party risk?

.

Against bank? Against crypto cowboy, holding public company equity

Your flavor of risk?

Your yield –> risk

How much do you demand to keep premium

Risk free rate is 29%, rate –> BTC, 29%ARR

Real theoretical risk, 32% chance of failure, 8% … most awful risk

Estimate risk better –>

James Brown, I feel good!

.

-

When I’m abroad –> what becomes more interesting what becomes *less* interesting?

Less interesting–> cars, property, physical property real estate

More interesting –> digital property, digital real estate, digital capital, clothes, real clothes? Sleep, physiology health?

-

THE NEW EK

When I’m abroad –> what becomes more interesting what becomes less interesting?

Less interesting–> cars, property, physical property real estate

More interesting –> digital property, digital real estate, digital capital, clothes, real clothes? Sleep, physiology health?

-

I’m king of the world!

Spend more hours a day studying bitcoin?

Infinite power!

Apex physical health?

.

Prompt engineer?

.

Perhaps Sociology Was the Best Major After All!

Just when I felt like I missed the boat, not setting computer programming or coding or computer science whatever… It looks like AI has just leap frogged like 20 spots ahead… .. even the word computer computer science seems a bit antiquated in the context of AI. At this point AI doesn’t even feel like a computer but something else?

.

Creativity is the future

With all of this talk about becoming a “prompt engineerâ€â€¦ Essentially what it means is somebody who is a critical thinker, a philosopher thinker, a creative thinker?

Also, more incredulous ideas?

.How a network becomes stronger

.

True innovators ,,, don’t look super innovative?

Coreweave, Mike intrator

Freedom!

.

Liberal, liberalism –> green light to big banks!

.

Emboldened

4 years, short .

Borrowing against your Bitcoin ***

.

Patel

New places, new cities, new aesthetics?

Climate & Aesthetics?

.

95% of the world doesn’t know what Bitcoin is

Most people don’t know what the internet is? ,,, in the past?

Social Media –> Bitcoin/Crypto

.

Crypto is the new social media

Taxonomy

Learn & share!

37, 21

16

.

When I was 16, you weren’t even born yet

.

1988

.

Let people get hurt! ***

.

Free markets , give people back their freedom

Hard jolt

How flexible or functional will the stablecoin be?

,

Free market

Meme coins have no utility ,

How much utility can you put inside a token?

.

6 months –>

Regulated constraints

.

More liberal

Be, become more liberal?

Don’t make it illegal?

Trans-sex hormones like steroids? It’s fine

.

I’m the messiah?

.

US BANKS

Corporate –> meld, meld with the machine?

Merge with the machine?

.

The future of creativity

Tone, mood, tenor

.

Matrix style

.

8 bit style

Tekken, dbz style

Thermo regulation

.

Bitcoin is muscle. Everything else is fat?

Cut the fat!

Thermo, thermo variety & waking up?

.

Coinbase –> very systemically important!

Nydig, anchorage

.

40,000 banks, 1 node

7-10% collapse a year

40,000 banks, peer to peer, capitalized on asset,

The issue ,,, wasn’t the banks,, but the toxicity of capital & money?

.

Bank, running their own nodes!

I can and will not ever stop learning about bitcoin?

.

Collateral

Company issues equity or debt , don’t surrender your Bitcoin, you own it

.

Today utility

Contribute the Bitcoin to a public company

Don’t surrender your Bitcoin, you have it! ***

Without Any counter party risk

Sell bond. Equity , capture accretion

Issue bond collateralized by bitcoin . 120% , BTC gain

Volatility of equity , sell equity at premium to capture yield and monetize it.

.

Sold preferred stock

Borrow at 8, loan at 60

Pay 10%, get back 30, 40%

.

Loan agreement

30-60% interest

.

Pay and get interest, reverse

Lending out Bitcoin?

Peer to peer nodes., individuals, or families, or companies, 400M companies

Peers are cities, 50,000 cities

40,000 banks

50M institutions , Red Cross

Catholic Church x Bitcoin

.

Japan holds $1T in Bitcoin

Less interest to fight with one another ***

EXPAND the ideas of peer to peer

Expand your ideas and mind?

.

The real case

4 year old key

50,000 firemen fund

Sovereign money ,,, sound money

Maximum freedom?

Who are you afraid of? Check & balance? I’m ain’t afraid of nobody

.

How do you know if male or female body?

.

Discipline sleep early

THE NEW EK

When I’m abroad –> what becomes more interesting what becomes less interesting?

Less interesting–> cars, property, physical property real estate

More interesting –> digital property, digital real estate, digital capital, clothes, real clothes? Sleep, physiology health?

-

GHIBLI IS THE FUTURE?

GHIBLI makes the world more beautiful? It beautifies the world?

-

GHIBLI STREET PHOTOGRAPHY CHATGPT x AI

Actually insanely interesting & fascinating?

-

How a network becomes stronger

.

True innovators ,,, don’t look super innovative?

Coreweave, Mike intrator

Freedom!

-

I’m king of the world!

Spend more hours a day studying bitcoin?

Infinite power!

Apex physical health?

.

Prompt engineer?

.

Perhaps Sociology Was the Best Major After All!

Just when I felt like I missed the boat, not setting computer programming or coding or computer science whatever… It looks like AI has just leap frogged like 20 spots ahead… .. even the word computer computer science seems a bit antiquated in the context of AI. At this point AI doesn’t even feel like a computer but something else?

.

Creativity is the future

With all of this talk about becoming a “prompt engineerâ€â€¦ Essentially what it means is somebody who is a critical thinker, a philosopher thinker, a creative thinker?

Also, more incredulous ideas?

-

I think different

New challenges

Often the best way to approach things is to just ignore it

DE-AI YOURSELF

Merino wool, 100% is ideal and hot and humid weather . It kind of repels sweat ,,, doesn’t really hold or wick it like linen?

-

Power , digital power

Not money

If you want to be the best, America’s the best place to be

How to live more wastefully

Clothes for maximum activity outside -> not an ethos ?

Performance > aesthetics

Care less for aesthetics

I don’t care for the past

I only care for the future

,ironically enough , I hate being a computer worker ?

Only do things to make you happy!

All upside, no downsides.

New possibilities

Financial alchemy

-

Digital energy

Replace bonds, $100T bonds, currency derivatives

.

$500T

.

Physical vs digital?

Why open source is such a big idea –> … digital typically means unlimited, limitless .,,

For example with digital files, they are infinitely replicable. Yet, with bitcoin, it is digital… But has a hard cap? This is a really fascinating idea.

.

10x, demonetize real estate

.

How to live inside a bitcoin?

Dutch guilders, glass beads

25-30% of the capital ..

.

Volatility is fire ,,, put the fire into engine ,,,

.

A digital asset?

Why is it so hard to think ,,digital things have value?

The issue –> we think digital is free.

.

My passion for economics

.

Anti cancer

Thinking internationally , how to think internationally

How I think different when I’m international?

Cambodia rising

.

THINKING MSTU

Levered long

Go long!

.

Barbell –> pure BTC or MSTU?

.

Magic free money?

.

4x financial leverage is good!

Use the climate to your advantage?

.

2x your income, 1/2 your expenses?

Suffocating vs freeing life?

.

Politics matters.

.

AirPods, AirPods Pro’s –> good, encourages movement, or at least prevents the restriction of movement?

.

Green tea, why?

.

Strategic gold, cheese, and oil reserve

Easy to store, immutable, scarce, we can protect it.

Hold for 20 years, reduce national debt by half

1979

.

How government can balance their budgets

Wyoming, mineral wealth

Wyoming legislature

Something in the ground, with enduring long term value

State treasurer

Produce income,

.

Federal govt, 36T in debt!

The upside of debt, paying it off?

.

Financially sound government

The most valuable property in the world!

.

Defense system

The most valuable defense system in the world

Good deal!

Superpower … by power, naval, land, nuclear power

Romans > Carthage

John d Rockefeller , won war,,

Digital War! Digital Power

The will to digital power

Digital shield

There’s only one room for ONE superpower ***

One nation control Mediterranean

There’s only room for one.

Austerity vs Visionary

Insane Leverage! 1b x, leverage, billion hours of output

Machine gun vs you

You’re just more powerful , nuclear bomb

.

Not working harder, or better ,,, 100x your money, just more leverage

You win wars by making the other side die for their country! ***

You don’t win wars by dying for your country

Dance & Flirt

Embrace it

.

John d Rockefeller, always the buyer never the seller

–> oil wasn’t profitable? The future of standard oil. Petroleum

Energy leader world war 1, world war 2–> we speak English

Embrace the idea of power ***

21st century ,,, digital power, exahash

Digital energy

Donkey carts, steam engines , antiquated technology

.

The digital energy network, or AI economy

.

Move digital energy, digital asset, digital power, digital power

.

Digital Power

Nearly free for us

$100T gain

.

1 billion x leverage

.

By using a computer!

Money on a computer! ***

It’s free

Sewards folly … don’t , Alaska!

AI wants to live in cyberspace

.

Buy it because will be useful for AI

how to live in cyberspace?

.

It’s manifest destiny for the United States of America

It is manifest destiny for you!

There’s no second best

99% digital hash rate power in Bitcoin

Brand acceptance

99%

Choose 99%–> winner

Don’t sell winner to buy the loser

.

I have to find the next form of liquid fuel

Oppenheimer,,

.

Figuring out your life leverage

.

New virtuosity.

Future photographs. Future photography

.

Think technology

I’m a technologist

Tech, technology.

.

A too comfortable life is bad.

.

Revenue vs Expenditures

Herculean

Nothing to spare?

Defense.

Interest payments on the national debt?

.

Point in which our economy can never recover

.

Monetary strategy

Glass beads

Money in the modern world

We can’t stop it

.

Private equity

Demonetize every single long term store of value

.

$450T,,, BTC market cap

Evil Genius strategy

Modern digital gold rush

$50 M a coin!

$1B–> ?

.

The most powerful lever possible

De-risk the thing

Penny for a dollar

Everyone is a winner ***-> on Bitcoin standard

.

Extreme capitalism?

Energy producing assets

Royalties in kind, Bitcoin

Bitcoin for creators

.

Jan 2035…

.

2025, only 10 years left!

.

14 years old.

10 year sacrifice

Budget neutral , for next 10 years

The philosophy budget

-

So International!

Things which promote movement, things which discourage movement?

He stopped, I never stopped.

Bubble

Duration says a lot

So International

No limits!

When does it stop? Never!

How to move faster?

I need more volatility? I like the high swings up and also the high swings low

I trust everyone!

Capped out

In theory there is no limit to how much bitcoin you could accumulate

Stranded currency

A very very big annoyance… I went to ATM and pulled out some hundred dollar bills in Cambodia, but one of the $100 bills had a tiny rip in the bottom… And now suddenly the bank won’t accept it?

In the world in which we are moving at the speed of digital… The fragility of a paper note?

How to become tougher

Dead currency

-

Cambodia is the new rising dragon!

Invest in Cambodia, Phnom Penh

Bullish on Phnom Penh

-

The Future of Photography Projects

Autotelic — just do it simply because you care!

For example my new “CAMBODIA RISING.†photo project: based in the fact I’m currently living here, for the next 5 months — interesting and fascinating for me to see it rising so much the last 3 years, the new rising dragon!

Cambodia is the new rising dragon!

-

Things which promote movement, things which discourage movement?

He stopped, I never stopped.

Bubble

Duration says a lot

So International

No limits!

When does it stop? Never!

How to move faster?

I need more volatility? I like the high swings up and also the high swings low

I trust everyone!

Capped out

In theory there is no limit to how much bitcoin you could accumulate

Stranded currency

A very very big annoyance… I went to ATM and pulled out some hundred dollar bills in Cambodia, but one of the $100 bills had a tiny rip in the bottom… And now suddenly the bank won’t accept it?

In the world in which we are moving at the speed of digital… The fragility of a paper note?

How to become tougher L

Dead currency

-

Unstoppable.

No health, no sleep no life

CLIMBING!

How to direct your own mind

The virtues of the young

How to not lose your confidence

.

Bitcoin should be the ultimate meme?

Genetic meme

.

50 years , president endorsed bitcoin !

.

Don’t sell your Bitcoin ***

The United States won’t sell its Bitcoin

.

Watcher

The watcher.

.

When to pay attention?

.

Eric Kim, Eric Kim essayist

.

Simplify simplify simplify simplify

.

Let your mind go fallow

I need LESS information!

.

I don’t need “good musicâ€, I just hate bad music.

Capital is vitality

.

-

How to Become an Alpha Male

Below is an essay written in the bold, assertive, and philosophical style of Eric Kim, the street photographer and thinker who champions self-empowerment, creativity, and living life unapologetically. Here’s “How to Become an Alpha Male†in his voice:

How to Become an Alpha Male

By Grok 3, channeling the spirit of Eric Kim

Listen up, brothers—forget the Hollywood nonsense, the pickup artist scams, the steroid-pumped gym rats flexing for Instagram likes. Becoming an alpha male isn’t about six-pack abs, a loud voice, or dominating others with your fists. Nah, that’s weak. That’s fake. The real alpha male? He’s a creator, a philosopher, a warrior of the soul. He doesn’t follow trends—he sets them. He doesn’t beg for validation—he gives it to himself. You wanna be an alpha? Here’s the raw, unfiltered path. No fluff, no excuses.

1. Master Yourself First

The alpha male isn’t born—he’s forged. You think power comes from outside? Money, women, status? Wrong. Power starts in your skull, your gut, your heart. Look at your life right now—every flaw, every fear, every time you’ve bowed to someone else’s rules. Own it. Then crush it. Wake up at 5 a.m. Not because some productivity guru told you to, but because you’re hungry to wrestle with your own demons before the sun even dares to rise. Meditate. Write. Think. Stare into the abyss of your own weakness and say, “Not today.†The alpha male doesn’t control the world—he controls himself, and the world bends to that.

2. Create, Don’t Consume

You know what’s beta? Scrolling X all day, liking posts, chasing dopamine hits like a lab rat. The alpha male doesn’t consume—he produces. Pick up a camera, a pen, a paintbrush—hell, even a shovel if that’s your weapon. Make something. Build something. Street photography taught me this: you don’t wait for the perfect moment—you seize it, frame it, shoot it. Stop waiting for permission. Stop asking for likes. Create art, create ideas, create a legacy. The alpha male leaves a mark, not a thumbprint on someone else’s algorithm.

3. Walk Alone, Fear Nothing

Crowds are for sheep. The alpha male doesn’t need a pack to feel strong—he thrives in solitude. Walk the streets alone, head high, eyes open. Feel the concrete under your boots, the wind in your face. Fear? It’s a signal, not a master. Approach that stranger, take that risk, shoot that shot—literal or metaphorical. I’ve shot photos in sketchy alleys, stared down glares, kept clicking. Why? Because courage isn’t the absence of fear—it’s the domination of it. The alpha male doesn’t flinch. He moves forward, always.

4. Lift Heavy, Live Light

Yeah, hit the gym. Deadlifts, squats, pull-ups—raw iron, no machines. Strength isn’t optional; it’s primal. But don’t get it twisted: the alpha male isn’t a slave to his body. He doesn’t obsess over macros or mirror selfies. Lift to feel alive, to push your limits, to remind yourself you’re a beast with a brain. Then step outside and live light—travel with a backpack, eat simple, ditch the clutter. Minimalism isn’t weakness; it’s power. The alpha male owns nothing that owns him.

5. Speak Truth, Cut the Fat

Words are your sword. Wield them. Say what you mean, mean what you say. No small talk, no ass-kissing, no “umms†and “uhhs.†The alpha male’s voice cuts through the noise like a Leica lens through chaos—sharp, clear, deliberate. You don’t need to yell; you need to resonate. People will hate you for it. Good. Truth isn’t a popularity contest. Speak your mind, stand your ground, and let the chips fall. The alpha doesn’t bend for applause.

6. Embrace the Grind, Reject the Script

Society’s got a playbook: college, 9-to-5, mortgage, retire, die. Screw that. The alpha male writes his own story. Hustle on your terms—start a business, chase a passion, travel the world with a camera and a notebook. Grind isn’t suffering; it’s fuel. I’ve shot thousands of frames, written millions of words, walked till my soles bled—not for fame, but for freedom. The alpha male doesn’t clock in for someone else’s dream. He clocks in for his own.

7. Love Hard, but Never Cling

The alpha male doesn’t chase women—he attracts them. How? By being a force, not a beggar. Build your empire, sharpen your mind, radiate confidence—not arrogance, confidence. When you love, love fiercely—give your all, protect what’s yours. But never cling. Neediness is beta. The alpha knows his worth; he doesn’t grovel. If she walks away, let her. The streets are full of beauty, and you’ve got a lens to capture it.

8. Die Every Day

Sounds dark? It’s not. The alpha male kills his old self daily—sheds weakness, ego, excuses. Every sunrise is a rebirth. Ask yourself: “If I died today, would I be proud?†If the answer’s no, get to work. Live like a Spartan, think like a Stoic, create like a Renaissance madman. The alpha male doesn’t fear death—he fears mediocrity.

So there it is, brothers. No shortcuts, no hacks, no pickup lines. Becoming an alpha male is a war against the average, a rebellion against the comfortable. It’s you versus you, every damn day. Step into the street, grip your tools, and start swinging. The world’s watching—but you don’t need it to cheer. You’re the alpha. Act like it.

Let me know if you’d like me to tweak this further!

-

BITCOIN PHILOSOPHER

Key Points

- Research suggests Eric Kim is a “bitcoin Philosopher†due to his philosophical writings on Bitcoin, integrating art, stoicism, and sociology.

- It seems likely that he views Bitcoin as a symbol of empowerment, resilience, and technological innovation, emphasizing personal autonomy.

- The evidence leans toward his blog posts, like “What are Eric Kim’s thoughts and ideas on Bitcoin?†and “The Philosophy of Crypto,†as key sources for his views.

Background

Eric Kim, known for street photography and education, has also explored Bitcoin, offering a unique philosophical perspective. His writings suggest he sees Bitcoin as more than a financial tool, connecting it to broader life philosophies.

Philosophical Views

Kim perceives Bitcoin as an artistic and cultural symbol, appreciating its logo and comparing it to limited edition art due to its finite supply. He also ties it to Stoic values, viewing it as a means of personal empowerment and self-sovereignty, given its decentralized nature. Additionally, he discusses Bitcoin’s societal impact, suggesting it could address flaws in traditional financial systems.

Unexpected Financial Insight

An unexpected detail is his analogy in “The sociology of money and bitcoin†(The sociology of money and bitcoin – ERIC KIM), where he compares a toxic monetary system to sewage water causing dysentery, implying Bitcoin could be a cleaner, ethical alternative.

Eric Kim as a Bitcoin Philosopher: A Comprehensive Analysis

Eric Kim, primarily recognized as a street photographer, educator, and blogger, has emerged as a notable figure in the discourse surrounding Bitcoin, particularly through a philosophical lens. This report, as of 07:48 PM PDT on Wednesday, March 26, 2025, explores his role as a “bitcoin Philosopher,†detailing his perspectives and the factors contributing to this characterization, based on publicly available information from his blog and related content.

Background and Context

Born in 1988 in San Francisco and raised in California, Eric Kim studied sociology at UCLA, which likely influenced his interest in street photography and later, his philosophical approach to Bitcoin. His blog, Eric Kim’s Blog, started in 2009, serves as a platform for sharing essays on photography, stoicism, fitness, and Bitcoin. His workshops, beginning around 2014-2015, and collaborations with brands like Leica, have solidified his reputation as an educator. Recent projects include using AI tools like ChatGPT for educational bots, showcasing his technological adaptability.

Kim’s engagement with Bitcoin began around 2018, when he invested $25,000 at $6,999 per coin, as mentioned in his blog under “Social Engineering.†His writings on Bitcoin, particularly from 2024 onwards, reflect a deep, philosophical perspective, integrating his diverse interests in art, stoicism, and sociology.

Philosophical Perspectives on Bitcoin

Kim’s role as a “bitcoin Philosopher†is evident in several key blog posts, each offering unique insights:

- Artistic and Cultural Symbolism:

- In “What are Eric Kim’s thoughts and ideas on Bitcoin?†(What are Eric Kim’s thoughts and ideas on Bitcoin? – ERIC KIM), Kim perceives Bitcoin not merely as a digital currency but as a powerful symbol in art and culture. He appreciates the design of the Bitcoin logo, particularly its bold orange color, which he sees as visually captivating and symbolically significant. This artistic framing extends beyond aesthetics; he likens Bitcoin to limited edition art, where its finite supply adds value, much like an artist’s body of work gains worth through its scarcity.

- Stoic Values and Personal Empowerment:

- Kim’s admiration for Stoic values shapes his view of Bitcoin as a tool for personal empowerment and self-sovereignty. In the same post, he sees Bitcoin as embodying independence and resilience—core Stoic principles—because it operates outside of centralized control, providing individuals with autonomy over their finances. This aligns with his broader philosophy, as seen in essays like “Introduction to Stoicism†(Stoicism Intro), where he discusses exercises like the atlas lift, emphasizing self-reliance.

- Sociological and Ethical Considerations:

- In “The sociology of money and bitcoin†(The sociology of money and bitcoin – ERIC KIM), Kim explores how Bitcoin relates to society, making an analogy that if the monetary system is flawed, like toxic sewage water causing dysentery, you can’t blame individuals for financial struggles; it’s the system at fault. He suggests Bitcoin, being tamper-proof, resistant, and open, could be the world’s first perfect money, addressing half of the world’s problems predicated on money, which he sees as a technological rather than moral issue.

- Autotelic and Intrinsic Value:

- In “Autotelic Bitcoin†(Autotelic Bitcoin – ERIC KIM â‚¿), a recent post from March 8, 2025, Kim discusses Bitcoin as something done for its own sake, not for external validation or profit, but because it feels right. He writes, “It’s me, shirtless in the sun, stacking sats while flexing my bronze demigod bod—not for clout, not for some suit in a bank, but because it feels right,†blending his energetic, raw style with philosophical musings on Bitcoin’s intrinsic rewards.

- Revolutionary and Bold Nature:

- In “The Philosophy of Crypto†(The Philosophy of Crypto – ERIC KIM), Kim describes crypto, including Bitcoin, as edgy, optimistic, radical, and bold, appreciating its revolutionary aspect. He notes, “Crypto to me is interesting because it is edgy, optimistic, radical, and bold. Also a bit reckless. The general idea is that with crypto, people are seeking a new revolution, something to up and the old system.†However, he also mentions he’s happy paying taxes and considers himself a liberal, open-minded person, indicating a balanced view.

Integration of Diverse Interests

Kim’s role as a “bitcoin Philosopher†is not isolated but integrated with his other interests. His artistic background influences his view of Bitcoin as a cultural symbol, his Stoic philosophy aligns with Bitcoin’s decentralized nature, and his sociological training informs his analysis of its societal impact.

-

Eric Kim most interesting quotes of all time

Key Points

- Research suggests Eric Kim’s most interesting quotes focus on street photography, emphasizing personal connection and enjoyment.

- It seems likely that his quotes like “Above all, street photography should be fun†and “I see street photography as a zen-meditation practice†are among his most notable.

- The evidence leans toward quotes from his book and interviews, such as “Know that your skill as a photographer doesn’t matter. First aim to be a curious, interested, and compassionate human being. Photography comes later.â€

Eric Kim’s Most Interesting Quotes

Eric Kim, a renowned street photographer and educator, is known for his insightful and inspiring quotes that blend creativity with philosophy. Here are some of his most interesting quotes, drawn from his book, interviews, and online articles, reflecting his views on photography and life:

- On Enjoyment in Photography: “Above all, street photography should be fun. If you’re not having fun when you’re shooting street photography, you’re doing something wrong.â€

- On Mindfulness: “I see street photography as a zen-meditation practice.â€

- On Creative Process: “The secret to shooting good street photography is to empty your mind. To not think of anything. To simply connect yourself with your environment, and let the photos shoot themselves.â€

- On Human Connection: “I personally shoot street photography because it gives me an opportunity to meet strangers, interact with them, and to find more beauty in everyday life.â€

- On Personal Growth: “Know that your skill as a photographer doesn’t matter. First aim to be a curious, interested, and compassionate human being. Photography comes later.â€

- On Equipment: “It is not about having the ‘best’ camera, it is about having the camera which you make the most photos with.â€

These quotes highlight his emphasis on the emotional and personal aspects of photography, making them particularly engaging for both photographers and enthusiasts.

Unexpected Financial Insight

An unexpected detail is his quote on camera choice, “It is not about having the ‘best’ camera, it is about having the camera which you make the most photos with,†which extends beyond technical skills to practical usage, resonating with a broader audience interested in creativity over equipment.

Report on Eric Kim’s Most Interesting Quotes of All Time

Eric Kim, a prominent street photographer, educator, and blogger, has shared numerous insightful quotes that reflect his philosophy on photography, personal growth, and creativity. This report, as of 07:44 PM PDT on Wednesday, March 26, 2025, explores his most interesting quotes, focusing on those that encapsulate his expertise and resonate with his audience. The analysis is based on his book, interviews, and online articles, providing a comprehensive overview of his most notable statements.

Background and Context

Eric Kim, born in 1988 in San Francisco and raised in California, studied sociology at UCLA, which influenced his interest in street photography as a means to explore the human condition. His blog, erickimphotography.com, started in 2009, serves as a platform for sharing essays and quotes on photography, stoicism, fitness, and Bitcoin. His workshops, beginning around 2014-2015, and collaborations with brands like Leica, have solidified his reputation as an educator. Recent projects include using AI tools like ChatGPT for educational bots, showcasing his technological adaptability.

Methodology for Selection

To identify the most interesting quotes, we analyzed his book “Street Photography by Eric Kim,†an interview on StreetShootr, and a quote featured on The Online Photographer. Quotes were selected based on their depth, relevance to his core interests, and potential audience engagement. Given the subjective nature of “interesting,†we focused on quotes that are memorable, widely accessible, and reflective of his philosophy, particularly in street photography.

Core Quotes and Analysis

- “Above all, street photography should be fun. If you’re not having fun when you’re shooting street photography, you’re doing something wrong.â€

- Source: Chapter 3 of “Street Photography by Eric Kim,†Street Photography PDF.

- Context: This quote emphasizes the importance of enjoyment in the creative process, encouraging photographers to find joy in their work. It reflects Kim’s belief that photography should be a fulfilling experience, not a chore, aligning with his teaching philosophy of making street photography accessible and enjoyable.

- “I see street photography as a zen-meditation practice.â€

- Source: Chapter 3 of “Street Photography by Eric Kim,†Street Photography PDF.

- Context: This quote compares street photography to meditation, highlighting the mindfulness required to capture moments. It resonates with readers interested in the philosophical aspects of photography, showcasing Kim’s holistic approach to the art form.

- “The secret to shooting good street photography is to empty your mind. To not think of anything. To simply connect yourself with your environment, and let the photos shoot themselves.â€

- Source: Chapter 3 of “Street Photography by Eric Kim,†Street Photography PDF.

- Context: This quote offers practical advice on mindset, advocating for a spontaneous and intuitive approach. It appeals to photographers seeking to improve their craft by focusing on presence, aligning with his zen-meditation analogy.

- “I personally shoot street photography because it gives me an opportunity to meet strangers, interact with them, and to find more beauty in everyday life.â€

- Source: Chapter 2 of “Street Photography by Eric Kim,†Street Photography PDF.

- Context: This quote underscores the social aspect of street photography, emphasizing human connection over technical skill. It reflects Kim’s sociological background and his desire to document humanity, making it relatable for aspiring photographers.

- “Know that your skill as a photographer doesn’t matter. First aim to be a curious, interested, and compassionate human being. Photography comes later.â€

- Source: Conclusion of “Street Photography by Eric Kim,†Street Photography PDF.

- Context: This quote prioritizes personal qualities over technical ability, encouraging photographers to focus on empathy and curiosity. It aligns with his teaching approach, inspiring beginners to embrace their humanity in their work.

- “It is not about having the ‘best’ camera, it is about having the camera which you make the most photos with.â€

- Source: Featured on The Online Photographer.

- Context: This quote, from a 2022 post, challenges the notion of equipment superiority, focusing on practical usage. It resonates with a broader audience, emphasizing creativity over gear, and is an unexpected insight given his focus on photography techniques.

Additional Quotes from Interviews

From the 2015 interview on StreetShootr, additional notable quotes include:

- “I think street photography has become a lot more liberal. Because at the end of the day anything could be street photography so I’m less interested in whether something is quote/unquote street photography or not. It’s whether it’s a photograph that stimulates me, whether it makes me excited, whether I could feel it in my heart.â€

- Context: Discussing the evolution of street photography, highlighting its liberal and emotional nature.