Unlocking value

I don’t want my thoughts to be derailed

I think the reason why I like to wake up early, before anyone else does, and then drink coffee, thing, walk around, either Vlog or jot down notes is because I don’t want my thoughts to be derailed by an external issues at hand.

You know best; never do anything to just make other people happy or make them feel at peace or restful;

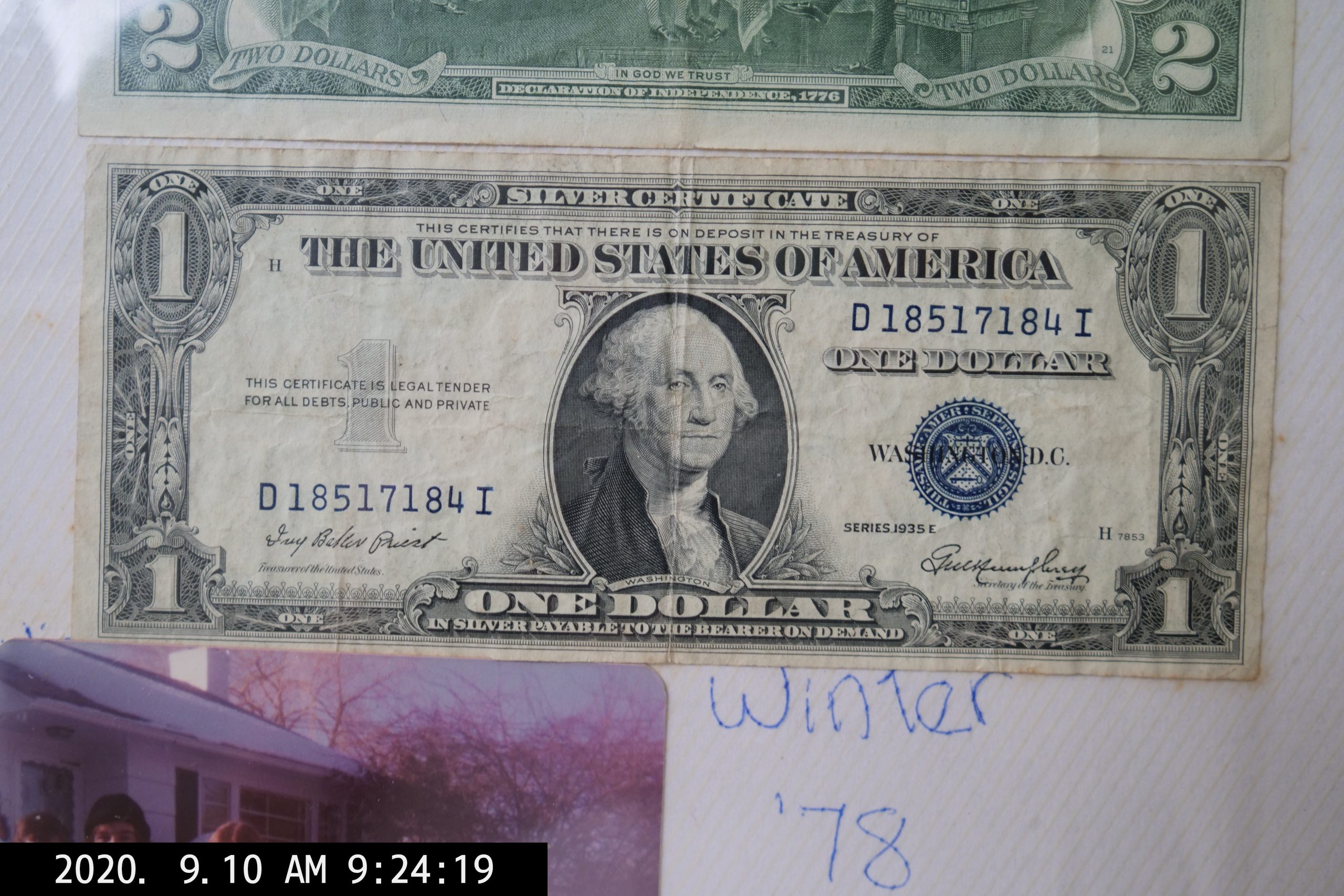

Financial Thoughts

Some finance, financial thoughts on my mind; how and why does finance matter?

What is the etymology of finance?

First of all, it seems that the etymology for the word finance is centered around the notion of a fine, the end, “finis‖

If you take this metaphorically, maybe finance, personal finance is all about the banks, these credit unions, issuing debt, and if you don’t pay the monthly payments, the ransom, the settlements, you will be charged a penalty.

Also taken more artfully; perhaps we should consider the end of finance, the end of money etc.

Money for the sake of what?

Recently I listened to the interview of Michael Saylor with Lex Fridman, I both watched the video YouTube podcast recording, and then ultimately I just read the transcript. One of the big takeaways was this:

Money is solidified labor, solidified energy and power.

For example, all of the money value that created over the last that give herself, traveling the world doing workshops, creating and selling products etc., ultimately all this money end up becoming solidified and codified into money.

Bitcoin as the most exciting thing since PayPal?

The reason why I have been very grateful to be alive at the time that I was, when I first started teaching workshops, I was easily able to create a PayPal payment by it now, in order to collect money from teaching workshops. The very very nominal 2.9% transaction fee to me was nothing; Essentially if PayPal did not exist, I would collect zero dollars, 0%. So 2.9% out of 100% to me is nothing. As long as the fee is less than 10%, I am happy.

One thing which is really cool about Coinbase, and I suppose a lot of these mainstream crypto market fund platforms is that you can easily purchase corn or whatever crypto with your US dollars or traditional bank account money, and also if you wish to, cash it out back into Fiat currency, if you want.

Even more interesting is the new Coinbase debit card visa card, in which you could essentially just use it to draw from your crypto reserves, to buy groceries at Costco or whatever. I think that I have yet been able to do is figure out a workaround or hack to have the Coinbase debit Visa card pay for rent; but beyond this, it is pretty phenomenal.

Why is it so damn hard to move money?

OK, some simple things; if I want to send money, either to myself from a different bank account, a simple wire transfer, whether domestic or international, why does it require me talking to a bunch of random people on the phone, wasting about 3 to 5 hours of my life, sometimes on the phone or sometimes in person, and sometimes having my money stuck in arbitrage, with some random person in the Back door of an office in the Philippines in Manila, “reviewing†my case, ensuring that my wire transfer is not a scam or fraud, before the transaction actually goes through?

Banks are the new gatekeepers, the new DRM digital rights management

OK, I have always been passionate about this open source notion, open source information, open source knowledge etc. Even what Saylor.org — Michael Saylor is doing with his open source information knowledge wisdom, is very admirable.

I think a huge point of enthusiasm and reinvigorated passion that I got from the Michael Saylor Lex Fridman  interview is Moores law, the immense power of the dematerialization of things.

For example, when it comes to aviation, rockets to the moon, whatever… Why is this all the same same? The fundamentals materials of aluminum hasn’t changed for almost 40 or 50 years, in the general shape of airplanes have not changed at all either. The only really big innovation that I think we’ve had during my lifetime is Tesla, and electric vehicles; but still if you think about it, the overall shape of cars, even the Tesla cars are pretty similar to what we already got, albeit much better.

Also a grand dismay that I have in regards to homes, real estate, etc.; why is it that homes have not really changed, even the new constructed ones? Maybe the only big innovations I’ve seen in house and home design is having your kitchen door patio thing open up directly Into the backyard or whatever, maybe have a pool or whatever, but that’s it. Why not any sort of Buckminster Fuller, geodesic, or even my own personal vision, a glass cube on top of a hill?

How bitcoin benefits from Moore’s law

I think a really big thing about bitcoin and Moore’s law is that anybody with the $50 smart phone or device can handle it, storage, in essentially the custody or the ownership of your money or your keys or whatever is a simple password that you can memorize in your brain. Or another thing which is good with Apple ID, your thumbprint, biometric data is that it is pretty difficult to fake a thumbprint; iron vision that a thumbprint is actually more secure than Face ID ID.

For example, I currently have an iPad Pro M1 chip, and already, the Face ID is busted. However compare this to my $299 iPhone SE; the thumbprint is secure. So even as much as I like to like the new iPhones, maybe just sticking to thumb ID is a better idea in terms of security.

Once again, digital property, materials cannot increase at a rate of 2X year over year or whatever more law is. Yet, bitcoin, crypto, digital money can.

Or even some other basic good things; crypto could be treated every second, every day, doesn’t matter if weekend or weekday. Isn’t it strange that even in 2024, today’s capital markets, the markets are closed on Saturday and Sunday? Come on, we live in the world of self driving cars, robots, Artificial intelligence, ChatGPT etc.; why are we still in the stone ages in terms of finance?

Are you going to use your gold bars to buy a home?

It seems that one of the great real assets that people eventually aspire to have our own or procure is a home, property, ideally a single-family home. It also seems the truth is any people whose first homes a condo, secretly hopes that they had bought a single-family house, or they’re just saving up more money in order to buy a single-family house.

Owning a condo is like glorified renting

I suppose one of the benefits being raised the way I was, I never was really into this idea of owning a house or owning home. Maybe this is because my family and my mom only ever rented our whole lives, part of it is that we were just broke, And part of it also, we moved around too much.

It seems that currently the American dream is all about owning a home, owning a single-family home. Perhaps this was just the postwar ideal or something; but maybe the new dream, the new Millenial dream should be to own (at least one) Bitcoin?

My simple math behind it is I equate one bitcoin to only one single-family house, or one piece of property. But the great upside of bitcoin and digital property is that I don’t have to maintain it, I don’t have to check for mold, I don’t have to worry about changing the roof, I don’t have to worry about bad tenants up the house, etc. And also, a big scam I think I’ve discovered about homeownership is property taxes;

Even if you buy a $3.5 million house all in cash, into perpetuity, you got it paid like $3000 a month in property taxes alone? That is essentially free money that you’ll never ever see again, that goes straight to the city and the government.

Even if I was worth 100 M, maybe because the way I was raised, I wouldn’t want to pay $3000 a month Justin property taxes, indefinitely? Especially considering that my rent is only $3200 a month right now, if the price of property taxes is equivalent to the price of renting, real estate really makes no sense.

The future of bitcoin and digital property?

Also another reason I found an interview with Michael Saylor and Lex Fridman so enlightening was not even the bitcoin stuff, but, how Michael Saylor cross pollinate his genius in sciences, history of science, engineering, mechanics and applies it to money finance in the world in general.

Especially the notion of energy.

For example, the reason why I am so grateful every single time I have a good cup of coffee is that there are people in Vietnam, in the Highlands, growing your coffee, tending to it, eventually picking it and sorting them, then you have an expert person like Hana Choi from 96b coffee roaster in Saigon Vietnam roasting it, and then ultimately delivering some great product like 100% fine robusta, ERIC KIM OMAKASE COFFEE, delivered straight to you.

What is a college degree, a PhD, a masters or a bachelor is worth today anyways?

If I think about it, if I think about it, cart blonde, Sukha today, if you didn’t want to go to college, or get a higher degree, I wouldn’t really mind too much. Why?

First, his parents, a.k.a. me and Cindy are already super educated. We both went to UCLA is undergraduates, Cindy got her PhD at Berkeley, and now is a full-fledged professor.

So why do we need more education in the family?

What is education for anyways?

Assuming that your family already has wealth, having a higher degree is only a legitimacy thing.

For example, if your family empire is already worth $500 million, and you have a bunch of kids, you just want them to graduate with at least the bachelors degree to “prove “that they’re not dumb.

If you’re doing any sort of business transactions, or just networking in general, eventually someone’s gonna ask you where you went to school, a.k.a. where you went to college.

Even now when I meet people, and ask them why they went to school or whatever, and they say UC Davis or something, I think that it is OK, and I tell them that I want to UCLA, I can already see their face and countenance change, That they feel a little bit made small by the fact that I went to UCLA and they went to a second tier school.

However, the reason why this is so bad is that why would you take your own self-esteem based on an institution?

This is also where brands, are so silly. For example everyone is so gaga over Louis Vuitton, but just Google image the actual founder of Louis Vuitton, a fat obese man with a funny mustache and beard; do you want to look like that guy?

Building the future, upgrading the planet?

The final words of Michael Saylor was quite poetic interesting and simple; “upgrade the world“, upgrade the planet, upgrade the human race.

“Uh-up-uh-upgrade complete!†– StarCraft

What does it mean to upgrade things, the planet, the human race?

First, maybe it is to first apply a fresh, gigabit Internet like mentality to our brains. For example everyone is so quick to just upgrade their iPhone or devices or their car or whatever, isn’t the more important fact to upgrade your mind?

For example, I just got rid of loser spectrum Internet, they still don’t get them, and upgraded to team gigabit fiber Internet which is 1 trillion times better. Even when trying to cancel my old spectrum thing on the phone, it was so damn annoying, just like trying to cancel your AWOL membership back in the day.

Anyways, maybe we gotta think about this like gigabit Internet Wi-Fi. Upgrading your mind is like going from 56K dial up modem to gigabit fiber Internet.

Grand Visions

I follow the Peter Thiel model here:

Better to risk boldness than to risk triviality.

Or another words, better to go insanely bold and big, and fail, rather than two go and bet same same, and succeed.

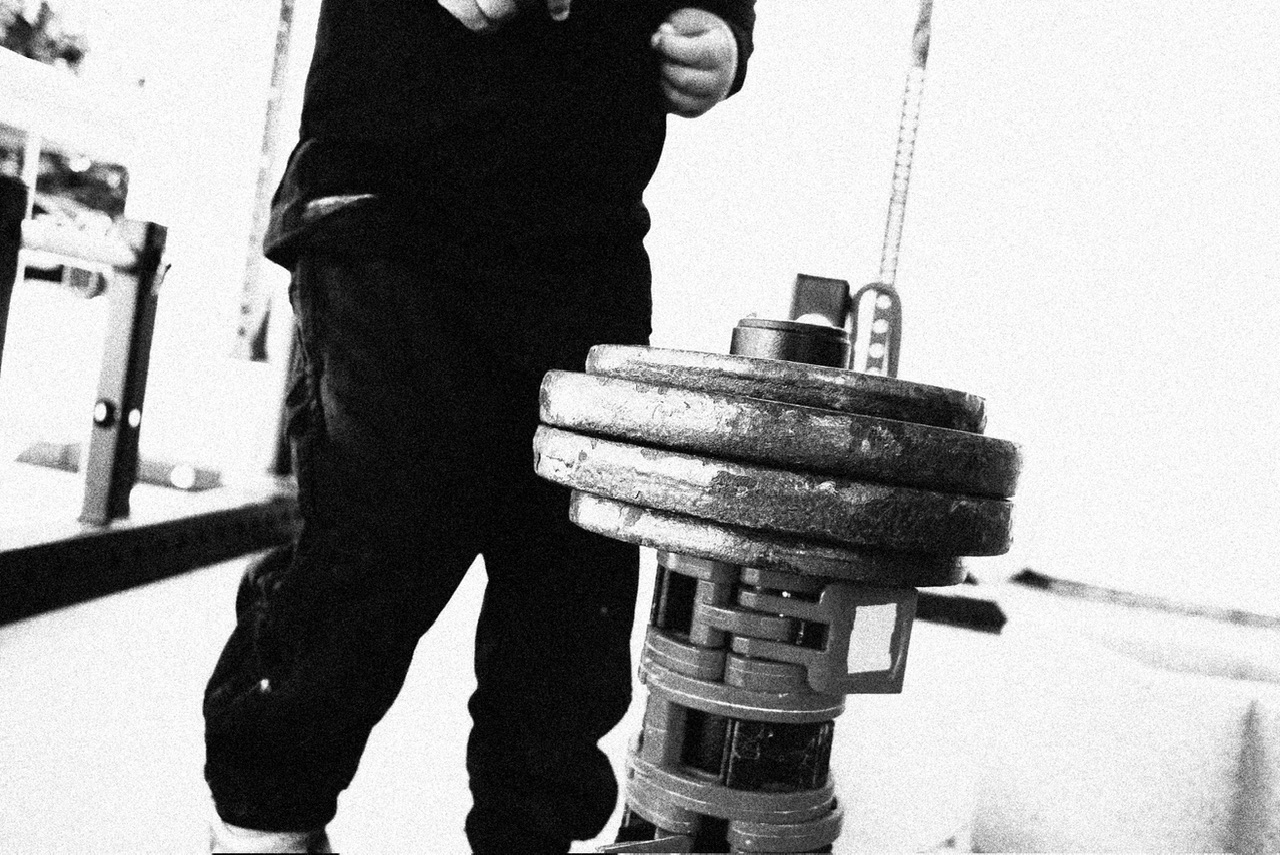

Even one of the random things that I am insanely proud about myself, is successfully lifting 1000 pounds; the infamous ERIC KIM Atlas lift.

I think it is more interesting to lift 1000 pounds, my unorthodox way, which is 10 plates of 25 and I think a five and a 2 1/2 are on each side, rather than even squat five or six plates the standard way, or even dead lift seven or eight plates the standard way.

Bigger always wins.

Once again, the ultimate flex in the ultimate interest is how many plates you have on the bar. When you stop counting, that is when you know you are strong.

For example, typically the reason why people like to dead lift, or do sumo deadlifts or whatever is that you could put more plates on the bar. For example a reasonably strong person can let’s say squat for plates, but for dead lift do five or six plates. And the upside to switching to sumo dead lift is that you could go from 5 to 6 plates pretty easily; if you’re doing conventional, Because the biomechanics are not as efficient, you cannot lift as much.

Lifting more is more important

Once again, to lift more is more impressive.

To do things, the conventional or standard way, is boring.

Or even taken into a greater extreme; what is more impressive, to lift 2000 pounds, or two benchpress 300 or 400 pounds? Lifting 2000 pounds is far more interesting.

Bitcoin developer

The funny thing is with real estate, your $1 million house cannot certainly become $100 million house in 10 years. But you’re $1 million worth of bitcoin can become $100 million a bitcoin in 10 years.

A funny rebuttal that people say about bitcoin is that it is not “worth†anything; but then again, owning property is not really “worth“ anything either; to own a few square meters of concrete somewhere is not as glorious as you might think it is, especially considering you got a pay property taxes etc. Not only that but maintenance cost, hidden cost, things breaking things gotta be maintained etc.

Even simple things, like gardening, cleaning up dead tree leaves etc.; then all of this additional labor.

Even if you hire somebody to do it, you still gotta put in the labor to manage them.

What new innovations have yet been created?

Bitcoin is interesting because it is still in the early infancy.

First, people have no idea what it is. Even amongst the bitcoin and crypto maximalists, nobody has anyone unified idea on what it is or what it should be.

For example, some people think that bitcoin should be digital money, other think that it should be digital property, other people think it should be digital gold. But maybe because there is not a consensus on what it should be, this is a feature, not a bug.

In terms of what technology you could build on top of bitcoin, it seems that the level 2 layer — the bitcoin lightning network is probably the most useful innovation thus far, that which Jack Dorsey has integrated into the cash app, and let us not forget that Jack Dorsey who is a huge bitcoin advocate also owns and runs square, the infamous and notorious little card reader thing that you use to buy your $10 cappuccino at any hips or coffee shop.

The philosophy of money and finances

I think money and wealth is all an attitude thing, which means wants to feel rich, to feel strong, to feel abundant. Nobody wants to feel broke, and poor.

Even Aristotle written in his economics, Oeceonomia in Greek said the very powerful and simple thoughts, which still rings today:

One’s expenditures should never exceed one’s income.

Live like a very poor person

Even now that I am super rich, I still use the cheapest iPhone, an iPhone SE. Why? Even though I could afford thousands of iPhone pros?

I think the simple heuristic that I’ve learned is that irregardless of how rich you are, it is always better to live like a very very poor person. Why? Honik and lifestyle creep; sure you make a little money here in there, and get some gains, get a bonus or whatever, you buy the Tesla, buy more expensive things, etc.… But the problem is that often, we think we are much richer than we actually are. The same thing with gains;

We always overexaggerate our gains, we always underplay our losses.

Additional things which are worthy of consideration include having to pay taxes, capital gains taxes, etc. Therefore, if you think about things a little bit more critically, always best to think and act rich, but live poor.

How does one live poor?

- Don’t drink or purchase or buy bottled water or filtered water: just drink tapwater, or filtered water at home

- Don’t drink alcohol, don’t consume alcohol, whether at home or at the bar, don’t smoke weed, waste money on weed and drugs

- don’t go to festivals, don’t go to Vegas, don’t listen to EDM music, a funny thought: has anyone ever gone to an EDM concert or gone to burning man and enjoy themselves sober? Without taking drugs? No.

- For a car, the best car is just a 2010 Prius; I love Tesla, I love Elon musk, I own a lot of Tesla stock, yet I don’t really want to buy one right now, yet. If I were to buy a Tesla, I might hold out for the cyber truck. And actually, in LA, the greatest flex is to drive around in the cyber truck; even more than driving a Ferrari or a Lamborghini!

- Never buy any new clothes

- Build your own home gym, work out at home: or just buy a 60 pound weight vest, and just go walking or hiking in the nature areas, in the woods etc.  For example in LA, I really love this Baldwin Hills hiking area stairs area.

- The best entertainment and leisure activities are free! Nature, hikes, state recreational parks etc.

Now what?

I always find the quote now what� Question the most fascinating. Why? After all of this, what is the point of it all? What should I do with my life and time?

A very simple one is exercise fitness and health. Movement, exercise, fitness is the ultimate leisure. There is no greater leisure than the human body.

Second, there needs to be some sort of creative output publishing that you do. I think this is the best way we could enact an impact on the planet; information, it is universal, a random person in a small village in India on the $50 android device could easily access your website and blog, or even a random kid in the Philippines.

Third, think technology, Moore’s law and scale: once again, I think the problem why real estate, land development, construction is so tapped out is that it is still so inefficient, and it does not follow more law. In the year 2024; why can’t I just 3-D print a house in an hour? Why does it still require a litany of annoying contractors, hold ups, and trillions of other problems?

Building digital properties

Maybe it is best that we think about websites and digital properties like real estate.

Something that nobody appreciates is that you could erect a website in 30 seconds, good luck doing that with the skyscraper or even a single-family home.

Second, domains, domain names. This is still a field which is very very important and untapped.

For example there is this thing called ES, Ethereum name network or system or something, owning your own crypto address in cyberspace seems like a good idea.

For example, currently playing around with a new Coinbase web3 wallet, and there is an ability to create your own username on it. Kind of like Venmo. Or PayPal. This is interesting and useful because if I want to just send bitcoin or crypto to somebody, rather than having to copy and paste a really really long Crypto address, it is easier to just punch in their “@“ user ID– it is easier to remember, much more secure etc.

Why Coinbase?

Coinbase is the goat. The most beautiful UIUX, it feels the most ethical, and it just works insanely good. Coinbase is like the new paypal for crypto.

You can just buy $100 worth of bitcoin

Everyone wants to own at least one bitcoin, but the beauty is you could just buy $100 worth of bitcoin, you could just do it in the cash app, or on Coinbase or whatever. An exchange I don’t really trust, but at least it is mainstream is crypto.com, I think they are Singaporean based, And they bought out the name rights for the Los Angeles Lakers Staples center, and it also looks like they are doing a good job marketing across sports and television channels.

Finance also looks pretty good, but I would still kind of stairway from it, because of the old controversies with the ex founder, CZ.

Now what?

I think the beauty of bitcoin, crypto is that we can all get rich together. Assuming that the value of it all collectively goes up, if I buy bitcoin, and you buy bitcoin, the value of all of it goes up. Only people who “loseâ€, are people who get into the game too late.

Rethinking economics, money and wealth

We humans are bad at metaphors, math, digital thinking, etc. As a consequence, it seems interesting to try to upgrade your mind, or rethink things from a blank state.

For example, being born in 1988; the idea of having to pay for information and knowledge always seemed ridiculous to me. But to the old-school people, the old guard, it seemed natural.

Even in the world of Atari, film photography, doing exhibitions and shows, printing out hardcover books, these are all old antiquated Parisian notions which must be re-examined especially in the year 2024; in which I could design and create a PDF photo book in minutes, publish it for zero cents, and essentially share it to all 8 billion people on the planet for nothing.

Consider the typical artist who has to sell out $20,000 of their own money, in order to print their book, and attempting to sell it, and eventually not being able to do so, still having hundreds of copies and storage, unsold.

The great upside of digital products and digital books is that there is no such thing as “stale“ inventory, no such thing as dead stock, or unsold inventory.

Think Digital!